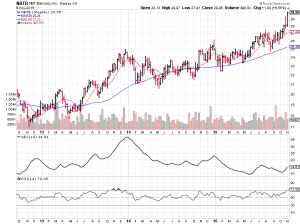

A decade and a half after sock puppets, stock muppets, and debt death predictions this juggernaut keeps growing. From shipping books (print!) to rockets that land like in 1950s Sci-Fi and public cloud services and virtual machines which can be “spun up” faster than all those books which rolled on order fulfillment conveyor belts year after year. This thing never looked back after QE 1 became old news. Druckenmiller went from trying to short things like this, to giving in and buying them when 2000 popped and now loves the machine that is AWS. While very sexty apps get marked down by mutual funds that just got on the private equity bandwagon, this is one of the beasts which powers the Internet you know and live with and will make money regardless of who captures the new high ground of messaging as “the platform”, just as it made money (and burned it on R&D bonfires bigger than Burning Man) when the browser wars were a “thing”.

Comments »Rolls Royce earnings’ head on collision with low oil prices

This morning’s news feed included another casualty reporting yet another horrible year. Rolls Royce, famed for the car, is a maker of jet engines and oil service marine engines, both of which are not in demand courtesy of the “Saudi America” crude oil dynamic, which helped carriers and jet owners put off replacing jets with newer engines and with oil service demand for new ship engines getting capsized. I recall reading value investor analysis months ago claiming Rolls’ earnings would also be hedged by its jet engine maintenance business but that has also failed. With almost a billion dollar hit to earnings in this morning’s report, dashing expectations for rescue from its ‘Trent’ engine line, the stock dived with a kind of crash not seen in 15 years.

I know most of us won’t be trading this in the ‘States but CEO Warren East’s observation about how a small change to the top line crashed into heavy fixed costs reminded me that Rolls Royce is NOT alone when it comes to this problem.

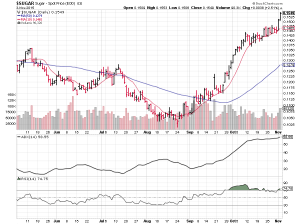

Comments »EURO RACING BACKWARDS TOWARDS PAR

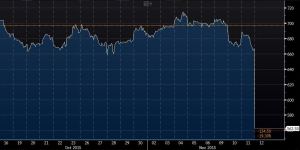

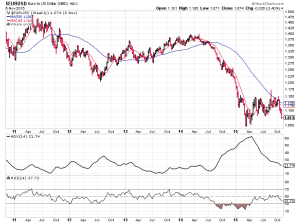

I like to use weekly prices and watch daily volumes as well. An enormous amount of money has been made from the 10-plus handle on $EURUSD but we’ll see what happens if and when this pair hits par and talk begins about “resistance” and then bets begin to pile on for a break. Afterwards there could be lots of trading back and forth as “oversold” dominates the stream and traderverse consciousness.

Let’s drill down from dailies to weeklies. Take a few minutes with me and really consider this. And then we’ll spitball about the macro. And then really consider what I muse about after these charts. Come back to this post after the close and please re-read it. This could be a big trade into 2016 or it’s beer money. Either way something is happening here.

The FXE Euro ETF daily, two year view, so we can capture that gigantic waterfall when R.O.W. outside Janetland began to cut rates and do QE. Here as soon as the 50 SMA broke the 200 SMA and “trendiness” which I like to watch ADX ramped up, it went to negative RSI and stayed there for months. Anybody fading this made pennies or lost money on a protracted basis. Right now it hasn’t quite developed into that again but it building.

Let’s go back even further, with a 5 year chart and this thing has done it before, albeit on a smaller scale from 2011 to 2012. Same dynamics.

I like the actual pair chart to look at itself $EURUSD

Below is another view and you can see the temptation that it may be ripe to fade and go long. YES, many traders will do just that. I am hesitant to go long EURO. I think you could make some money but it could be a case of pennies made versus accounts lost on a protracted basis. The R/R is generally good only for the fastest amongst you.

OK, Here is EURUSD Weekly. 10 Week SMA is clearly moving lower, and is below 50 Week SMA which is beginning to drift lower. The “trendiness” will be slow to appear but when it turns, this is when I get interested in shorting EURUSD in various forms. I joked to other colleagues and online that the pair will likely be 1.05 or lower by the time I can go to work in earnest. I’m sure it could be done right now, but I have different accounts with different time frames set up.

