Aside from all of the horrible things, Castro was actually a solid guy. Good cigars and hospitals.

Comments »Creepy Tim Kaine Calls for An End to ‘Senseless Acts of Gun Violence’ Following Ohio State Knife Attack

You should all pray to the Gods for bestowing his child, Donald J. Trump, upon us — vanquishing clownish vagrants like Tim Kaine and his stupid face.

In light of today’s terror attack at Ohio state, which included a rogue Somali migrant knifing 9 people, Tim Kaine was ‘saddened’ by the senseless gun violence.

Deeply saddened by the senseless act of gun violence at Ohio State this morning. Praying for the injured and the entire Buckeye community

— Senator Tim Kaine (@timkaine) November 28, 2016

Fucking cuck.

And then there are people like this who walk amongst us. Damned racist white cop shot an innocent black migrant who just stabbed 9 people because he was a viiiiictim.

Comments »So white officer Alan Horujko who shot and killed the Black Somali stabbing suspect in Ohio is being paraded as a hero. Thats interesting

— Tariq Nasheed (@tariqnasheed) November 28, 2016

Morning Joe Highlights the Idiocy and Hypocrisy of the Media Over Presidential Recount

When Trump said he was going to leave his options open, in regards to accepting the results of the election — the media went apeshit, decrying him to be a dog and a scoundrel. But now that Shill Stein and Soros funded Marc Elias from the Clinton campaign decided to do it after getting defeated in the general election, there’s nothing but crickets out of them.

The double standard is palpable and is the primary reason why alternative media sites are flourishing at a time when legacy media are in the depths of hellish rebuke.

Joe and Mika weigh in on the real fake news.

Comments »The double standard on accepting the election result. A look back. https://t.co/dn9kNm3DeA

— Morning Joe (@Morning_Joe) November 28, 2016

The Trump Rally Receded and Gold Was Found Shining Just Beneath its Veneer

Although I’m a fan of the God Emperor Trump and pray to the Gods every night that he’ll cast his enemies into the black sea to be devoured whole by monsters, I do not think any of the recent rally will hold — when people finally come to grips with the fact that status quo is dead and Hillary Clinton is going to prison.

Stocks receded a bit today — lending to a sharp rally in gold — the best in many weeks.

My favorite gold plays are the ones that I own: $AU, $AUY, $ABX and $GLD.

Bonds rebounded. Have a look at $TLT and $ZROZ. And banks got hit, rightfully so. I am short $DB and $LFC.

With yields coming in, the biggest outperformers were in the defensive stocks that have been working all year: utilities and REITs.

Stocks like $NRG, $ED, $TAC, $DUK and $AES led the utes, while $AVB and $PSA outperformed in the REITs.

The single best way that I am able to describe risk on v risk off is through the Exodus old man portfolio v the bubble basket. The old man traded down by 0.32%, while the overvalued shit in the bubble basket was down 1.8%.

Notably, the biotech sector was ravaged today — a place of magnanimous profit ever since Hillary was defeated. Biotechs traded down 2.7% as a sector — led lower by $SGEN, $ALNY, $RARE, $ICPT, $BLUE, $PRTA, $ALDR and $OPHT.

Ouch.

