Ira Magaziner, former healthcare advisor for President Clinton and current CEO of the Clinton Health Access Initiative for the Clinton Foundation contacted Amitabh Desai, foreign policy advisor for the Clinton Foundation, in December of 2011 — chagrined by comments made by Bill Clinton, suggesting that the deliriously high price of aids drugs in the U.S. needed to come down.

Here was Ira’s rationale for keeping drug prices expensive in the U.S.

Source: Wikileaks

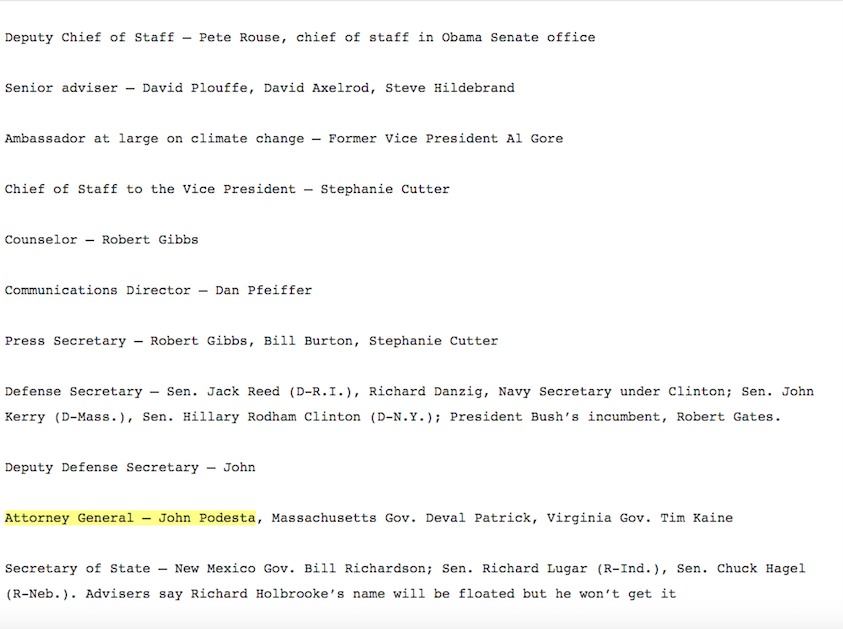

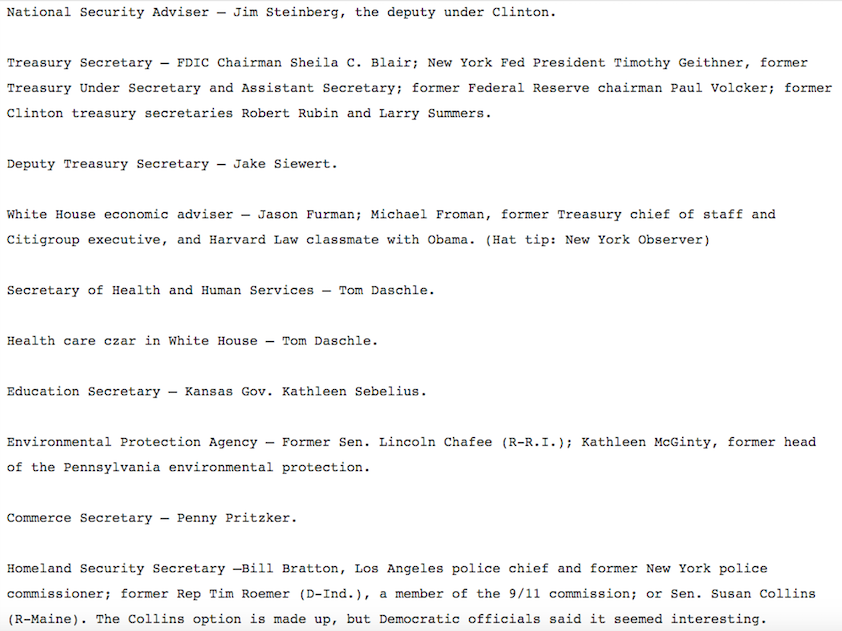

This note and the attached memo are in response to your inquiry as to whether CHAI has any thoughts on how to proceed on the comments President Clinton made on lowering domestic AIDS drugs prices at the World AIDS day event. Attached is a detailed memo with recommendations on how CHAI and President Clinton could be helpful in the domestic fight against AIDS. We have been working on this memo since the last CHAI board meeting when this issue first came up and had planned to send it to President Clinton and the CHAI board in December for further discussion.

