Our markets are pretty much belching off the rout in Europe. But it’s serious over there now, especially with the banks.

In every European country, post stress test results, which showed how fragile the entire European banking system is, shares are getting ramshackled.

Santander -5%

Unicredit -9%

Commerzbank -12%

The company reported earnings today and spoke about how truly awesome they were.

“In general, Commerzbank is one of the most un-riskiest stocks in banking that you can currently get. We are well-capitalized, we have a strong leverage ratio, we have an extremely low NPL (non-performing loan) ratio and in that sense, that is a good reason to invest,” Stephan Engels, chief financial officer of Commerzbank told CNBC on Tuesday.

“Secondly, we are still the second biggest bank in the fourth biggest economy in the world which is still growing so there is a lot of good argument to go for the stock.”

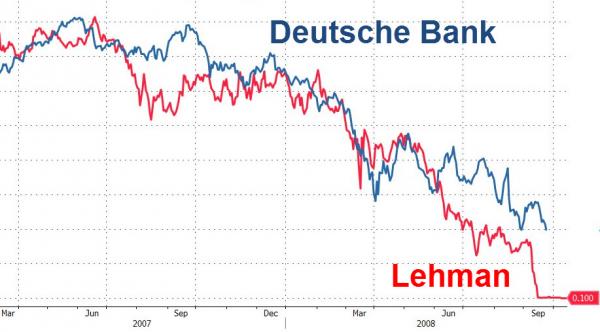

And I borrowed this gem from Zerohedge. DB is doing great today, down only 4%

UBS -8%

If you enjoy the content at iBankCoin, please follow us on Twitter

Good thing the stress test found them to be solid financial institutions.

Thank heavens

Is there some ETF or a way besides individual stocks to profit from this? I see EUFN, is there anything else?