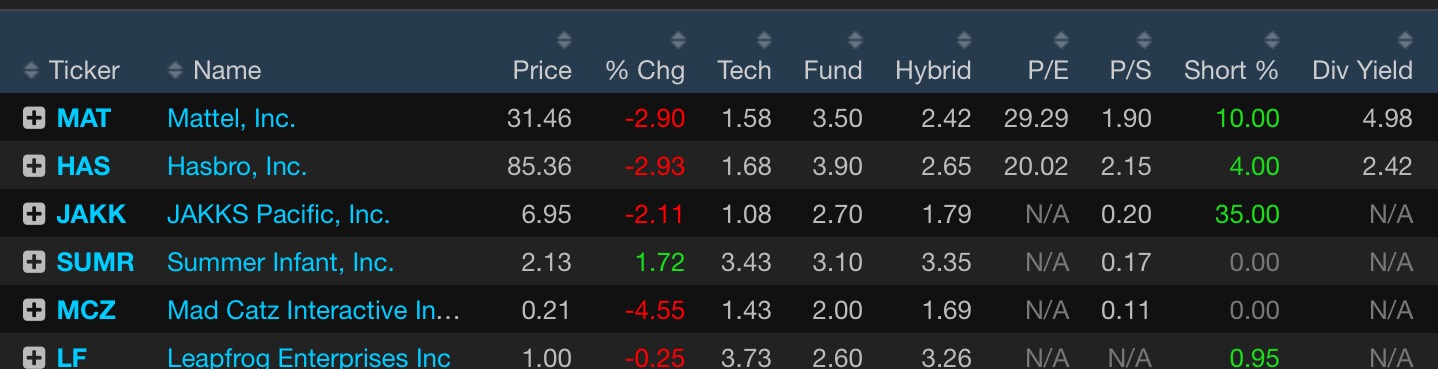

Comments »Retail Stocks Retreat After Lackluster Black Friday Sales

I was being generous by calling them lackluster, when in fact they were abysmal — off by 10.4%. Considering the fact that many retail stocks ran higher heading into the momentous day, investors have more than one concern now to sell them and move on.

Online shopping is all the rage again, according to Adobe. Black Friday sales surged online by 18% and are expected to gain 9% on Cyber Monday — effectively stabbing the shopping mall in the heart and leaving it for dead.

Sales on Cyber Monday were expected to finish up 9.4 percent at $3.36 billion compared with last year, according to Adobe Digital Insights. As of 10 a.m. EST on Monday, sales totaled $490 million.

Adobe collects the data by measuring 80 percent of all online transactions from the top 100 U.S. retailers. Of every $10 spent at the top 500 U.S. retailers, $7.50 goes through the Adobe Marketing Cloud sales platform.

Cyber Monday’s robust start highlights the ongoing shift within retail to online shopping. It also follows Thanksgiving and Black Friday when online sales beat estimates to increase 18 percent from a year earlier to $5.27 billion.

Of the online retailers, Amazon is easily the biggest. But even with these great numbers being reported, investors are selling down shares of AMZN.

This is a classic example of buy the rumor, sell the news.

Comments »Volatility Spikes, But No One is Really Scared

The VIX bounced off the all reliable $12 level and is now higher by 9% today, thanks to some early morning weakness, likely due to the Italian referendums, the Jill Stein recounts and dreadful brick and mortar Black Friday sales, which no one wants to discuss anymore. After all, Amazon is doing great.

Not before long, in our lifetime, you’ll bear witness to entire shopping malls being acquired by Amazon and converted into warehouses for their shit. All of the mall workers will be fired and robots will take their jobs. If you try to rise up against the robots, an automated uber will deliver robot security guards to cut your arms off — but do so in a way that you’ll live to tell the tale. Robots are all about precision.

VIX TITS is spiking, but no one is really scared. There’s a distinct smugness, an air of invincibility permeating the marketplace. The United States literally elected Hitler and the SPY ran higher by 8% because of it. Nothing can stop the market now. Not you, not a dead Fidel, not even Putin.

Everyone laughs at the VIX and throws popcorn at it. It’s all fun and games, fuckers, until your brokerage accounts hits zero and you’re pissing your fucking pants because you dropped your whole load inside of the market at the top.

You thought deleterious trade deals for China meant higher copper. But you were wrong and your face got fucked for it.

You thought building a 2,000 mile wall on the Mexican border was good news for Mexican stocks. But you were wrong about that too, as well as betting that the Fed could do whatever the fuck they wanted, and get away with it. Having $20t in debt was good news, until it wasn’t anymore. Rising rates into prospective fiscal stimulus and actual deflation proved to fuck your face, yet again.

BREXIT proved to be less than harmonious and the destruction of the EU and its currency wasn’t exactly news worthy of buying more shares. That too ended up drilling serious holes into your flotilla, sinking you to the bottom of the swamp, to be ravaged and eaten alive by cold blooded sharks.

Lucky for you, none of this has occurred yet. You can still enjoy the hedonistic gains, uninterrupted, as you donate residual funds to the Jill Stein recount effort.

