Some quick notes on Deutsche Bank. Unbelievable, just months ago everything seemed manageable in Mittle-Europa and then gradually, slowly European Banking in the heart of the Continent is coming apart at the seams, with a “slowly, then all at once” quality.

After seeing the madness over DB, I wanted to take a look at recent coverage on the internets and it has been ugly, ugly, and ugly. Everyone in twitter finance is focused on the stock and the Contingent Convertible, a/k/a CoCo Tier 1 bonds (junior subordinated perpetual bonds yielding 7.5%.) which were intended to “help” with meeting regulatory capital requirements and I wanted to take notes.

BTW, WHAT’S A CO-CO? Via the Bank of International Settlements:

“their primary purpose as a readily available source of bank capital in times of crisis”

“Private investors are usually reluctant to provide additional external capital to banks in times of financial distress. In extremis, the government can end up injecting capital to prevent the disruptive insolvency of a large financial institution because nobody else is willing to do so. Such public sector support costs taxpayers and distorts the incentives of bankers.

Contingent convertible capital instruments (CoCos) offer a way to address this problem. CoCos are hybrid capital securities that absorb losses in accordance with their contractual terms when the capital of the issuing bank falls below a certain level.”

From Bloomberg’s coverage, which cites CreditSights Inc’s CoCo analysis:

Deutsche Bank AG may struggle to pay coupons on its riskiest bonds next year if operating results disappoint or litigation costs are higher than expected, according to analysts at CreditSights Inc. The bank said it has sufficient capacity this year and next.

“While we are confident about 2016 coupons, we are less so about coupon payments in 2017,” CreditSights analyst Simon Adamson wrote in a note to clients

Just as you or I would confirm with our checkbook sometimes to avoid a bounced check, DB has to do likewise with “available distributable items”, and CreditSights’ analyst Adamson, assured about the present is less so by the time President Obama is ready to begin work on his presidential library come 2018. Analyst Adamson sees trouble in the future. Inability to pay in the future comes from troubles in the present.

We can thank DB’s reported 6.8 BILLION EURO loss for the year, thanks to things like a 12B EUR write-off, courtesy of crap I-Banking, “non-core” divestment and litigation. Bad market in fixed income, no shocker given the rates environment, write-downs for di-worsification plays (bye bye Hua Xia Bank, which is being pawned off to help pay the bills according DB, bye bye Postbank and that “private client” business) and last but not least, the settlement and fees for past bad behavior in oh so many matters.

I-Banking, the motor of the bank, has gotten rusty. Business is way off, when looking at the daily “Value at Risk” ( or “VAR”) per day. VAR has round-tripped from the first reported year 2004, going from 70M EUR/day, peaking at 140+M EUR in 2008/9 and now 40M EUR/day – thanks to lower client business and higher regulatory capital requirements. The inflows for asset and wealth management will not save the day anytime soon, as management tries to adjust for increased regulatory age. (Bloomberg Gadfly covered the desire to get a top-five placement, while DB is ranked twelth.)

Meanwhile Mr. Market frets DB will be hard-pressed to pay the bills now.

Some quick and dirty notation of DB’s litany of sins:

Apr. 2015: $2.5B for interest rate manipulation on loans, monkeying around with forex benchmark rates.

Nov. 2015: $258M fine paid for dealing with pariahs including: Iran, Libya, Syria, Myanmar and Sudan

BUT the mortgage market badness did not end, look at this latest development:

Deutsche Bank must face a US lawsuit seeking to hold it liable for causing $US3.1 billion ($4.3 billion) of investor losses by failing to properly monitor 10 trusts backed by toxic residential mortgages (Royal Park Investments SA/NV v. Deutsche Bank National Trust Co, US District Court, Southern District of New York, No. 14-04394.)

AND MOAR LAWSUITS: Including one filed in the Southern District of New York, for DB’s Autobahn high speed trading platform. Apparently, under the direction of management, DB may have misled customers and profit from currency trading fraud.

OTHER WEIRD NEWS related to DB’s ethical house of pain:

“Deutsche Bank AG’s South Korean brokerage unit and one of its employees were convicted of manipulating share prices in November 2010, triggering a one-day rout that wiped out 28 trillion won ($23 billion) in value from the nation’s equity market.

The 43-year-old banker was sentenced to a five-year jail term and his employer, Deutsche Securities Korea, fined 1.5 billion won, according to a ruling released Monday by Seoul Central District Court Judge Shim Gyu Hong. The employee wasn’t identified in court.

The one-day selloff occurred Nov. 11, 2010, in the last 10 minutes of trading when the Kospi 200 Index dropped 2.8 percent, as a result of derivatives positions set by the bank’s Korean employee and three Hong Kong-based Deutsche Bank colleagues, according to government data. The three traders in Hong Kong sold 2.44 trillion won worth of shares, according to the court.”

The punchline in this weird side-story:

The whereabouts of the Hong Kong-based traders — who are citizens of the U.K., France and Australia and have left the bank — are unknown

WEIRD NEWS #2 from DB’s ethical house of pain. Remember that little April 2015 Libor rigging settlement? Check this out:

“Deutsche Bank has been forced by a German court to reinstate a Frankfurt employee whom New York regulators had ordered the bank to fire as part of a settlement over alleged interest rate rigging.

The Frankfurt Labour Court told Reuters on Wednesday it ruled in late 2015 that Deutsche Bank’s dismissal of a Frankfurt-based vice president was invalid and it obligated the German lender to continue to employ the staff member.”

WEIRD NEWS #3 and #4: I won’t even bother to bring up the sub-prime auto loan investigation but this the following, weird news #4, is too rich. The former head of equities for DB in Moscow sued DB for wrongful dismissal but DB attorneys claim the former employee was:

“the mastermind of the scheme for the withdrawal of billions of dollars from the country.”

