We can’t blame Aubrey McClendon, he’s been gone for years. We can thank the “King Dollar”, “China Becomes A Consumer Economy” narrative for this one. McClendon announced he was stepping down almost three years ago and was gone come April 2013. Meantime, Lyft benefactor Carl Icahn is in for about 11% of a company with extreme leveraged exposure to energy, recently axed about one-sixth of its workforce and has around half the float short. It has something like $1.75B USD which must be conserved. The McClendonian summer during which $1.75B would have been lunch money has given way to winter for energy credits – just ask anyone in high yield energy. This is NOT Icahn’s only play in energy and raw materials – the mind reels when you lump in LNG, CVR and FCX. Hard to fade a kid from Queens who went on to card-shark his way through college and then turn the options business upside down but hard to see how CHK could even move from its now sub-$3 handle to anything worth what was plowed into it. The 19780s-era terror, now 2010s activist, of Corporate America, has lost something shy of a nickel for every dollar of his net worth ($1+B in paper losses so far) in CHK alone.

Comments »Two Giants Surrender To Each Other: Suncor and Canadian Oil Sands

How times have changed from the days of crude oil’s super-spike. Under the relentless assault of falling prices (Benchmark Brent was under $30 bbl as of this writing) two tar sands giants agree to a friendly merger. Suncor and Canadian Oil Sands shall hold each other as the sky grows black via a $4.24B CN ($2.92B USD) all-share exchange merger, plus debt assumption (0.28 Suncor shares per 1.0 Canadian Oil Sands and $2.4B CN in debt assumed). Come February 5, the deal will be done once 51% of shares have been tendered. When an industry is in tumult, and energy is most certainly that, we shall be reading about all kinds of event-driven investing opportunities and that includes mergers as well as reorganizations and distressed/bankruptcy deals. (Tangential thought: what a time to brace for the IPO of black gold’s ultimate leviathan, Saudi Aramco.)

Comments »Amazon’s Got Drones, Planes and Now …Ships? (Sort Of)

Straight out of China. Amazon will become an ocean freight forwarder in China. This feels like a way to entice Middle Kingdom exports into the head FANG’s “Fulfillment by Amazon” pipeline back to US. And now for some random notes.

That link leads to the Federal Maritime Commission and click on that, find “Trade Name” on the pull down menu on the search engine and type in Amazon. Boom. “AMAZON CHINA, AMAZON.CN, AMAZON GLOBAL LOGISTICS CHINA” are the Trade Names for Beijing Courier Joyo Courier Service. Long story short Bezos will not be admiral of a 21st fleet necessarily. His eyes are pointed skyward after all.

http://www2.fmc.gov/oti/NVOCC.aspx

This below referenced blog, written by Flexport CEO Ryan Petersen, head of a freight forwarder, covered Amazon’s foray into the oceans.

https://www.flexport.com/blog/amazon-ocean-freight-forwarder/

Flexport CEO Petersen’s assessment: “Amazon’s ocean freight offering could be a huge hit for Chinese merchants. But I predict that Amazon will fail to win traction with U.S. brands. American companies will simply not be willing to turn over such sensitive supply chain data to a major competitor and channel partner.”

But this may not just be about China. It could be about this company. https://www.wish.com

http://recode.net/2015/12/28/meet-wish-the-3-billion-app-that-could-be-the-next-walmart/

Wish, a MOBILE platform, and Russian funded e-commerce unicorn (at 3.5B+ USD valuation based upon Yuri Milner’s $500M injection) which seeks to disrupt that which Amazon is already disrupting – Walmart. Petersen’s Flexport blog offers a nugget about a potential “WHY” behind Amazon’s maritime moves. To oversimplify it’s an “Empire Strikes Back” scenario, with Bezos’ Empire poised to crush mobile upstart Wish.

