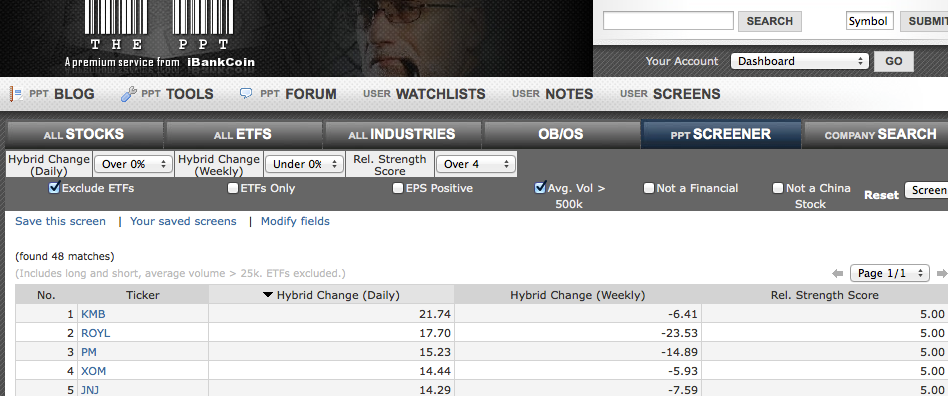

Courtesy of The PPT algorithm, here are the most current top five readings from my “12631 RELATIVE STRENGTH” custom-made screen, identifying which stocks are exuding some of the best performances to the market at-large at any given moment.

I look for stocks whose Daily PPT Hybrid Score surges, while the Weekly Hybrid has been negative over the past week. This can often yield stocks which are emerging from consolidations.

Members can click here to view and save the screen.

Sorted for at least 500,000 shares of daily average volume to ensure liquidity.

Please click on image to enlarge.

________________________________________________________

Comments »