We all want prosperity. The idea of buying a stock and seeing it run is an ideal worth striving for. Since the beginning of the year, I’ve taken a more visceral approach to stocks, casting away the hyper-active trading style for more of a macro, algorithmic based system, one that is predicated around the idea that markets are in fact prisoner to the negative rate conundrum, which is plaguing the world.

This great change in style has caused many of you to question my methods. But you’re not seeing the bigger picture, one that is undeniably ominous.

Over the past two years, stocks have done nothing. As a matter of fact, the only sectors worth writing home to Mom about are one’s beholden to yield and/or a risk off factor. The vast amount of risk assets, by which many of you make a living trading from their wellspring, have traded with an arc-type maleficence, often seen in onerous bear’d markets.

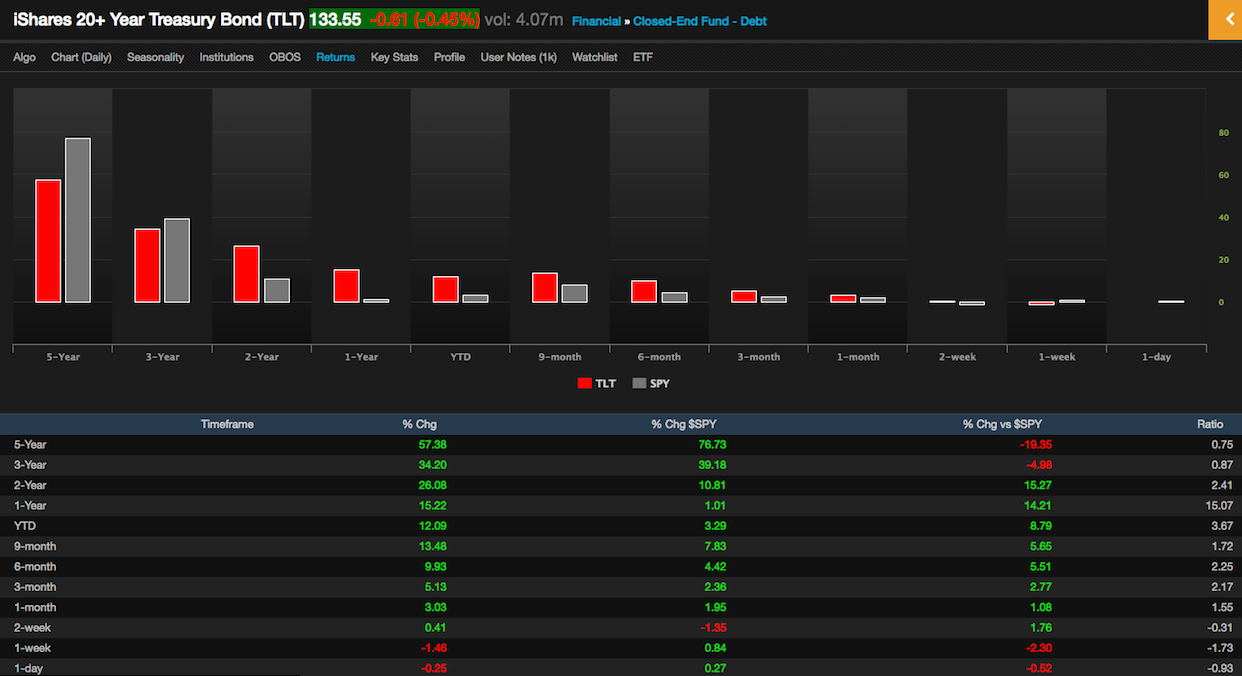

For those of you trading for a living, the pool from which you’ve opted to make a living has been a dying one, filled with scams and warnings, a minefield for those with a penchant for losing limbs. My stated goal is to build wealth. I’ve traded for most of my life, all the way back to the age of 10, while most of you were busy climbing and falling out of trees. I am not interested in preservation of capital, however. At least not now. Instead, I am merely following a core thesis, which has been thoroughly examined and enacted through years of professional training and asset management. Moreover, my position in TLT is a logical one, simply following a trend that has been extremely predictable, almost without pause. The question I have for many of you is, why are you fighting this pattern?

Including dividends, TLT is higher by 30% over the past two years. The bull case for bonds surrounds itself around the seemingly neverending plunging rates in Japan and Europe. While I am unsure as to when markets will explode or implode, I am keenly aware that markets are in a rut of inertia and have blessed those positioned in bonds, NOT stocks.

If you enjoy the content at iBankCoin, please follow us on Twitter

Senor Tropicana, I hope you saw this article….. http://www.cnn.com/2016/06/21/opinions/kentucky-ark-costello/index.html

Of course. That’s me.

Bearexit – the move to slash exposure in portfolios acrosstheboard acrossthecountry for anyone with heed with the ludicrous disparity in stocks before the bear market begins

So you’re saying ride the trend till it ends. Well I am very much looking forward to see if you can escape should the bond market collapse sir. Can’t wait

You are looking at 40 years bull market reaching negative yields. You should know that when such a thing ends, the door is so narrow not a soul can get out. At best you ll give back everything you’ve made and sell if you’re really a strong manager.

Thrers circuit breakers so . In one day a small guy can bail, if they are anticipating the action. The keys is to know whats coming. You can be early or late. Long as you have anticpated the big move and not get greedy. Greed will fuck you up even if your right.

1. You’re both assholes and have no idea what you’re talking about.

2. Central banks are blitzcrieging bond markets with hundreds of billions in freshly printed capital.

3. Rates cannot go up because the true issue isn’t deflation, but a debt burden and inability to service the debt over a long term time frame.

I will sell my bonds once the yield curve inverts and my thesis proven right. All of you are just shit talking mashed potato slingers.

Just noticed the comments were both from one guy, so just 1 asshole.

You might want to rethink 3. Should bonds collapse 50 to 70% it will actually fix the debt problem of nations.

2. You could have made the same argument with bunds last year. Yet they furiously dropped in April and everybody was panicked. The ECB was powerless to stop the move. We are starting from more extreme levels now especially in Japan so good luck to you next time this happens.

Bunds are at all time highs. Thanks for proving my point.

Banned!