Regarding this mobile unicorn, some observations by Re/Code journalist Jason Del Ray: “The company has taken the direct-to-consumer fad to the extreme, connecting buyers directly to Chinese manufacturers who ship to customer’s doors from factories, cutting out middlemen and markups along the way. That helps explain the dirt cheap prices, from $7 sweatpants to $15 smartwatches, but also the long delivery times of two to three weeks.” And this could help explain Amazon’s big to get China more directly plugged into Amazon’s distribution channel.

Is this about Wish > Amazon > Walmart?

Avast ‘ye, arghhh.

Comments »

Housing Bubble Coda: Goldman Squid Settles

It’s tentative, but Goldman Sachs has a deal to settle its housing bubble MBS hangover with the D.O.J., the NYS and Illinois AG offices, FHLB of Chicago and Seattle and the National Credit Union Administration to the tune of $5B+ USD, in the form of $2.385B USD civil penalty paid, $875M cash and $1.8B USD in “consumer relief” (e.g. principal forgiveness for underwater mortgages). It’s not sealed and delivered by the market will treat it as such and this will be on the heels of it upcoming Jan 20 earnings report, which the Street had already discounted year-over-year Q4 from just shy of 4.4/sh down to about 3.6/sa. It’s kitchen sink time: “Fixed Income” bank desks have been getting culled (regulatory balance sheet costs plus customer woes), 2015 related headaches (extra “I …drink…your…milkshakes”) and now a bookend for circa 2005 MBS excess.

Comments »

Alcoa All Crumpled

Here we go again, it’s that time of year again and Alcoa $AA gets to go on stage first and surprise, surprise, it’s all about losses from the older cyclical industrial side of $AA. No worries, there will be some bankers to save the day. Look forward to higher growth transport-related special “value added” manufacturing and what shall be a cigar butt.

And now time for some copy-paste monkery of the press release plus quick notes.

Net loss of $500 million, or $0.39 per share; excluding-special items, net income of $65 million, or $0.04 per share

(I just love “excluding-special items”. It’s up there with “normalized for” etc. etc. Extra sarcasm)

Revenue of $5.2 billion, 7 percent revenue increase year-over-year from aerospace and acquisitions more than offset by a 25 percent decrease from lower alumina and aluminum prices, divestitures and closures. Yes, there it is, no surprise. $3.3 billion comes from the “value-add” business and the “Upstream” business brings the drama of declining prices. The future is about breaking this company into one that makes high-end OEM components for plane makers and other customers and into the “Upstream” business which has to shut down smelters.

(As you can see, given the trend in alumina prices and earnings growth in higher-end manufacturing they are looking forward to this breakup/split/spin-off. It’s I-banker “coyote morning” time. It would be nice if karma could make the cigar butt more valuable than the presumptive higher growth “value add” but I doubt it and only if you pay at less than cigar-butt prices. )

(Secret wish if I had one for $AA: Post financial engineering, the side carrying the “Engineered Products & Solutions” business gets “baby out with the bath-water” as if it was the stinky smelty cigar-butt side of the older business, while Mr. Market continues hater mode on all things raw material/”China goes to the mall and not the mines”. That little “engineered products & solutions” business is the crown jewel. If the higher growth side gets re-priced for just one of its divisions then you got something. I doubt it will happen. I need to read reports and wait, it won’t happen immediately.)

Link to the press release below

http://www.alcoa.com/global/en/news/news_detail.asp?pageID=20160111000314en&newsYear=2016

Comments »

