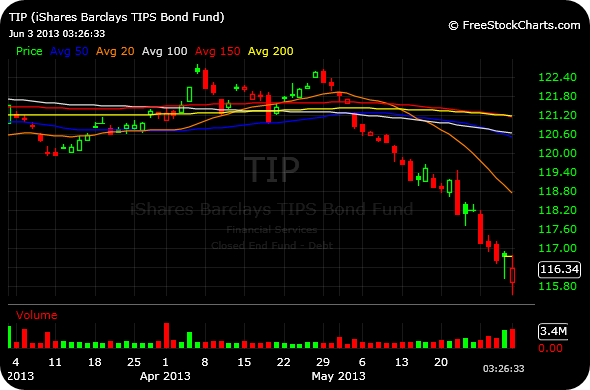

We looked at TIPS and Treasuries last Friday as potentially putting in a tradable low. Thus far, TIPs saw its hammer reversal candle breached to the downside, while Treasuries are taking the first step in stabilizing. Both downtrends have been steep and these are merely clues to look for with respect to an interim low, rather than a major one.

The sell-off in TIPs continues to be indicative of deflationary pressures.

_____________________________________

_____________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Had an eye on the TIP today based on your post. A well setup clean hammer on a medium term downtrend looked good, but today, like you note it was breached. Will keep an eye on it.

Saw quite a few notes around the internets about all the “HAMMER REVERSALS” in a bunch of indices. Makes me think of summer 2011 and not in a good way. For a hammer to have weight (pun!) the downtrend has to be established and a reversal in momentum with buy volume.

Exactly! Discussed that in my video tonight.