The Government Pension Investment Fund (GPIF) has a new mandate to keep an astounding 25% of their fund in equities. But since Japanese stocks have done so poorly this year, -14% and counting, their equity allocations are below target. As such, the good folks over at GPIF, in charge of destroying the pension of its citizens, will need to invest another $53 billion in stocks–in order to give them the full flavour of their mandated exposure.

Thus far, this exposure has resulted in losses amounting to $52 billion.

“They have room to buy,” said Hideyuki Suzuki, general manager at SBI Securities Co. in Tokyo. “They’re the type of investor that purchases when shares fall and the value of their assets decline.”

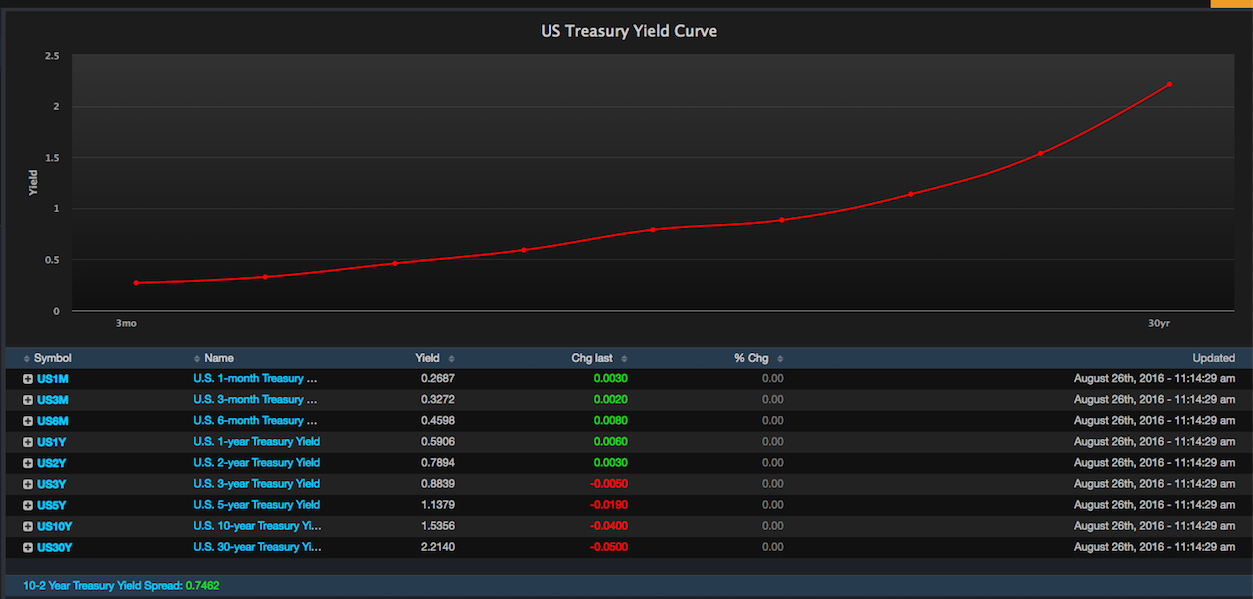

Also, because their bonds have went up so swimmingly, as yields descended into a catastrophically comical territory, they’ll need to sell $56b worth of them.

“The expected buying left from GPIF combined with BOJ annual buying add up to north of 10 trillion yen,” analysts led by Yohei Iwao, executive director of the institutional equities division, wrote in a report on Friday. “This should at least provide some support for equity markets,” but any purchases from the fund probably won’t happen until later this year.

Indeud. It isn’t manipulation if gains are all but guaranteed. Between the BOJ and GPIF, Japanese stocks have nowhere to go but up. If you’re thinking about investing in Japanese equities, just know that profit is all but an assured thing. You could, for example, take out a loan from Deutsche Bank and buy millions of yen worth of index futures. In anticipation of your splendid cash victory, you might endeavor to purchase automobiles, jewels, and estates– both summer and winter. It’s important that you understand that earnings and passé qualities, such as fundamentals, are meaningless morsels of information in front of what is expected to be buying frenzy for the ages.

Comments »