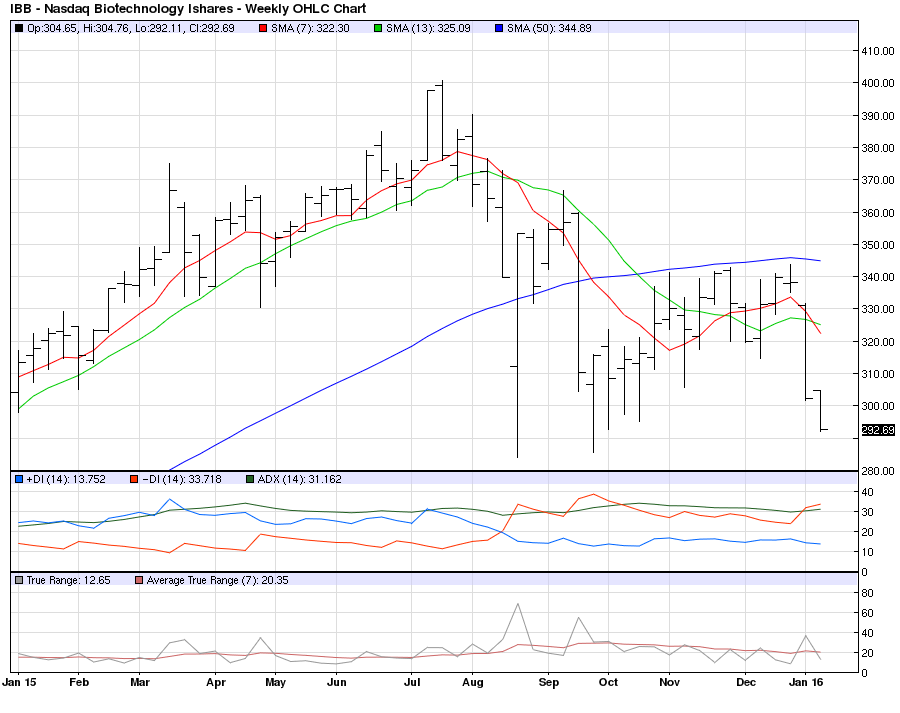

Quarantine as Biotech Breaks?

Quarantine protocol for biotech basket $IBB. Yes, it’s been telegraphed on daily charts for about six months as in trouble, and it seemed like it was over but now it’s not. I use weekly price filter for prices and it sucks again. I can’t trade opinions, I trade price. Swing, reversion and shorter-term traders will have a field day. There are bargains to be found in space like raw materials and among the survivors of what could be a wash-out in energies. In BIOTECH however, in that space which has all the allure of Unicornian optimism but none of the income necessarily and is prone to regulatory preemption (hello FDA) we have real trouble.

The 50 week SMA has begun to dip, again, and this could be something you trade against on a shorter time frame. Watch for bounces and price action that will idiotfy this post, but I wouldn’t make “holds”, I would bank them and short against them. (I’m looking at June puts, I’m not set up for shorter time-frame trades and if it’s right, it gets more right and suddenly we’re talking about the “2” handle as absurd as it might be but so was “3” last summer, wasn’t it?)

Background view as this is unfolding: Europe is weakening as I write this again. The China/RMB/Yuan narrative dominates. Let’s see what the New Year (of the Fire Monkey) brings. None of this matters for this post. I see $IBB dropping now. This is the one biotech play that’s easiest to hold and it is not doing well.

Yes, it is Monday. Tomorrow could make a hero out of longs. But right now $IBB is below $300. Maybe this is the tradable bottom. We’ll see.

Below is a quick chart, weekly basis, with some SMAs (but the 50 Week is on my mind). Ripe for rip? Yes but ripe to sell against (extra vaccination).

Comments »

Valeant Chops Pearson: Is $VRX to become a “tax-loss” exit favorite?

This has been nothing but a series of “cluster-whatisgoingon?” lately in the markets. I knew about Pearson’s hospital stay and figured this was stress-induced illness but an actual press release turns rumor fodder into reality. Pearson was the master architect underlying the economics of a pharmabeast which uber-hedgie Ackman rode. But as I suss this out, the model is about to go tip-toe-ing quietly into that goodnight into outright Shkreliplosion. What will be the point of owning a machine without its primary mover??? What will become of Ackman’s 2016 now? Will we see more filings about more “tax-loss” exits?