We were taken by surprise by President Clinton’s comments on world AIDS day and wish that someone had consulted with us before he made these comments.As you will see when you read this memo, we think that publicly pressuring the US and European AIDS drug companies to lower prices and bringing pressure to allow generic AIDS drugs into the United States will have limited if any success and could seriously jeopardize our negotiations to continually lower prices in poor countries. We also believe that there are other more impactful ways to address the US AIDS crisis today.

In other words, Ira was pissed Bill made a speech without his prior approval. Moreover, he didn’t want Bill lobbying the drug companies to lower their prices in America — because it would hinder negotiations for cheap prices in poor countries. These people aren’t American, but foreign mercenaries working on behalf of corporations. This is proof.

We have always told the drug companies that we would not pressure them and create a slippery slope where prices they negotiate with us for poor countries would inevitably lead to similar prices in rich countries. If we were going to change our view on this, we should have informed the companies before President Clinton went public with his statement and attempted to negotiate a way for them to participate in and get credit for whatever steps we could have persuaded them to take to help the crisis in the states. We might or might not have been successful in getting them to do something, but we believe the chances of success would have been higher than by trying to pressure them through a public campaign. It has taken us many years to build positive relationships with these companies while at the same time pushing them to continually lower their prices.We will now have to try to repair these relationships.Since President Clinton’s comments were made, we have been contacted by a number of advocacy groups who are now intending to wage a public campaign to bring in generics and lower drug prices.

By making a speech calling for lower prices for life saving aids drugs, President Bill Clinton fucked up long term relationships with big pharma. As a result of this faux pas, pesky, liberally minded, advocacy groups contacted Ira to wage campaigns for generics and lower prices. What these advocacy groups didn’t know was that Ira and the Clinton Foundation wasn’t a liberal organization and not interested, whatsoever, in lower prices in the developed world. Fuck America.

We do not feel we can participate in this without jeopardizing our work around the world. We cannot oppose what they might do, but we also cannot be publicly supporting it either. This campaign will not get started until January, so we have some time to figure out and act upon our own strategy. If we do try to do something in this area, we suggest that we approach the innovator companies that can currently sell products in the US with the idea of making donations to help clear the ADAP lists. For a variety of reasons, the companies will likely favor a donation approach rather than one that erodes prices across the board. I would guess that they would also likely favor a solution that involved their drugs rather than an approach that allowed generic drugs from India to flood the US market at low prices or one that set a precedent of waiving patent laws on drugs. This will be complicated to work out, but it might be possible. We would have to initiate discussions with multiple state health officials as well as HHS in addition to talking with the drug companies. If President Clinton wishes for us to be proactive, we suggest that we try a cooperative approach first. We can go to war with the US drug companies if President Clinton would like to do so, but we would not suggest it.

Ira was between a rock and hard spot. He couldn’t let the advocacy groups know he supported very high drug prices in America, while damaging the hard fought relationships with his buddies in big pharma. Could you imagine if the fucking Indians flooded America with affordable life savings drugs? Ira must’ve soiled himself by the prospect. Nevertheless, like Tony Montana, Ira was willing to ‘go to war’ if Bill wanted to.

Whatever we decide, we need to make a decision quickly and President Clinton and CHAI need to be in synch. I do not think it is a good idea for President Clinton to be taking one position and CHAI another. Once we have decided what to do on the drug question, we can then decide if we want to work with state health authorities in the ways that the memo suggests to implement programs to expand testing and treatment. CHAI management is willing to expand the mandate of CHAI to add a focus on domestic AIDS, though this will involve having to build an organization to do the work and significant time and resources. We would need to go to the CHAI board for approval as it would represent a major add on to the strategy that we presented to the board and that the board approved at its last meeting.

And of course if we do this, we need to find a way to get it funded. I do not know if President Clinton has any thoughts on funding for a domestic AIDS project. Even a negotiation on how to clear the ADAP lists by getting drug companies and state officials and the federal government to work together on a deal would take a significant amount of time and resources to accomplish. We can undertake it, but unless we can get the work funded or the board gives us leave to do it as an unfunded project, we could not move forward.

Perhaps we should have a discussion with President Clinton about next steps.

Thanks Ira

One question for you night owls out there: Does the Clinton Foundation sound like an ‘American First’ organization?

Comments »