Markets are up 330 and I promised to become a eunuch should we rise by 600 today. I was going to sell short if we had a weak rebound — but this is strong and hairy chested. This is a Hemingway bounce back and I expect it to continue — since we’ve learned today that the tariffs are good and helping America grow and achieve greatness.

Cramer is butt-hurt over Trump’s trade war masterplan.

CNBC’s Jim Cramer voices concern about the staying power of the stock market’s bounce.

President Trump’s latest tweetstorm “has made it so we got to wait to be able to buy,” warns Cramer.

Trump should “knock the tweets off if he wants the Dow to start going up, at least today,” adds Cramer.

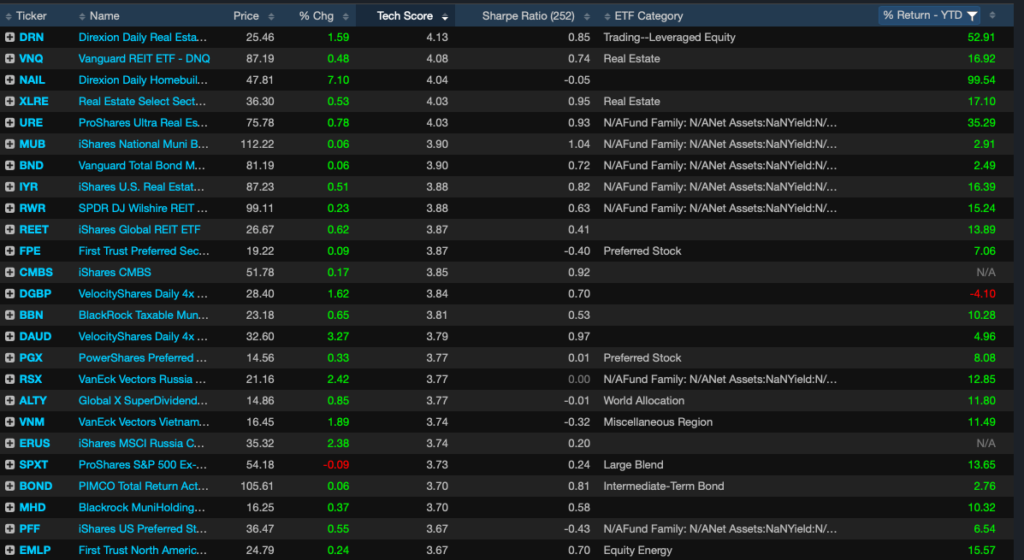

“If the trade war is over, then what are you gonna do with your inverse ETFs moron?”

I’ll probably hold them for another day, treat them like collectibles.

“Hey kids, want to see what a depreciating asset looks like?”

“Whoa Dad, where’d you get that? That’s awesome.”

“I found it lying around on the exchange, so I picked it up and put in my portfolio.”

WTI is up after the House of Saud whined over a drone attack on one of their pipelines. How rich.

But HYG and everything is up too. Yesterday was, apparently, a fiction — a one off event. We can never begin to think rationally and hope for normal market conditions. The trade war is the trade war and it really never affects anything in real life. It’s just a press release inside of this nice simulation.

“What now fucked face?”

Maybe I’ll look to add a long or two. Not sure — but I’ll figure it out.

Ciao.

Comments »