I have been away, nearly felled by a virus, on nerve pain meds and watching from the sidelines. The salutary effects of being in cash as all went perdition’s way has been worthwhile however. (extra-cuttingoff-diplomatic-ties)

More to come, as I read this and try to make sense of this madness.

Comments »

Trader who made 500M USD from shorting the housing bubble also looked at Clovis

For those who follow biotechs and pharma, Clovis Oncology was a casualty of an FDA request for more information, which happened not long after rival AstraZeneca had a competing drug approved. Normally such a story ends the interest of most speculators but I posted about Zachary Schreiber’s recent purchase of 7.7 percent of Clovis as a heads up that the recent dumping may have been an opportunity to buy. Schreiber’s is well known in trading circles for his $1B USD profit from shorting crude oil and for having been a protege of hedge fund legend Stanley Druckenmiller.

Not long after Schreiber’s Clovis position was filed, another successful and smart investor, Kyle Bass, who made about half-a-billion dollars from fading the housing bubble, discussed Clovis. (History recap for those of you who just became legal to drink, about a decade ago, Bass had taken the other side of a trade against synthetic CDO managers who underwrote de facto insurance against the default of Collateralized Debt Obligations (CDOs). CDOs were those bundle of mortgages, which were created in mass quantities and gobbled up by institutional investors, thanks to the roller-brush rating blessings of rating agencies, even if not all the mortgages were of equal quality. But I’m getting away from Clovis.) Not long after the internet masses starting talking about this appraisal of Clovis, I read this fascinating research late last Tuesday evening but then the ramp-up to “National Feast” festivities took over. Before I make another roast turkey sandwich, I wanted to assemble some very imperfect notes to help me learn, think, and help me work out in my mind what is going on with Clovis.

Before you go any further, please read my earlier notes from my initial post on Clovis Oncology. That might serve as a warm-up prequel to this post.

What follows is a collection of thoughts as I work my way through both the science and the business elements of this “story”.

Some initial takeaways from my readings:

First, to oversimplify: the assertion about Clovis’ lower rates of success may not be entirely fair. AstraZeneca had apparently had more Asian subjects in its Tagrisso trials, resulting in a more successful looking drug. This looks like a very material issue. From what I could gather from the analysis, and then looking into what the oldest organization focused on the study of lung cancer had to say, based upon the potential rates of disease and responsiveness to treatment among Asians afflicted with lung cancer, there may be an imperfect understanding of the competition between Clovis and AstraZeneca.

Second, again to oversimplify: it occurs to me that the question of Clovis’ lead lung cancer drug, Rociletinib, working or not is not the issue. It does seem to work but I think the wrinkle became the issue FDA’s request for more info. This wrinkle was thanks to the nature of the data submitted by Clovis as it was building its Tiger drug trials – which included both confirmed responses and unconfirmed responses by subjects. It looks like Clovis was optimistic and had expected a higher conversion. What looks like management’s complete screwup, regarding the usage of “confirmed” and “nonconfirmed” objective response rate (“ORR”) data, is being mixed up with the separate issue of drug efficacy. has potentially jeopardized Clovis’ breakthrough drug status for Rociletinib but not killed it yet. It looks like they will work to make good and supply more information but the market has said, “too little, too late”. This is moot given that rival AstraZeneca’s Tagrisso was not only approved, but was approved about 3 months earlier than expected, and that might be the wedge which hurts what could be a delayed approval of Rociletinib. One complication about these medications becomes the issue of mutation and resistance, and while might well be a place for Rociletinib for patients who become resistant to other treatments but I’m not sure if that is enough to help Clovis catch up.

