This is not as bubble, but a renaissance. The glorious Chinese people are adorned with the best of things — the prettiest and mightiest repurposed Soviet era aircraft carriers and the best stocks money could buy.

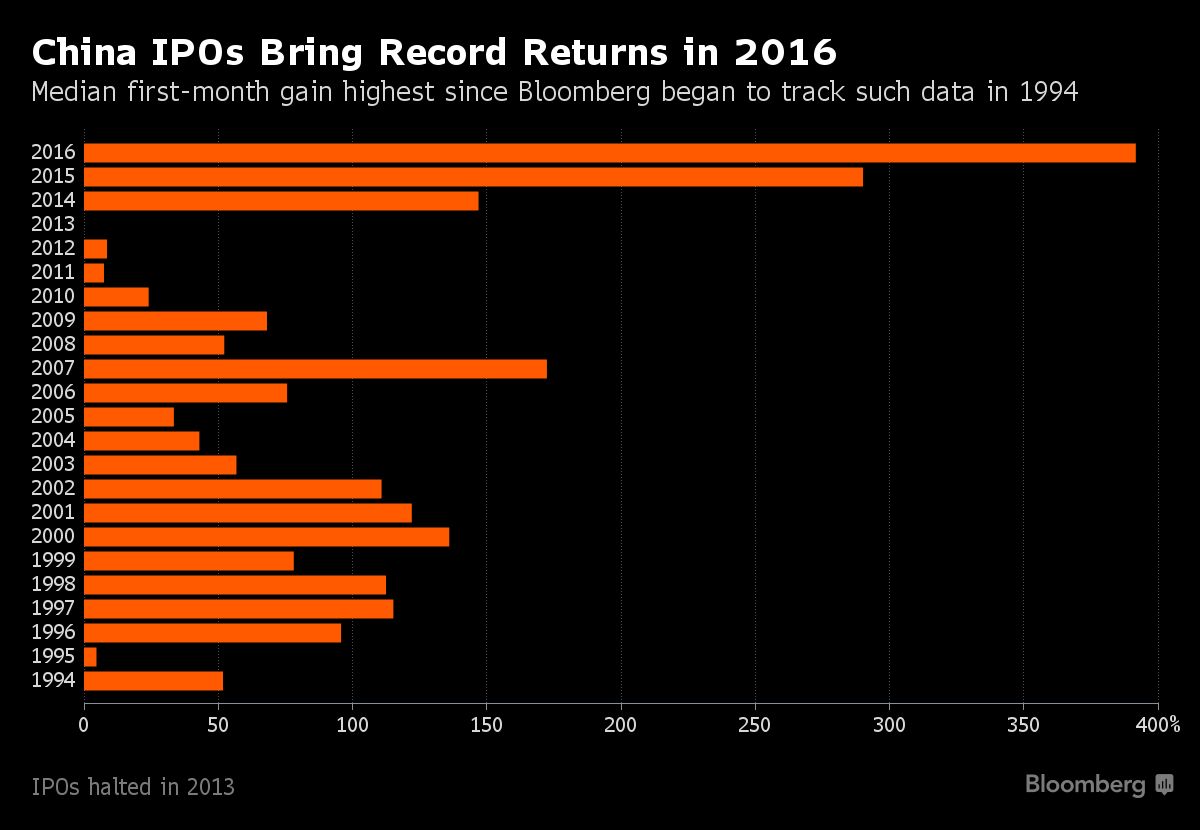

Over the course of 2016, mainland Chinese IPOs returned a mere 392% during the first month of trade — a mere pittance for such a wonderfully decadent society of dog eating swill drinkers.

It’s worth noting, the Chinese IPO market is a hard nut to crack. Similar to the United States, where preferred clientele at Goldman and JP Morgan get the bulk of the allocation, you have to be well connected and rich to get one in China. Bloomberg places the odds of getting an IPO at China 1 in 2,500, but I’m positive that’s a bullshit number — disseminated by enemy propaganda.

It’s much, much higher.

Two hundred and twenty six companies went public in China this year, the most since 2011, and the MEDIAN return was 392%.

The fuck out of here with this shit, right?

Meanwhile, the Shanghai sucked some major dick, off by 12%.

“In a weak market, speculators crowd into new shares where they believe selling pressure is low,” said Zhang Haidong, chief strategist at Jinkuang Investment Management in Shanghai.

Oh, you don’t say? That’s what happened, a flight to inequality so to say.

In case you’re wondering how in the world 226 stocks yielded a median return of 392%, the answer lies in the rules set forth by the government in Beijing. If you’re interested in tapping capital markets, you may not bring your company public unless it’s valuation is below 23x earnings. Where did such a precise number of 23x earnings come from? No one knows. Most likely from one of the whores or mistresses of any number of Chinese government officials.

The average IPO size was $106m. In other words, China’s ipo market is a rigged system of penny stock shit offerings.

If you enjoy the content at iBankCoin, please follow us on Twitter