LAST LOOKS on a chart basis. We stop with a 5 year weekly chart. You see again two declines and the possibilities that things go “further than expected”. This is what I’m on watch for. AND BEYOND CHARTS, the macro narrative is in our favor here.

Yes, we got jobs and we have a relatively less dirty shirt, stronger economy, etc. etc, even if NOT everyone (yet) is looking for work.

What we have going for us is that we can stand pat, and I suspect might on rates. We just have too much still unresolved baggage on our balance sheet. We do indeed just have beer muscles, the kind you have when you elbow and skooch your way over to the bar for beers, and not Fitness Planet or 24/7 Fitness, and can instagram about.

HOWEVER, everyone else around us looks like death about to come and be warmed over.

Gundlach is right about the United States and rates.

Hugh Hendry might be right about us not panicking. I extend that to our domestic “need” to change rates, and that we mustn’t panic and raise rates. I worry that the Fed talks about R.O.W. in its deliberations but likely that has always been the case even if unofficial that we include global conditions in domestic rates/credit policy.

Gold is approaching 1000 and I wonder if Hedgie John Paulson might need to find Paolo Pelligrini again to bail HIM out with another good idea.

John Burbank is a macro and value guy and has a bearish view and bet on emerging markets I recall. I might be mistaken. Here I think about that “other shoe”. The emerging markets dollar denominated debt exposure that’s out there. That’s a dollar short that might or might not be called in. I’m really uncertain about this.

The “Saudi America” energy complex will persist. Low rates cure low rates if the Sauds relent. But until then they intend to push every rival producer into bankruptcy and into the hands of deep pocketed larger North American companies, Chinese investors and probably a new crop of hedge fund guys buying cheap assets. This could very well be the thing that hits OUR economy and keeps our rates at zero-bound for a while.

That said I do think savers should not be stolen from and I hope we don’t do negative rates here someday, and I would rather we have higher rates, and focus on tax incentives and actual reforms and not crowd out domestic spending and investment.

Okay, the R.O.W is now going to play a familiar tune and race to the bottom. They’re gonna be racing backwards. If we manage to not hike rates and stand still, we’re racing ahead. The dollar shoots up again for a while.

SOON, I will build the longer time frame shorts. Really sharp traders, probably in already in iBC have been trading and doing 50 year Macallan and enjoying themselves.

Comments »

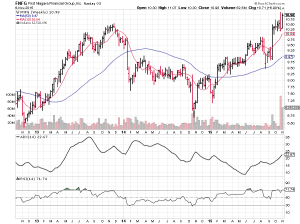

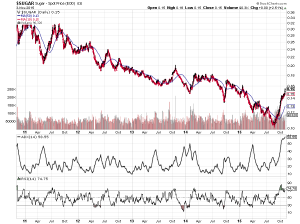

Update: Monster stock $PCLN got the chopper

And just like that Priceline faced the chopper. Swift and merciless. Probably a good spot for an entry. Having broken the 50 day, 10 week SMA this is now meat for shorter-term trading and looks to mark the potential good Risk/Reward entry point. Below are the weekly and daily versions of this beheading.

Comments »

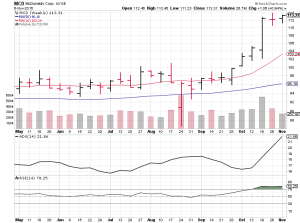

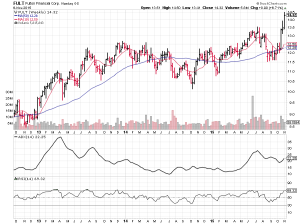

Trading with giant monster stocks and staying afloat $AMZN $MCD $GOOGL $MSFT $PCLN