(Post-script: An attentive reader pointed out, respectfully (thank you for not taking off my head), that I made an error by pointing out logically that it is essentially moot if both confirmed and unconfirmed data is presented to the FDA, since “efficacy” has to be based upon “confirmed” ORR data. I lack the correct terminology but I have been influenced by Bass’ argument, that they do in fact have a candidate that could potentially be approved but now they have to work in the aftermath, and under the shadow of having submitted “nonconfirmed” data which prompted the FDA’s actions. This is what I meant by “separate issue” – there could be a drug that proves its efficacy but now the company has to try again but had provoked Mr. Market into dumping shares. The error is mine and thank you reader.)

So where is the value? Why in the world am I talking about what really does seem to be a disastrous pharma investment? Yes, one company might have “gamed” the system with how it populated its trial but right now the other company may have not only missed its opportunity to do likewise (assuming it was even allowed to do so) but made things worse by being way too optimistic that the “nonconfirmed” subjects would convert at a high enough rate to “confirmed”. I have to admit my interest comes down to two non-medical investment professionals. Normally, I would have taken a pass on a “knife” but it’s not everyday you see someone like a Zachary Schreiber come in to buy a little over 1/14 of a company and then see another analytical machine, like Kyle Bass, who built a career on independent and insightful analysis (as far back as his early days at Bear Stearn’s Dallas office) on “shorts”, come in with a buy analysis. It’s weak beer to admit that but it I’m taking their actions seriously enough to spend time on this and risk wasting yours.

My interest in Clovis was inspired by Zachary Schreiber’s 7.7 percent position. Nobody throws away money and Schreiber is a big picture investor who Druckenmiller sees as a possible market wizard (“market wizard” is my characterization not Druckenmiller’s) in next 15 years or so. It’s a little daunting to look into some serious science but it looks like this is a real, and not pie-in-the-sky, pharma investment opportunity,with real drugs coming to market. As part of this, I am making best efforts to understand why some smart money is interested in Clovis, after a massive market price decline, with a little help from wikipedia and Google.

Let me return for a moment about what I was getting at about the number of Asians in both Clovis’ and AstraZeneca’s trials.

“The International Association for the Study of Lung Cancer (IASLC) is the only global organization dedicated to the study of lung cancer. Founded in 1974, the association’s membership includes nearly 4,000 lung cancer specialists in 80 countries. IASLC members work to enhance the understanding of lung cancer among scientists, members of the medical community and the public. IASLC publishes the Journal of Thoracic Oncology“.

From the March 2015 issue of the Journal of Thoracic Oncology:

“Non–small-cell lung cancer (NSCLC) accounts for approximately 85% of lung cancers,1 with an estimated 1.8 million new lung cancer cases worldwide in 2012, including 1 million cases in the Southeast Asian and Western Pacific regions combined.2

Recent advances in lung cancer research have resulted in the identification of several mutations that contribute to carcinogenesis of NSCLC.1,3 The epidermal growth factor receptor (EGFR) is encoded by one of the most commonly mutated genes in NSCLC, with activating mutations detected in up to 15% of adenocarcinoma (ADC) and less than 5% of squamous cell carcinomas (SCC) within the Caucasian patient population.1,4 Mutation rates are higher in Asian populations, with EGFR mutations reported in up to 59% of ADC and 5.4% of SCC cases.5 “

My reaction to that macro data: What would Clovis’ results have been like if the trials had taken place in an Asian market?

Last week’s reading about Clovis points out that AstraZeneca seemed to have 3 times as many Asian test subjects for its Tagrisso drug trial than Clovis had for testing Rociletinib. (I have questions about why the composition of the study groups were different.)

Quick notes on lung cancer. These are by no means complete notes on the subject and I apologize for inaccurate and incomplete notations.

There are two main types of lung cancer:

(1) Small cell which makes up 10-15% of lung cancers

(2) Non-small cell (NSCLC) which makes up 85-90% of lung cancers (a/k/a: NSCLC). Adenocarcinoma (40%), Squamous cell carcinoma (25-30%) and large cell (10-15%) are the 3 leading types of NSCLC.

