I hope all of you had wretched weekends, filled with comical slips and falls down empty elevator shafts.

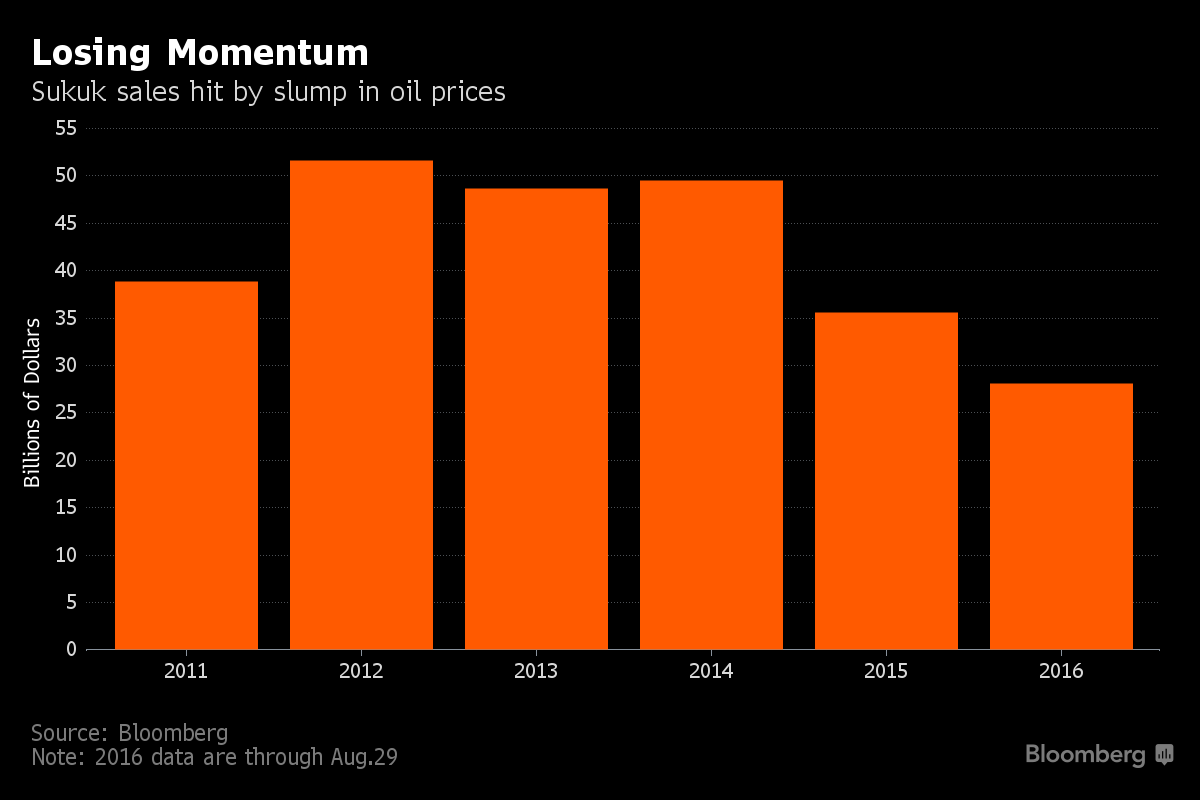

Markets shouldn’t be expected to do much ahead of Friday’s jobs report, especially on the last week of August. Do you have any idea what a blessing this summer has been for Wall Street’s elite? Clearly, you can see why H. Clinton is the preferred President. The status quo is working well for the men in dark navy suits. Profits are bountiful, tax havens are secure, and central banks are working in concert with gigantic pension funds to ensure quality melt ups.

While it’s true, all of the new investment is occurring overseas and the Dow 30 is more of a global mix of oligarchs gone mad, than a true representation of America’s economic power, no one really gives a shit anyway.

With that in mind, the market is pricing in a 33% chance of a Fed rate hike in September and a 60% chance of one in December.

On Friday, the August jobs report is expected to come in at 180k. If that number is met or exceeded, the chances of a September hike will soar. Barring some sort of market malady, the media will go haywire with Fed rate hike commentary, most likely followed up by flurry of hawkish speeches by Fed heads.

This might lead to a sell off in bonds, gold and other safe havens and into financials. Or, it can cause a true and powerful rally in the dollar, which in turn might negatively effect FX markets in Asia and lead to a flight of capital in mainland China, similar to what we saw earlier in the year. I guess it all depends on mood and whether or not investors feel comfortable hiking rates in a low inflation environment.

The last rate hike didn’t bode well for risk assets, bear that in mind.

Enjoy the rest of your 8-balls.

Comments »