Last year I wrote and published two short stories about my time coming up and down in the business. In hindsight, I don’t know what the fuck came over me to bargain I could write books — as I found the process both exhilarating and incredibly obtuse; but it reminded me of yesteryear and how I always pressed the pedal all the way down when approaching bull markets. I rarely exhibited restraint, which I’ve found is something that is acquired, like a bad taste, as one ages.

In many ways, I’m the same person as I was in 2000, impulsive and brave, careless, and deliberate in my approach to maximize returns. My one deviation has been to allocate 75% of my investable assets into a quantitative strategy, far away from my direct day to day management. I’ve found this to be a blessing, as it permits me to run roughshod with my active account.

That being said, on the news that President Trump won the trade war for the fifth consecutive time, I kicked out of SQQQ for a 2% loss and TZA for a 4% win. With the proceeds and some of the cash allocated on the sidelines — I bought the following stocks.

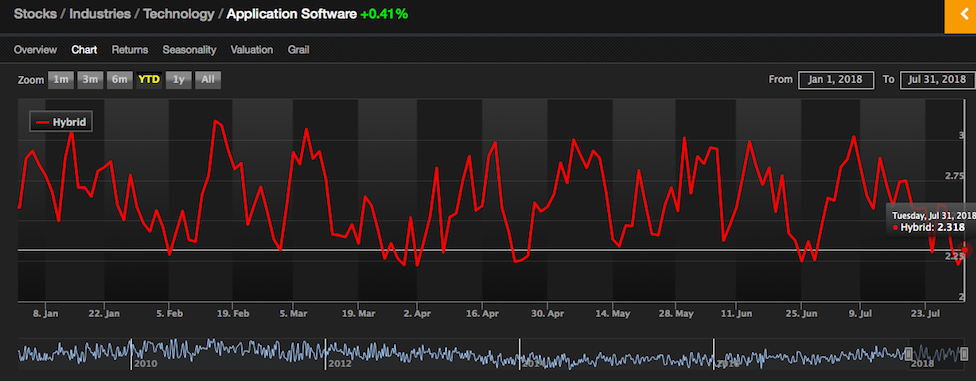

RNG, ZEN, HUBS, TEAM and IQ.

5 positons totalling ~30% of my assets — leaving me with roughly 50% cash. Although I’m buying into a melt up, I find it hard to refrain from buying dips in SAAS. I know there are those who believe this sector is rife with excess and due for a severe downturn. In the event markets fail, I’ll stop out. But for now, I’m betting on a continuation of this initial bounce — as the headline news improves on the China-US trade front.

Comments »