Courtesy of last week’s action, the message is straight-forward: Banks up, Income plays down.

Utilities lost about a year’s worth of income in a day last friday, according to blog, Dash of Insight http://dashofinsight.com/weighing-the-week-ahead-what-will-higher-interest-rates-mean-for-financial-markets/ (one of my weekly references for perspective and context). I am watching the long bond via $ZB_F futures and yield indices for further continuation of this change. In the back of my mind Gundlach’s commentary echoes. From a 10,000 foot perspective, better rates could translate into increased incentive to loan. If you had something you wanted to sell and could suddenly charge higher prices for it, you would be inclined to aggressively seek out customers who were eligible and then close more deals. Meanwhile you could offer better prices for your suppliers, in this case your depositors. Yes, I have over-simplified and rendered a bullish narrative on an elementary school level, therefore I am doing for free what is delivered for unconscionable sums in other places.

I agree higher price tags would knock out the casual shopper, the browser but suddenly your growing list of eligible customers become clientele.

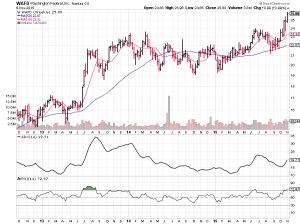

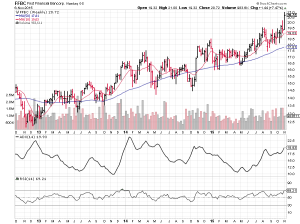

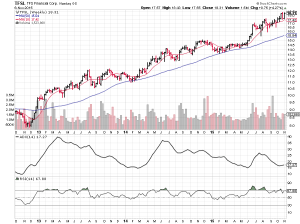

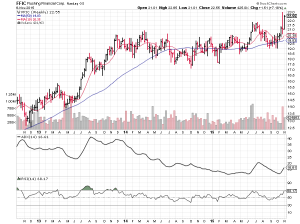

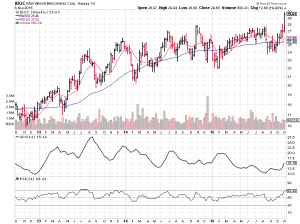

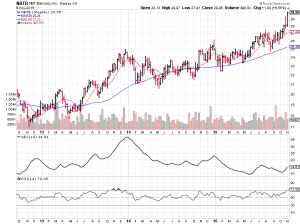

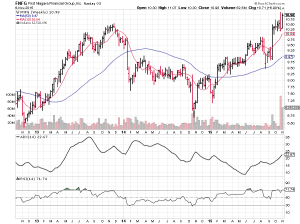

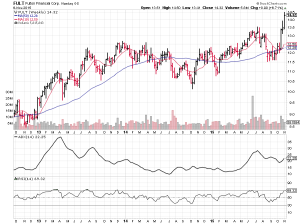

Some ideas popped up in my personal screens and systems. Here are a few of them:

$WAFD $FFBC $TFSL $RBCAA $FFIC $IBOC $MBTB $FNFG $FULT

If you enjoy the content at iBankCoin, please follow us on Twitter