Shares of CS are getting hammered on wider than expected losses, generally playing themselves in the biggest way possible.

Comments »“We have a clear strategy, clearly we are implementing it in difficult markets and our outlook for the first quarter remains very cautious,” Thiam told an analyst call.

“(We have) very unique market conditions and they are challenging, but fundamentally we are maintaining the objectives and the targets we have presented”.

Four months on from when Thiam set out his strategy, many analysts are still unsure how Credit Suisse will hit growth targets, which include more than doubling Asia Pacific pretax income by 2018.

The bank posted a 2015 net loss of 2.94 billion Swiss francs ($2.92 billion), worse than the median estimate of a 2.12 billion loss in a Reuters poll.

It booked a goodwill impairment charge of 3.8 billion francs in the fourth quarter as a result of the new strategic direction Thiam is pursuing.

The impairment was mostly related to the acquisition of U.S. investment bank Donaldson, Lufkin & Jenrette in 2000, it said.

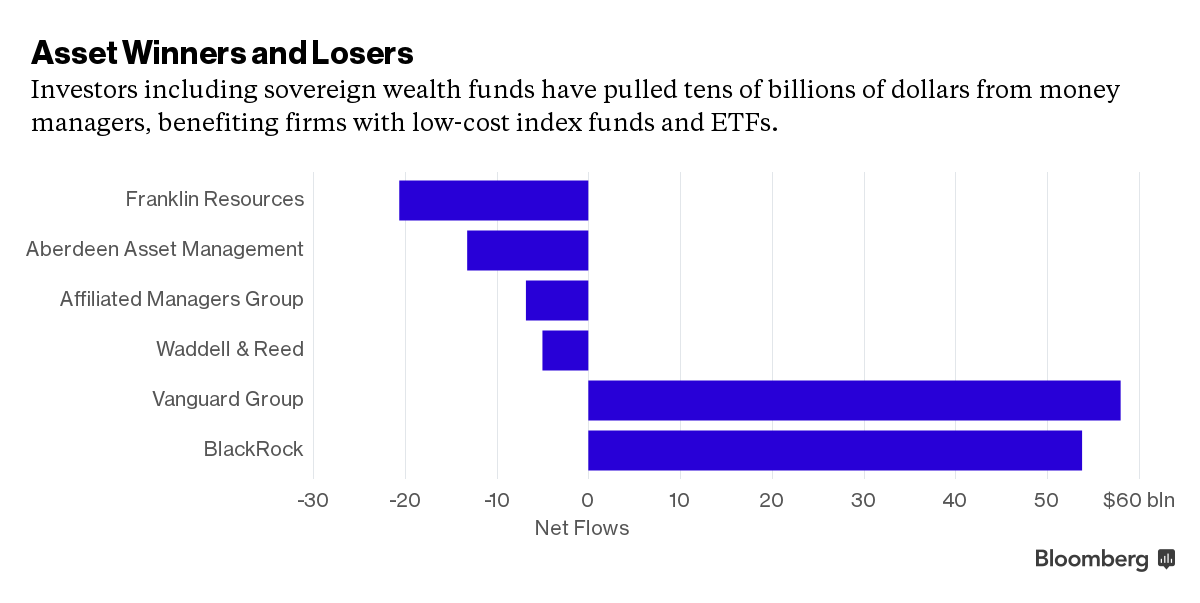

The lender said it saw net outflows of funds in two of its three main wealth management divisions during the period, though it target market of Asia Pacific was the exception.

Rival UBS this week announced its best annual results since 2010 although it also saw an outflow of funds and weakening margins at its flagship wealth management business.JP Morgan Cazenove analysts called Credit Suisse’s results “very messy”, noting an underlying loss before tax versus market expectations of a profit. The bank’s common equity tier 1 capital ratio of 11.4 percent also lagged consensus even after a 6 billion franc capital raising last year, it noted.