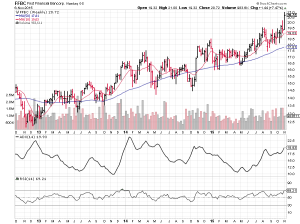

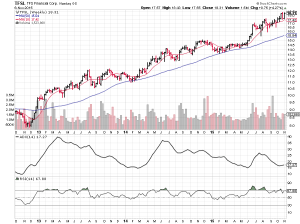

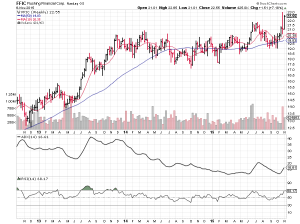

A regular scan in my system revealed in addition to financial stocks as leading the charge, that the great beasts of the market, the Sharktopus-Cap sized tickers still kept going up. The current crop of “Four Horsemen”, known as”FANG” (Facebook Amazon Netflix Google), are today’s “Nifty 50” stock group only much shorter etc. was also what led the way. Presented below are some giants and one relative guppy (Priceline) $AMZN $MCD $GOOGL $MSFT $PCLN

When taking positions here, I respectfully advice you give the beasts a wide berth and longer time frames, which could be a bit more than you might be prepared to devote, reducing your trade size.

Suggested stops loss exits for those trading on a longer time frame: $AMZN 580 $MCD 105 $GOOGL 680 $MSFT 49.75 $PCLN $1315

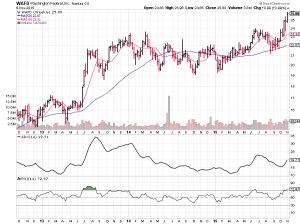

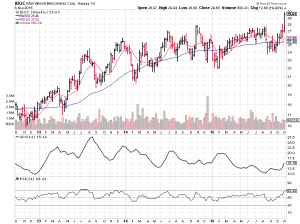

Comments »TAKE NOTE, BANK STOCKS coming back: $WAFD $FFBC $TFSL $RBCAA $FFIC $IBOC $MBTB $FNFG $FULT

Courtesy of last week’s action, the message is straight-forward: Banks up, Income plays down.

Utilities lost about a year’s worth of income in a day last friday, according to blog, Dash of Insight http://dashofinsight.com/weighing-the-week-ahead-what-will-higher-interest-rates-mean-for-financial-markets/ (one of my weekly references for perspective and context). I am watching the long bond via $ZB_F futures and yield indices for further continuation of this change. In the back of my mind Gundlach’s commentary echoes. From a 10,000 foot perspective, better rates could translate into increased incentive to loan. If you had something you wanted to sell and could suddenly charge higher prices for it, you would be inclined to aggressively seek out customers who were eligible and then close more deals. Meanwhile you could offer better prices for your suppliers, in this case your depositors. Yes, I have over-simplified and rendered a bullish narrative on an elementary school level, therefore I am doing for free what is delivered for unconscionable sums in other places.

I agree higher price tags would knock out the casual shopper, the browser but suddenly your growing list of eligible customers become clientele.

Some ideas popped up in my personal screens and systems. Here are a few of them:

$WAFD $FFBC $TFSL $RBCAA $FFIC $IBOC $MBTB $FNFG $FULT

Comments »

A quick revisit of “the one to watch” $USDJPY along with $EURUSD $FXY $FXE

Nothing like larger time frame charts with weekly price bars to wash out the daily noise. Sure when daily charts go gangbusters it’s a sight but if a weekly price update stands out, it’s something to give pause or encouragement. The Dollar is shuffling around in its bathrobe, looking for its crown, having put it down weeks ago and forgotten about it but is trying to get ready to end its sabbatical. Charts below are 3 and 9 month weekly charts, with 10 and 50 week SMA and just ADX and RSI. What really matters is how price keeps moving without really looking back over since autumn began. (Please no Game of Thrones memes about “winter”.)

Comments »A $VRX “bear” trade to take ONLY if you have a large bankroll and the “minerals”

The time to tactically short, with less “stress” has passed when it passed the “two-hundred” roll, breaking decisiviely with hundreds of percent above average trading volume. So, it’s ripe for face-ripping and pain after the first few rounds of knife-catching.

SO.

SO… if and only if you have the minerals for it Tommy (film reference “Snatch”) and about 5K to spare (potentially lose) could you perhaps consider this.

Right now, the “lowest” price way to play this with some give could be the March 2016/April 2016 puts at a 120, 125 strike for about $50, or better. In that neighborhood, it’s about a $5K trade give or take. If the balance sheet narrative overcomes all and this gives up the ghost, this should be a hefty leveraged return with a limited downside (that approx $5K you might pay for this one). (I defer to optionsaddict and raul for more advanced plays.) this one is a vanilla long option play with decent delta and enough time to play out or be played out, which means you could get stopped out around 150+(!) and recover pennies on the dollar on these puts if anything. Set a stop loss if the underlying rockets up to 150 (which could happen any day or week now) after the soul searching begins at the offices Ruane Cuniff. Yes, I said to $150, that is wide stop loss trigger on the underlying.