Clovis’ Rociletinib was intended precisely for EGFR mutation-related “non-small cell lung cancer” (a/k/a “NSCLC”) and it looks like management had challenges with both handling the data as well as with how the study was populated. I will need to look deeper into this and see if I understand what happened with management. Clovis may in fact have a drug competitive with AstraZeneca for all we know but we are dealing with two data sets, with two differently composed study groups. “Apples and oranges” may be the problem here.

Turning very quickly to the valuation estimates: I read them with a grain of salt but I am fascinated by the mechanics of such an estimate and if they are in the ballpark then Clovis, at recent prices, is an attractive investment idea.

Scenario 1: Clovis could be $45 a share upon approval of a second drug under development, Rucaparib which was not subject to the FDA info request, while leaving open the possibility that former favorite turned “problem child”, Rociletinib, could still be approved.

An oversimplified description of Rucaparib from my reading of Clovis’s info: Our DNA gets damaged and we have systems that repair our DNA to prevent mutations and cancer. Sometimes we get cancer because the damage cannot be undone readily. In fact, cancer cells themselves can stay alive through similar “repair” mechanisms. Poly ADP-ribose polymerase (PARP) initiates a process which quickly repairs DNA during the early stage of damage, and this is part of how cancer cells keep themselves alive. Rucaparib is a PARP “inhibitor”, and could prevent cancer cells from repairing themselves. “In the absence of PARP, cells are unusually sensitive to DNA damage when exposed to radiation or DNA-alkylating agents.” The idea is that radiation and chemotherapy’s work won’t be undone by cancer cells repairing themselves. Analogy: the ground troops of radiation/chemo get air support from drugs like Rucaparib.

The FDA granted Rucaparib “breakthrough drug” status for treating ovarian cancer , which is from my early reading, is the seventh most common form of cancer and eighth most common cause of cancer-related deaths.

The anchor steadying this scenario is that Rucaparib could be approved in 2016. Rucaparib, unlike its sister drug under-development Rociletinib, is not the drug under increased market scrutiny and skepticism and which caused Clovis shares to collapse to the mid-20s per share. This seems to be a “baby thrown out with the bathwater” scenario.

As there is no immediate earnings, the valuation estimate which resonated for me was cash on the balance sheet, + guesstimated values of each drug, depending on what stage of development it was in.

Breakdown of Scenario 1 estimate: $8 per share + maybe $10 (up to $15) for FDA trouble child Rociletinib + $ maybe $25 (up to $30) for Ruciparib, with an estimated total ranging from $43 to $53. $45 is the suggested mid-guesstimate. NOTE: that $8/share should be the 600+M of cash then less the 287+M in convertible debt.

The cash + the middle child of Rucaparib, at current market values, offers a “call option” on the reformation of the problem child of Rociletinib. This situation seems to be a kind of value investing/stub stock play. Take out the trouble child and it’s $8 + $25 (to $30), or about $33 to $38 NOT including Rociletinib. I know it’s not $125 a share like not long ago but for you and me, the late comers, this is a big upside from the mid-20s handle.

Scenario 2: In a more forward looking, “growth” scenario, Clovis, over a longer period of time, could become $90 a share IF:

IF both lead oncology drugs, Rociletinib and Rucaparib could be shown to be used for other “indications” (treat other diseases )

OR

IF both Rociletinib and Rucaparib are in final stages for approval for their initial indications, while a third drug further behind in development, Lucitanib, goes to Phase 2. Lucitanib is an “inhibitor of the tyrosine kinase activity of fibroblast growth factor receptors” (a/k/a “FGFRs”).

(An attempt at understanding Lucitanib: My bad analogy is that fibroblast growth factor receptors are like USB ports on the surface of cancer cells. Tyrosine kinase activity refers to the “on/off” on cancer cells. Floating around are Fibroblast Growth Factors (FGFs) , which are proteins called ligands, floating around and finding their way toward the receptors. If these FGFs, these ligands, like a swarm of flashdrives, connect with the receptors, located like USB ports on the surface of cancer cells, then cancer cell growth follows. If my bad analogy holds then Luci is meant to interrupt the instructions cancer cells may receive to proliferate by turning the “on/off” switch to “off’ on the receptor, so that flashdrives don’t connect with usb ports and trigger cancer growth. End of bad analogy.)

