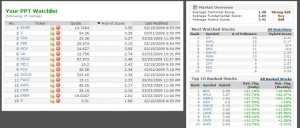

Within the matrix of The PPT, you get to set up a public watchlist viewable by ever member in The PPT. My list includes stocks I would love to buy on any further dip.

Here’s a snapshot of my watchlist, along with some other cool features on the right. One of my favorite features is the Overall market hybrid score, top right.

If you enjoy the content at iBankCoin, please follow us on Twitter

Can you believe ENER?!

good list. -def watching MELI and PBR, UA is kinda scary though.

tonight: Amazon.com introduces “Kindle for iPhone and iPod touch” (AMZN) -cool.

Smith Barney / Citi on NVDA tonight, no major call or change, but good to read:

Nvidia in a Sweep — Apple introduced new models of its iMac, Mac mini and

Mac Pro desktop PCs to round out its revamped product line-up after the

refresh of its MacBook notebook PCs. With the chipset win in all of today’s new

Apple desktops, Nvidia’s has swept the current line-up of Apple PCs with its

9400-series chipset with integrated graphics.

Buy the Dips — While some may prefer to wait until fundamental proof of a

cyclical turn is evident, we view the semiconductor group as early-cycle; history

suggests some degree of fundamental discounting is typical. We remain positive

and continue to advocate a “buy the dips” strategy as pullbacks arise in tune

with overall market downticks. But given the limited nature of marginal

downward estimate revisions, we continue to expect chip stocks to outperform

the broader market. ALTR, NVDA, QCOM and INTC are our favorite ideas.

more late night Citigroup ramblings to read for those still awake:

TIE:

What’s New — Based on company guidance, recent results and spot market

weakness, we are lowering our ’09 EPS estimate to $0.35 from $1.09, ’10 to

$0.80 from $1.35 and introducing ’11 of $0.85. Due these changes our target

price falls to $8/sh from $10/sh, maintaining Buy/Speculative (1S) risk rating.

and PALM:

On the night of March 3 Palm preannounced February sales of

$85-90m vs. consensus of $158m & $312m a year ago. While many expected

February sales to be challenged given the gap before the “Pre” product launch,

the magnitude of the miss underscores our concerns for lack of support for

Treo Pro & other Palm products & risks of carrier inventory workdown as Palm

users wait for the “Pre”. In 2008 Palm’s largest carriers were Sprint at 41%,

Verizon at 13%, & AT&T at 11% & we believe US carriers may be hesitant to

support Palm’s legacy products given the exclusive agreement for Pre at Sprint.

**Stock Call — We maintain our $6.50 target price as we believe Palm shares

have gotten ahead of themselves (no “Pre” European carrier support

announcement yet) & we are concerned carriers may temper their support of

legacy Palm products. The staggering sales shortfall in the February quarter

drives consensus sales & EPS expectations lower. We see another very

challenging quarter ahead with losses & cash burn accelerated by marketing

ramping for the “Pre” launch driving the need for Palm to raise capital.

Wow, look at GE.

and WYNN !