That’s right, all I’m talking about is the potential downside, because it’s obvious what the upside on these puts could be if there more bad news, revelations or whatever.

Again, if you don’t have a hefty bankroll, large 6 figures to modest 7 minimum, don’t do this. Don’t.

Odds are pretty good no-one will read this one so I can put this out there and do a fake victory lap if it works out. If not, I can hopefully slink away and have my ego-wounds cauterized.

Perhaps it’s better if you DO have the bankroll, reconsider idea and instead go long $AMZN, $GOOG, and $FB and the growing pariah lineup I find myself confronted with, that no-one will have any interest in until price absolutely screams this was the stuff to go long weeks ago back when a bitcoin could only buy you Old Navy instead of Tom Ford and Savile Row.

Just some spitballing to get this out of my system.

Comments »More pariahs become paragons: $SSEC $CNXT $TCEHY Shanghai Shenzhen Tencent

It’s coming back, week by week, yuan by yuan. Not sure if we’ll have farmers back at street stalls hawking both fresh greens and trading ideas but I do see a return of this market, just as surely as some of that animal spirit revival has found its way in bitcoin and public company merger deals left and right. It’ll be over when we have dozens of ETFs for a variety of SSEC components/constituents but that might be a long way off.

Shanghai and Shenzhen both figure in a theme I think will unfold over the coming months, “PARIAHS ON PARADE”. These pariahs will be hated “S” tickers/ideas, all of which are working out bottoms, ready to climb higher over a rocky terrain dotted with skepticism and cynicism. We covered Sugar. We covered the “Soviets” via Sberbank. And now today’s it’s Shanghai/Shenzhen. Last on the list will likely be South America (via already resurgent plays such as those found in Argentina and Brazil, but we’ll get to that in the next day’s post). By week’s end/weekend, I want to recap and discuss these “S” trades, that have all been hated and reviled and pushed into the earth. Seeds of indifference by burned traders/investors planted are now ready to bloom and perhaps surprise.

Below is $SSEC $DJSZ and a personal bias favorite, $TCEHY but there are many. These are weekly charts but it’s enough to encourage. You will laugh and laugh at me. I just need more price action and an arbitrary derivative like ADX and RSI to help encourage. Once the appointed hour has arrived, it’s time to light the fires and meet you at the ramparts. Once that moment is in the readiness, be ready to take profits from short-selling running dogs who can’t fathom that ghost cities could one day be crowded shoulder to shoulder, filled with the families of second and third born children, with their own kids in tow, shopping at knock-off mega-malls designed to mimic 21st century “Fast Times at Ridgemont High”.

Comments »

Sugar Rush $SB_F $SGG $CANE

Halloween has come and gone but I’m left with need for more sweets.

After an explosive move (thank you Brazil?) and break of the longer term price trend, as exemplified by the 50 week, this particular soft’s price is at last hardening. AND is it time for a selloff? I would not be surprised by calls for a “that’s it” and “Sugar Crash” click-bait on other sites, since I saw that already being written as soon as October hit and sugar began to trade back and forth, back and forth. My favorites are among the most hated trades, higher highs,lower lows, because trends have a tendency to take on a life of their own and persist. All it requires is patience, a bit of speculative imagination, a bankroll and the willingness to both use it but with some judgement. I am certain many will fade this move up and do a small R/R trade fading this move and go short. I wouldn’t blame them. On a much shorter time frame that seems the thing to do. But I’m thinking about this with a different time frame.

You will all laugh at this greenhorn notion of buying a new “high”. BUT from what time frame are YOU talking about? I will consider the possibility of something running for far longer than I expected. It’s happened before and in the case of this soft, it did for a good long time – just downward for years. NOW the r/r is about a far longer down-trend line being broken. You can almost picture it here. If that were to happen, break-out the insulin. THIS is the one I wait and watch for here, the last few weeks was a delicious tooth-aching sample of what could be, but we’ll see.

Comments »