Testing going back five years indicates Luci could be of help against breast cancer and lung cancer.

Breakdown of Scenario 2 estimate: $30 (Rociletinib for original + other “indications”, other applications) + $40 (Rucaparib same story) + $20 (Lucitanib has some kind of data to share). This is a growth story, that the problem child Rociletinib is reformed and Rucaparib, the middle child, both are approved and then move on to new markets while the baby of the drugs, Lucitanib, shows its potential in Phase 2 data. Hey, let’s take out the “problem child” Rociletinib. That’s $40 + $20 maybe, or about $60. Still super-optimistic but it gives me a sense of the potential upside without Clovis’ screwup.

Don’t ask me what the odds are for either scenario. I see them as frameworks to help me understand what Clovis means to Mr. Market. I don’t know if any of these guesstimates will play out. It’s all a big speculation but I was fascinated by the translation of real research into real solutions for awful diseases and that valuations could assigned to it. I have only explored the tip of the iceberg but the iceberg appears real.

I had already made my play before this came out for the internet to feed upon, right after Schreiber’s filing and if works, that’s great but if not the risk employed was small. Could this be a 100+% play in the next 12+ months, that could run up to 200+% with more time, assuming it all worked out? That would be serious coin for relatively small risk, if done properly but that will require more thinking. Personally I would not leverage up as there is no need to. At this point I am more fascinated by the process of analyzing a situation the market had left for dead which could in fact be seriously misunderstood. Thanks for bearing with me and allowing me to share these notes. My focus is usually macro and systems based investment and speculation, for those who know me on Stocktwits, but I admit to being fascinated by the confluence of bad market sentiment and post-price crash smart money interest in this idea. I appreciate being able to push to explore this idea on iBC.

Comments »

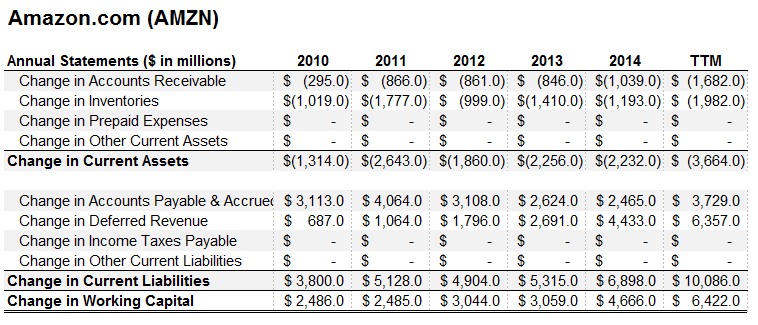

Amazon refuses to die

I noticed the Monday pop-up in Bezo-coin and wanted to record some notes to help me think through the big picture on Amazon:

This is a stock that refuses to die a final death. It has walked amongst us throughout most of the Internet Age, taking years of Black Friday and impulse shopping earnings to be carted off to finance Amazon’s becoming a B-film content provider, a maker of pizza-drones, a spaceship fleet, and for the last 10+ years, slowly absorbing the backend supporting that amorphous infrastructure labeled the “Cloud”. These last few years, year over year changes in working capital have worked its magic, showing how the Dot-com that would not die kept trouncing WalMart every holiday, outpacing IBM at its own Cloud game, keeping Apple at bay in the eBook space and now challenging Netflix for supremacy of BingeWatchSpace.

