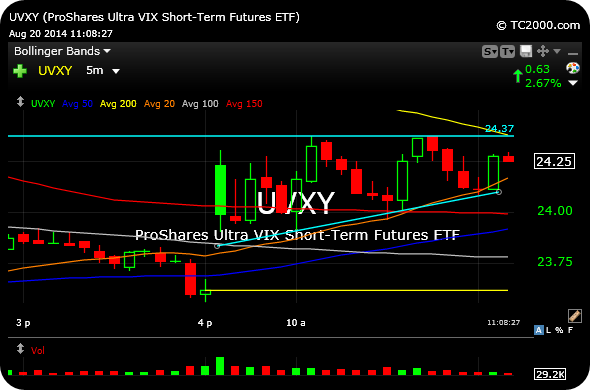

The FOMC Minutes just came out, a bit more hawkish than expected as several members wanted a “relatively prompt” hike in interest rates. Overall, though, Yellen and the Fed seem to be waiting on more data first before acting (see story here).

The initial move in stocks was mildly lower, though we have not seen fireworks yet, as dip-buyers are working on trying to swoop in here. Before the Minutes, I locked in a few small winners on the long side inside 12631.

Macro aside, the market has been mixed and sluggish for a while now, on the whole. A name like YELP is displaying good relative strength, while other marquee issues have been in a hurry to do a whole lot of nothing.

While the major averages are either mildly green or only slightly red, the small and micro cap indices are again lagging noticeably today.

After trading some modest winners on the long side this week, this seems to be a relatively prompt time to reassess.

Comments »