Comments »Don’t Expect Fireworks in December; January Will Have the Real Action

For all of the hype of retail sales and holiday shopping, generally speaking, December is a big waste of time. Sure, maybe this year is different — but I doubt it.

Very soon, all of our beloved elite hedge fund managers will close shop for the year, leaving junior to run the trading turrets, with explicit instructions to not fuck up or die. Volatility will decrease and people will go to work drunk off morning egg nog.

Here are the returns for December, dating back to 1999 for the SPY.

The only major event taking place this year are the Italian referendums on 12/4. Even though this might lead to an Italian exit from the EU, I’m certain the globalist scum will figure out a way to minimize it and keep markets propped up. The Fed rate hike is already baked in and another hike isn’t expected until June of 2017, so all of the stars are aligned for a somewhat benign December, capping off a very good year.

Speaking of which, The Option Addict is hosting his final boot camp of 2016 in a few weeks. This one is a must attend event for all interested in trading for a living, or for those trying to figure out what to expect in 2017. Jeff has done a killer job in remaining calm and booking profits, all year long.

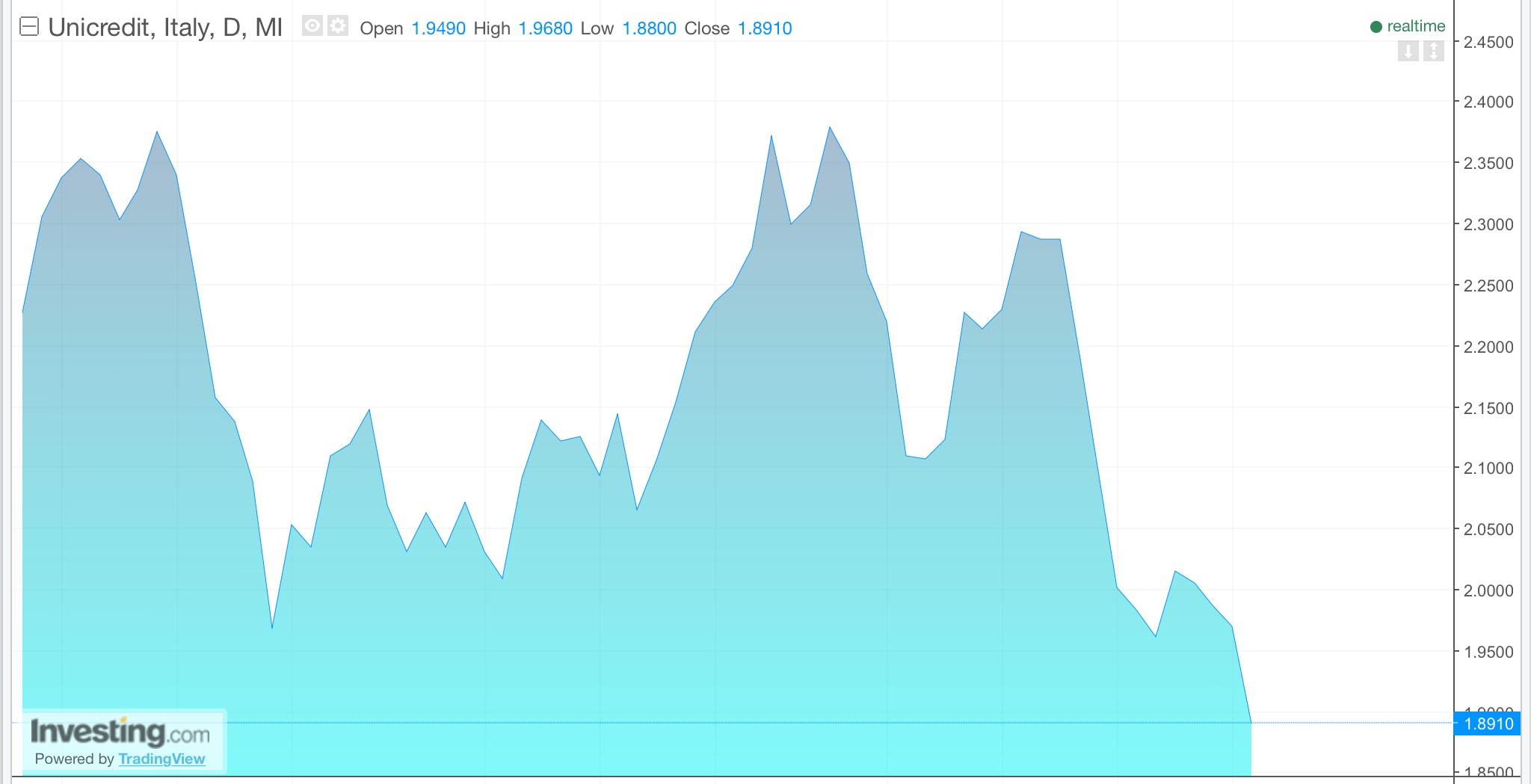

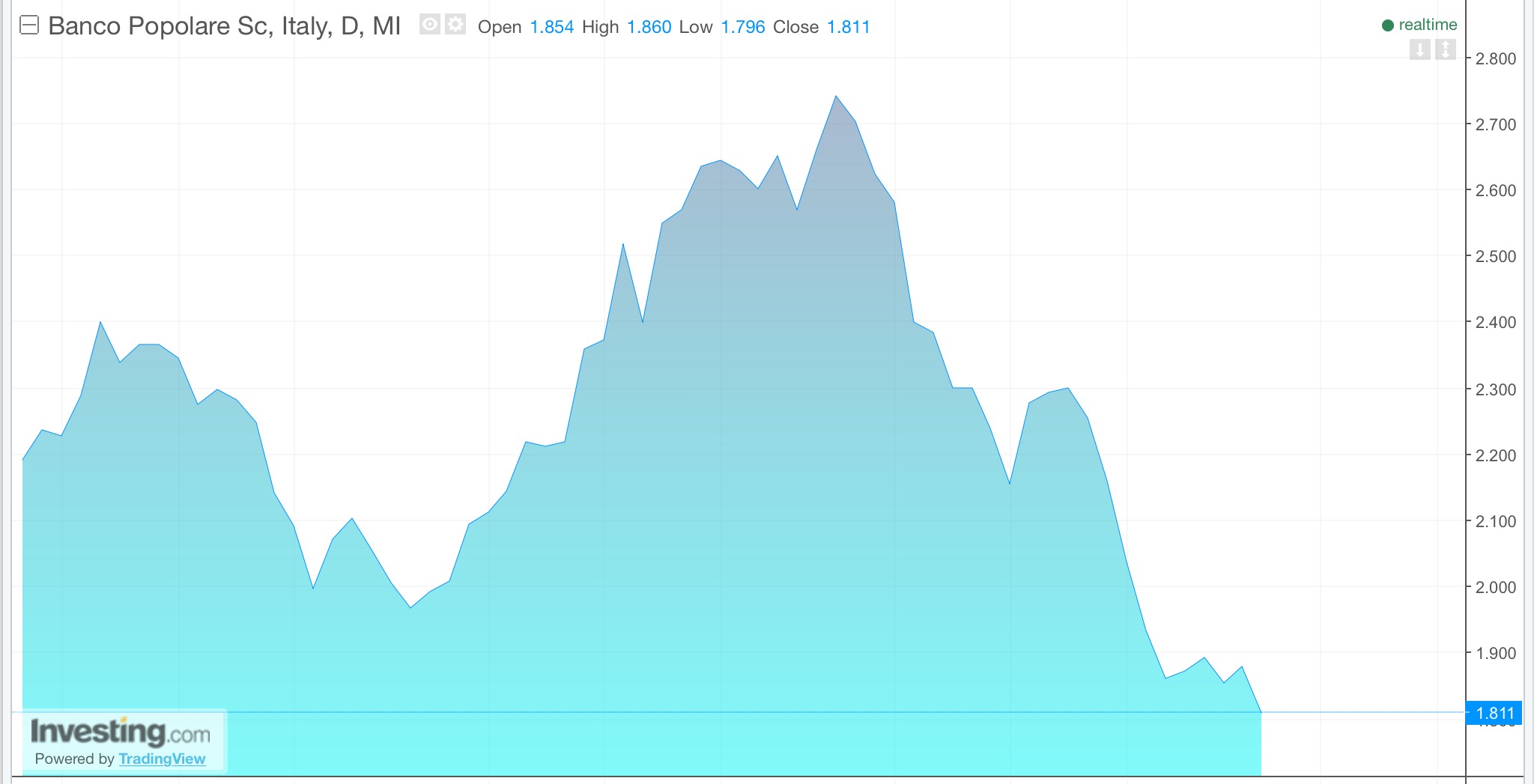

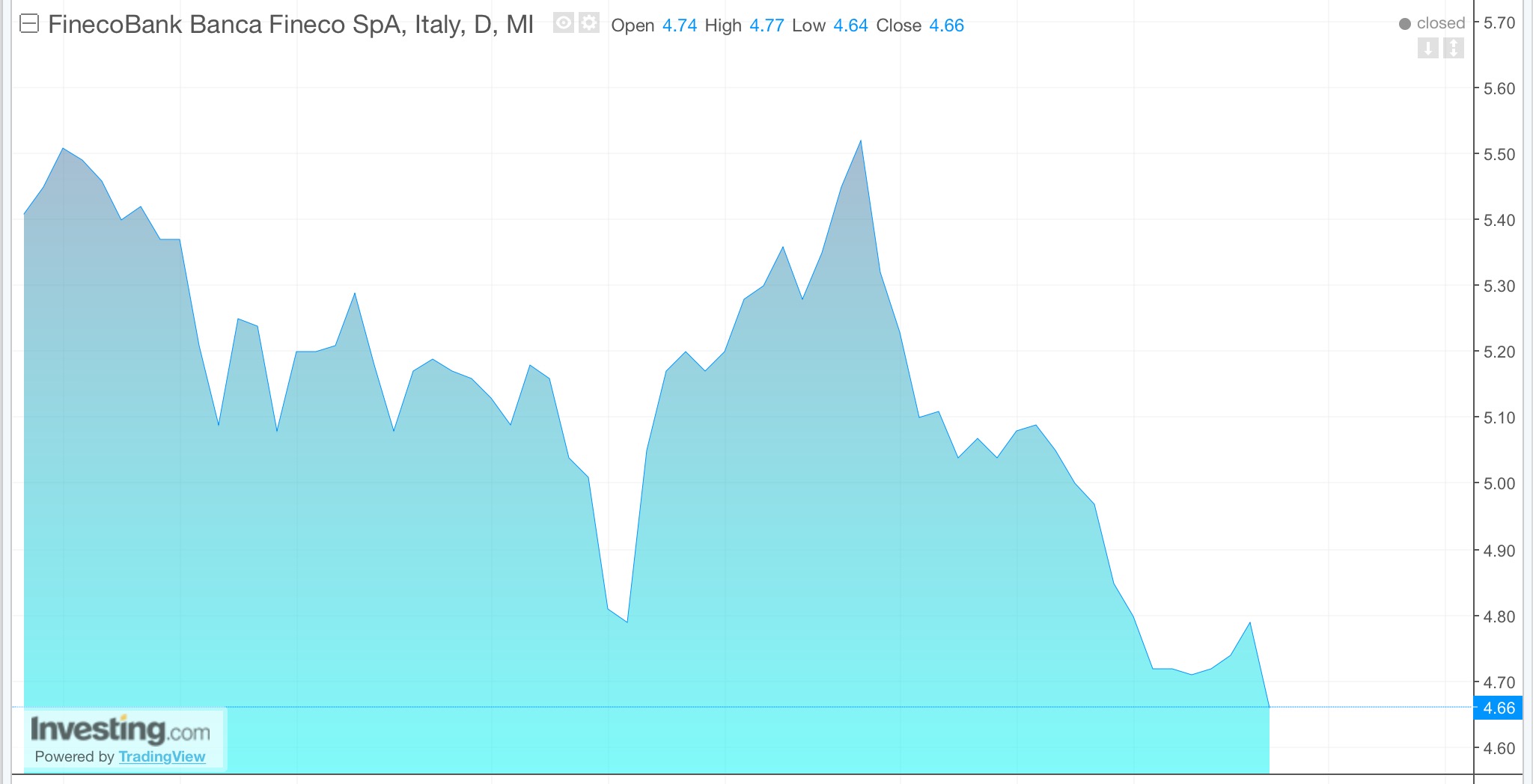

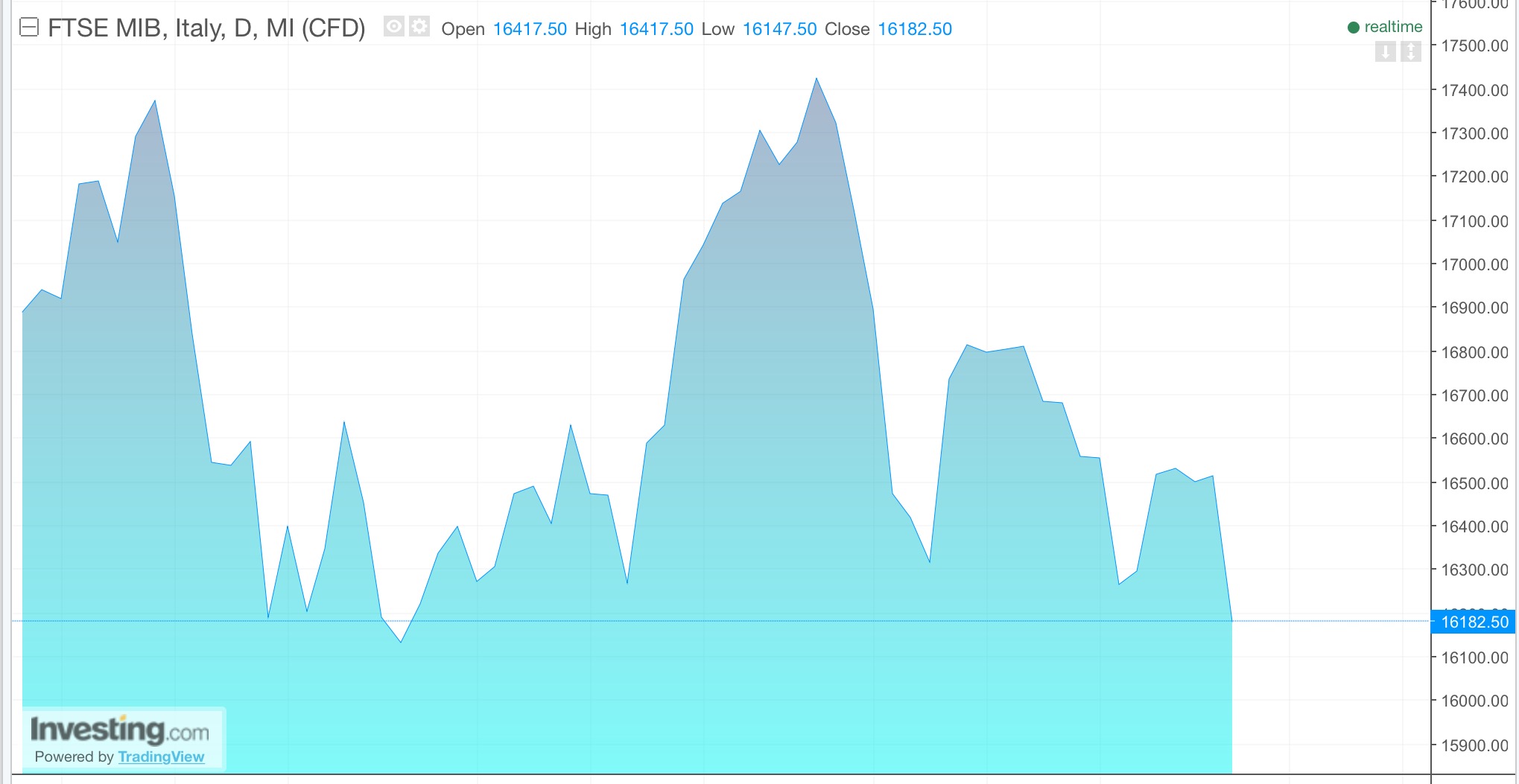

Comments »Italian Banks Hit Again Ahead of the Looming December 4th Referendum

There may be another reason why the Euro has been so damned weak v the dollar: it might not exist for too much longer. With Le Pen from France surging in the polls and Prime Minister Renzi from Italy promising to fire himself should a drastic and very aggressive constitutional realignment fail to pass in a referendum on December the 4th, the anti EU five star movement might takeover and tell Germany to fuck off.

All of this is weighing heavily on Italian stocks, one of the worst performing indexes in the world this year, off by 23% — somewhat immune to the greatness of QE and all of its grandiose splendor.

To that end, Italian banks continue to slug lower, amidst acrimonious sentiment that a potential exit from the EU might lead to the ultimate destruction of an already comically overburdened and woefully undercapitalized Italian banking system.

