I like to use weekly prices and watch daily volumes as well. An enormous amount of money has been made from the 10-plus handle on $EURUSD but we’ll see what happens if and when this pair hits par and talk begins about “resistance” and then bets begin to pile on for a break. Afterwards there could be lots of trading back and forth as “oversold” dominates the stream and traderverse consciousness.

Let’s drill down from dailies to weeklies. Take a few minutes with me and really consider this. And then we’ll spitball about the macro. And then really consider what I muse about after these charts. Come back to this post after the close and please re-read it. This could be a big trade into 2016 or it’s beer money. Either way something is happening here.

The FXE Euro ETF daily, two year view, so we can capture that gigantic waterfall when R.O.W. outside Janetland began to cut rates and do QE. Here as soon as the 50 SMA broke the 200 SMA and “trendiness” which I like to watch ADX ramped up, it went to negative RSI and stayed there for months. Anybody fading this made pennies or lost money on a protracted basis. Right now it hasn’t quite developed into that again but it building.

Let’s go back even further, with a 5 year chart and this thing has done it before, albeit on a smaller scale from 2011 to 2012. Same dynamics.

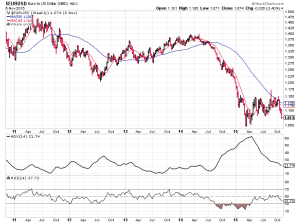

I like the actual pair chart to look at itself $EURUSD

Below is another view and you can see the temptation that it may be ripe to fade and go long. YES, many traders will do just that. I am hesitant to go long EURO. I think you could make some money but it could be a case of pennies made versus accounts lost on a protracted basis. The R/R is generally good only for the fastest amongst you.

OK, Here is EURUSD Weekly. 10 Week SMA is clearly moving lower, and is below 50 Week SMA which is beginning to drift lower. The “trendiness” will be slow to appear but when it turns, this is when I get interested in shorting EURUSD in various forms. I joked to other colleagues and online that the pair will likely be 1.05 or lower by the time I can go to work in earnest. I’m sure it could be done right now, but I have different accounts with different time frames set up.

LAST LOOKS on a chart basis. We stop with a 5 year weekly chart. You see again two declines and the possibilities that things go “further than expected”. This is what I’m on watch for. AND BEYOND CHARTS, the macro narrative is in our favor here.

Yes, we got jobs and we have a relatively less dirty shirt, stronger economy, etc. etc, even if NOT everyone (yet) is looking for work.

What we have going for us is that we can stand pat, and I suspect might on rates. We just have too much still unresolved baggage on our balance sheet. We do indeed just have beer muscles, the kind you have when you elbow and skooch your way over to the bar for beers, and not Fitness Planet or 24/7 Fitness, and can instagram about.

HOWEVER, everyone else around us looks like death about to come and be warmed over.

Gundlach is right about the United States and rates.

Hugh Hendry might be right about us not panicking. I extend that to our domestic “need” to change rates, and that we mustn’t panic and raise rates. I worry that the Fed talks about R.O.W. in its deliberations but likely that has always been the case even if unofficial that we include global conditions in domestic rates/credit policy.

Gold is approaching 1000 and I wonder if Hedgie John Paulson might need to find Paolo Pelligrini again to bail HIM out with another good idea.

John Burbank is a macro and value guy and has a bearish view and bet on emerging markets I recall. I might be mistaken. Here I think about that “other shoe”. The emerging markets dollar denominated debt exposure that’s out there. That’s a dollar short that might or might not be called in. I’m really uncertain about this.

The “Saudi America” energy complex will persist. Low rates cure low rates if the Sauds relent. But until then they intend to push every rival producer into bankruptcy and into the hands of deep pocketed larger North American companies, Chinese investors and probably a new crop of hedge fund guys buying cheap assets. This could very well be the thing that hits OUR economy and keeps our rates at zero-bound for a while.

That said I do think savers should not be stolen from and I hope we don’t do negative rates here someday, and I would rather we have higher rates, and focus on tax incentives and actual reforms and not crowd out domestic spending and investment.

Okay, the R.O.W is now going to play a familiar tune and race to the bottom. They’re gonna be racing backwards. If we manage to not hike rates and stand still, we’re racing ahead. The dollar shoots up again for a while.

SOON, I will build the longer time frame shorts. Really sharp traders, probably in already in iBC have been trading and doing 50 year Macallan and enjoying themselves.

If you enjoy the content at iBankCoin, please follow us on Twitter