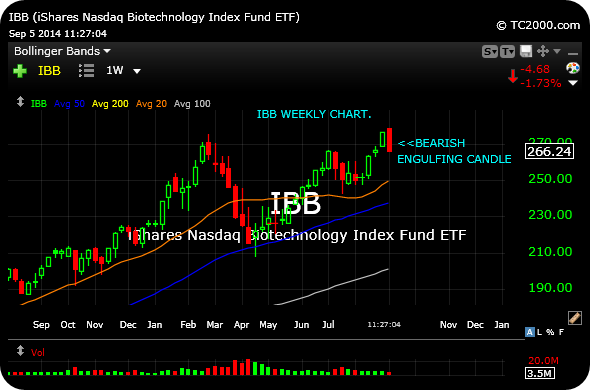

While shorting individual biotechnology stocks has been brutal, generally speaking, for bears in recent years, I went long BIS (the ultra-SHORT biotech sector ETF, purchased yesterday inside 12631).

We had some success playing this instrument during the correction bitoechs suffered in the spring.

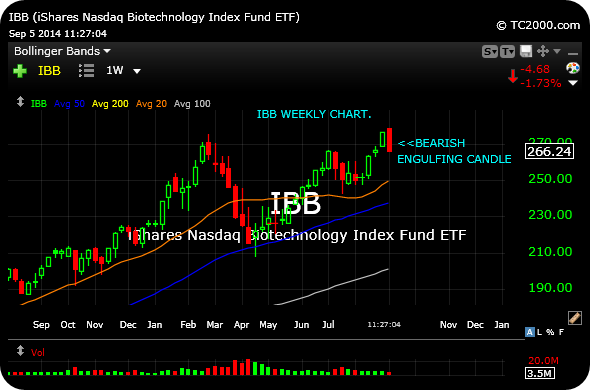

And with the IBB, sector ETF for the bitoechs, putting in a weekly bearish engulfing candle (for this week, it appears), I am betting on the weakness in the likes of GILD today not being an isolated event.

I went long BIS at $12.41, playing for IBB to at least crack its 20-day moving average before I add to the BIS.

My stop-loss is a move below $12 on BIS.

____________________________________________________________

Comments »