What that side-show in Russia was about:

“U.S. and U.K. officials are looking at more than three years of so-called mirror trades in which clients bought Russian blue-chip stocks for rubles in Moscow and simultaneously sold them in London for dollars, people familiar with the investigations have said. Deutsche Bank said in October that its own investigation found violations of its internal policies and deficiencies in controls related to the transactions.”

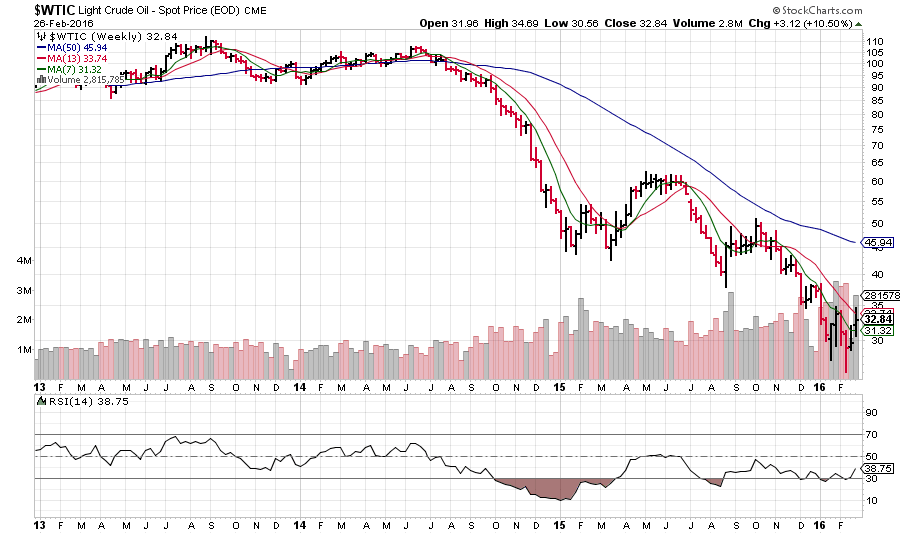

DB is not just a box of ethical non-existence, prompting the resignation by a Co-CEO Anshu Jain for failure to repair the Bank’s culture, it has plain vanilla bad exposure to the worst market on earth right now, ENERGY:

Deutsche Bank may have “significant” energy exposure “that is not investment grade and is not well secured,” Amit Goel and Jag Yogarajah, analysts at Exane BNP Paribas

Moral is down and what will become of talent that walks out the door each and every day? DB CEO John Cryan, retained for his triage and cleanup skills, had to admit on an investment conference call:

“We expect some people to give up the fight,” he added on a conference call with analysts on Thursday.

Cryan, in this same call, points out DB costs for litigation will continue with another estimated $1B EUR to come but hey 2016 looks to be a “peak restructuring year”. Comforting.

CFO Marcus Schenck, in a Jan 28, 2016 CNBC interview is a bit more optimistic:

“I think the vast majority has the fighting spirit and also sees in a way the big reward that is out there at the end. Don’t forget, we are coming from a humongous loss position, if we turn this around over the next 2 years, and we said that 18 is going to be the first quote-unquote “clean year”, if we really make that work and achieve our targets then I think this is a very attractive place to be in.”

BTW, CFO Schenck would disagree about DB’s exposure to energy (in that same CNBC inteview):

“On oil, we have a much smaller exposure to that sector than probably all the other major banks. Which had some downside – we lost a bit of market share in particular in our leverage finance business. But the positive flipside of that is our exposure, we think, on a relative basis is maybe half of what other banks have. So we’re not concerned about that sector.”

WITH 9,000 people about to go out the door, that’s really tough to read and agree with. 200 out of 700 branches to shutter before 2018. Tough to agree with.

LEST YOU THINK there’s a TARP to the rescue?? Maybe, maybe not according the internets, via the Financial Review’s Philip Baker:

It was August 2014 when Paul Schulte, the chief executive of SGI Research, warned Australian investors that all was not well at Deutsche Bank and he still thinks the bank has several problems to deal with.

First, he said that more than any other global investment bank Deutsche

had too many leftover assets from the global financial crisis – more than $US10 billion ($14.1 billion) by his estimates – that are very illiquid and simply too hard to value.

With regard to all the financial scandals mentioned at 2015’s annual meeting, he also thinks there are further fines to come, while Deutsche also seems to have a large book of commodity-related derivatives that are under stress from the collapses in most commodity prices.

Schulte says there is still too much leverage at Deutsche and it is in the centre of a sclerotic system of Euro-paralysis, which prevents any dramatic sort of “TARP” program.

HERE’s A KICKER QUOTE regarding who to blame. It’s NOT the PIIGS:

“This has been brewing under everyone’s nose, because while people thought that the problem was periphery banks in Ireland or Spain, the actual problem is that Deutsche Bank, and the French banks with lots of toxic debt in commodities, are over-stretched, badly run, have no sense of risk management and are organs of state capitalism,” Schulte says.

From the Financial Times, “FastFT” coverage:

Meanwhile Markit’s iTraxx financial indices, which track financial groups’ CDS and serve as a proxy for credit risk in the sector, have jumped to new two-and-a-half-year highs today. The subordinated debt index has jumped 110bps year-to-date to 172bps, while the senior debt index has climbed 52bps since the start of the year to 89bps.

Armin Peter at UBS said:

Is the iTraxx financials trying to tell us something? You don’t get moves 21bp without something factual lying beneath the woodwork.

Deutsche BREAKING BAD. You just know there’s a desire for someone to come to the rescue.

Comments »