Shares are hitting new recent lows, down from 2-4% this morning.

Barrons sums up the best and worst case scenarios. The best case scenario is something of a fantasy, sort of like a Hillary Clinton recount election win. Not that I’m a fan of the pollsters, but the people really want to see Renzi Fire himself, with the no’s leading by 5 points in the final poll before the referendum.

IN THE EVENT the reforms are rejected and Renzi resigns, the implications are much more complicated. It is possible that Renzi’s center-left Democratic Party-led government could form a new administration, headed by one of his cabinet members, with a short term and a narrow mandate, such as writing a new electoral law. Italian equity markets probably would underperform, and the political malaise could delay capital injections at the beleaguered banks. Spreads on the 10-year bonds could widen.

In a worst-case scenario, a new government couldn’t be formed and national elections would be held, paving the way for popular euro-skeptic parties led by the Five Star Movement to put together a new administration. They could push for a referendum on continuing membership in the euro zone, which would have a destabilizing effect on the entire area.

If that happens, the euro, whose decline against the dollar has accelerated in the past few months, could face more stress. “The systemic consequences for the whole area would be material,” maintains Deutsche Bank senior economist Marco Stringa. “So the euro would probably depreciate, although it is difficult to calibrate by how much.” On Friday, the European currency was worth $1.059.

Doom is just around the bend.

Comments »METAL MANIA: Zinc and Lead Surge to Nine Year Highs, For No Reason Whatsoever

Very nice. A massive speculative bubble has shifted from bonds to zinc over the past 2 weeks. Due to an all of a sudden bullish wave of wanton optimism for China under a Trump administration, brainless idiot traders have bid up the price of lead and zinc to unbelievably stupid levels, for reasons unknown to everyone.

Industrial metals have climbed almost 30 percent in 2016 after three years of losses as demand growth stabilized in China, President-elect Donald Trump pledged to invest in infrastructure and revitalize the U.S. economy, and mine closures curbed supply. Chinese investors have added to the speculative binge.

Zinc, the best performer on the London Metal Exchange this year, climbed as much as 5.4 percent to $2,970 a metric ton and traded at $2,954 by 3:23 p.m. in Shanghai. Lead advanced as much as 7.2 percent before trading 3.4 percent higher. Both metals closed up the limit on the Shanghai Futures Exchange.

“We’re bullish on zinc and lead given the tightness in ore supply and potential production cuts at smelters in coming months, but the speed of the rally exceeds our expectations,” Dina Yu, an analyst with CRU Group, said by phone from Beijing. “There have been no big changes in fundamentals that can explain such a surge. The market is driven by bullish sentiment in all metals.”

Zinc is higher by 80% this year, while lead is up by 40%.

According to Exodus, $SSRI is the only stock in a database of more than 4,000 stocks that has both lead and zinc mining operations in its profile.

Comments »BANE EXPLAINS PRESIDENTIAL RECOUNT TO BELEAGUERED LIBTARD

When the democratic party is in ashes, then you have my permission to die.

Prepare to lose twice, snowflake.

Comments »