The following chart is from a blog called “Old School Value” run by an impressive analyst, Jae Jun, who teaches a course with his take on investment valuation. I don’t get a penny from this OSV blog but I was impressed by this analyst’s focus on constantly improving his valuation skills and I wanted to share it, for those with a “fundamental” bent on stocks. He recently revised his thinking on how to think about working capital, changing his focus from deriving calculations from the balance sheet and paying more attention on cash flows. This one quote from Jae Jun got my attention, “The rate at which they are collecting cash upfront before an item or service is provided is growing exponentially.” Many of you will have a better handle than me on this FANG and laugh at me or nod in agreement or whatever, I don’t care, both the weekly price action and the chart below has me attentive. Maybe I’m wrong to focus on this beyond the amazing price action, on both daily and weekly charts but this caught me off guard. I was cynical too about the “FANGs” being the new Nifty Fifty, “4 horsemen”, etc. etc being ripe for a rip and dump, but who knows, could VC billionaire Chamath Palihapitaya be right? He tweeted about Amazon being his largest position, and that it was poised for $1T USD status. (I originally thought it might be Apple or Alphabet but maybe I’ve had too much Kool-Aid and Exxon or some kind of company like JNJ will still come out on top circa 2025.)

http://www.oldschoolvalue.com/blog/valuation-methods/working-capital-free-cash-flow-fcf/

I read that the “fair value”, according to respected NYU-based valuation expert Prof. Aswath Damodoran, for the Dot-com that walks amongst mortal man is about $200 per share. Fair enough, and a reasonable average “floor” for shares currently poised to hit the “3” century handle. That said, we trade price and if we size accordingly, I’ll ride the trend for as long as I can and ratchet the stops on a weekly basis. Faster hands, on the internet, and most likely at iBC, will be trading stocks and juicy options for maximum effect on a daily basis, either for the finest Suntory Whiskey or watered down beer at the corner tavern depending on their risk management.

I hope to gather more notes and get a handle on this, and add, or maybe I’ll just dump the position if it hits my stop. Either way, I’m “wrong” probably, depending on the time frame.

Comments »

Moar Steak: Market Friendly Macri Wins Presidency of Argentina

BBC says it’s official, a man who likes the market and wants us to make money and eat awesome steak has become President of Argentina.

http://www.bbc.com/news/world-latin-america-34897150

I shared some charts of Argentina related stocks last week and I think we’ll see more trading in these ADRs. In fact it’s already begun according to the price action.

http://ibankcoin.com/edwardrooster/2015/11/17/tango-cash-buying-argentina-2/

Opposition candidate and former mayor of Buenos Aires, Mauricio Macri, according to the news, has become the next president of Argentina, marking the beginning of what could be a boom in a country locked out of the markets since the beginning of the 21st century.

The lack of interest in Argentina for stock jockeys was understandable given the past 15 years. Aside from hardcore ticker mavens, the last time Argentina was eligible to borrow from the global capital markets was back in 2001 and then came the default. Since then, it’s been a cycle of crisis on and off, and crisis briefly forgotten but not fixed. With Macri’s presidency, Argentina’s default status may soon change and maybe billionaire Paul Singer won’t have to seize anymore warships or freeze tiny bank accounts to get his point across for getting paid back on his distressed sovereign debt play in the land of Tangos & Steaks.

Initial thoughts:

(1) The black market in Argentine Pesos may evaporate if Macri liberalizes. The Peso may well sell off but the market is freed up at last and it’s the beginning of the return of Argentina to the capital markets. Despite what will happen to the Peso, I suspect stocks will still provide a nice return over the coming months during a “honeymoon” euphoria over Argentina’s version of “hope & change”.

(2) Bank stock ADRs are telegraphing anticipation of the end of a logjam in the Argentina’s prospects.

(3) I noted in my post last week that there may be a quarter of a trillion USD outside the country ready to return home.

http://finviz.com/screener.ashx?v=212&f=geo_argentina

My personal “favorites” include $GGAL and $PAM. I’ve included ETF $ARGT to offer a potential basket to trade.

Comments »