A commonly parroted narrative by the vaccinated people on the teevee is to suggest December, for all intents and purpose, is this pomp month replete with gifts from Satanic Santa — a boon of sort for investors. But is this true, or the machinations of weak people with weak minds projecting their holiday depravity unto you?

Here are the facts.

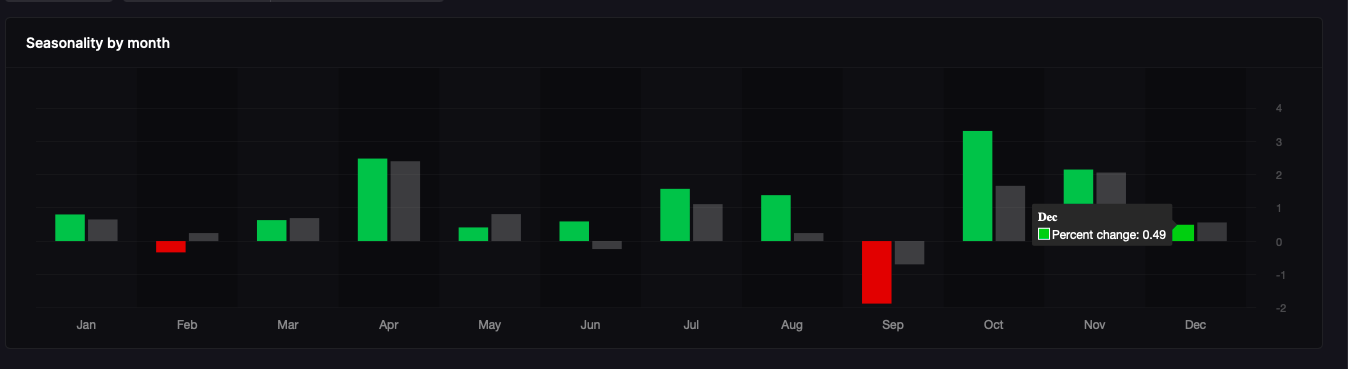

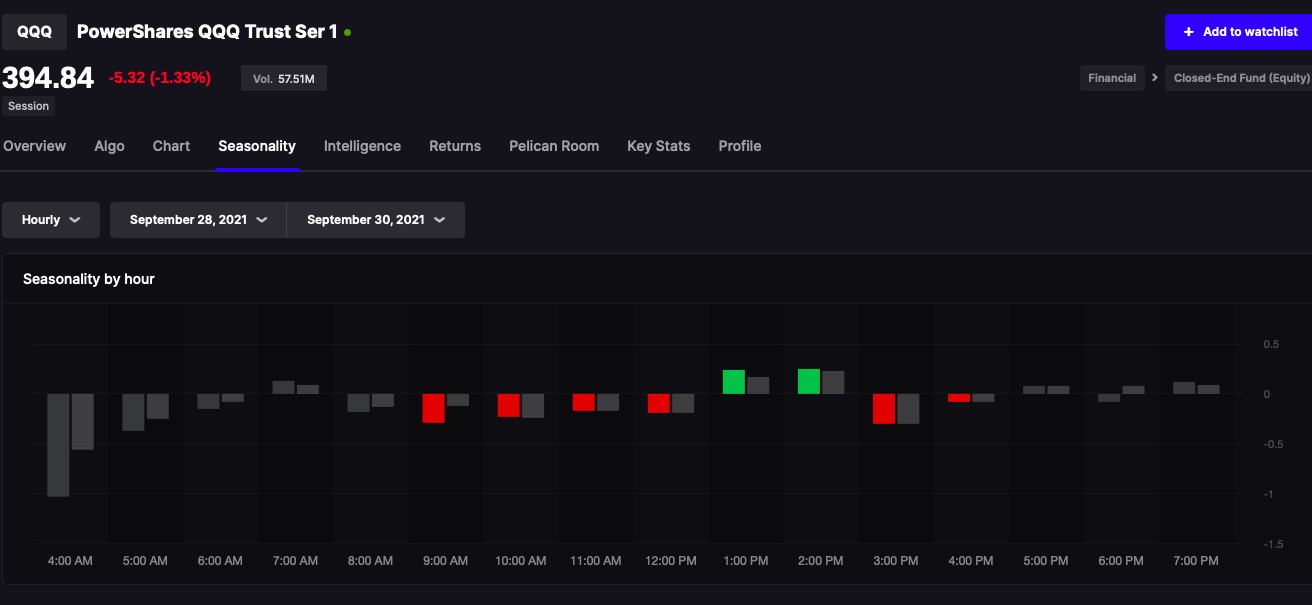

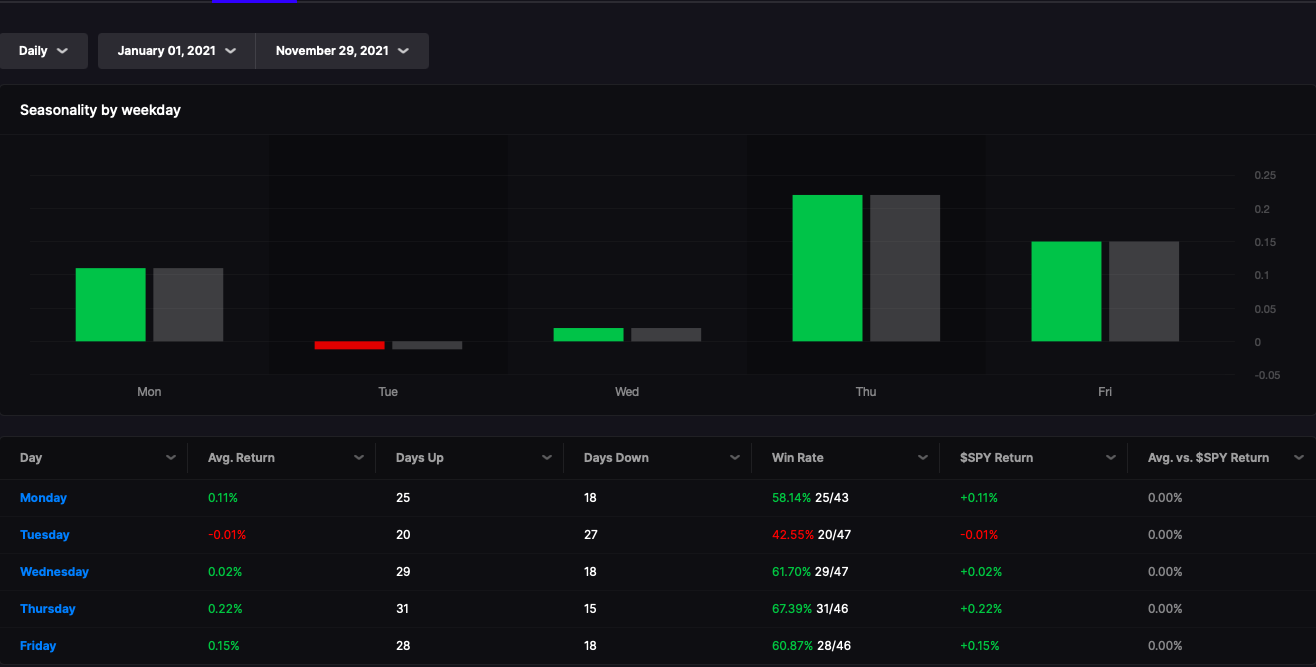

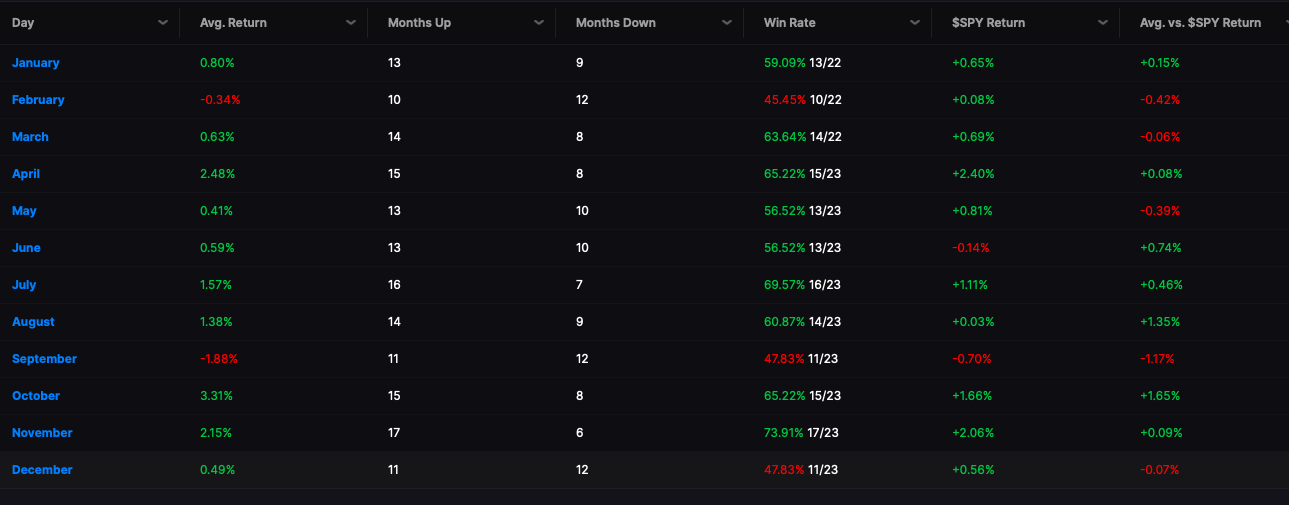

Data via Stocklabs

So the reality is December is one of three months in the year that trades down more often than up, going back to 1999. Do you see what I see?

OMICRON FEARS are palpable and the news is ONLY GOING TO GET WORSE. The misconception of vaccinating ourselves into the bosom of safety is more than ridiculous at this point — but absurd. The tedious data points of highly vaccinated places like Portugal or Denmark enjoying COVID breakouts suggests one of two things.

1. The vaccine is failing and causing ADE. The vaccinated are causing the variants and are like walking biological time bombs. Last I checked, viruses evolve after meeting resistance from something trying to fuck it. Us pure bloods aren’t trying to fuck anything.

2. The vaccine is ineffective.

The net result is having to deal with the weak and the FATS die off in large numbers. Having said that, should I succumb to COVID OMICRON and die off like the rest of you, it won’t be because I didn’t choose to vaccinate, but because I got sick and died you stupid piece of shits. If people who got triple vaxxed are dying off like morons, why the fuck can’t I being zero vaxxed?

At any rate, I went long a bunch of shit, all discussed in Stocklabs, and hedged it with a 15% position in TZA — 20% cash.

I was up 35bps for the session — flat for December.

Comments »