Josh Brown had an interesting post up yesterday, presenting a visual from The Charts Etc blog.

The Charts Etc blog has a trio of charts indicating the arrival of a risk-off atmosphere after an extremely long, virtually uninterrupted, bull run.

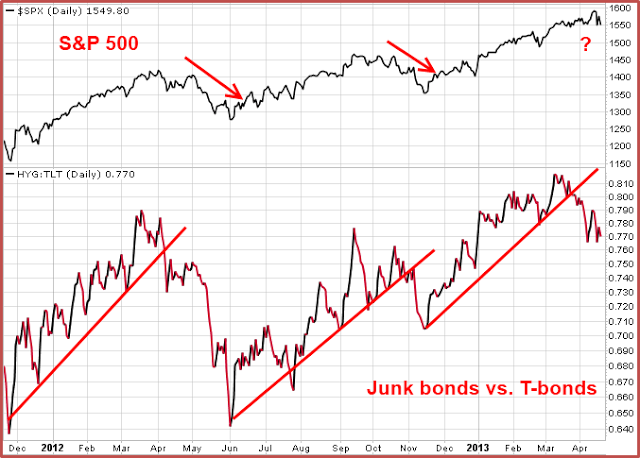

This one is interesting, you’re seeing the S&P 500 vs junk bonds priced in Treasurys:

As you can see, if history is any guide then equities are facing headwinds regarding an imminent, sustained leg higher from here, even if a deeper correction does not materialize.

Also consider TIPs, which I referenced the past few years. They appear to have made a lower high, but certainly have not rolled over yet. I am watching the, though, as any big moves here would be noteworthy.

_______________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

treasury 5yr fwd breakeven is one of the favored infltion metrics used by the Fed… had its first trend break back on 1/25

nice!