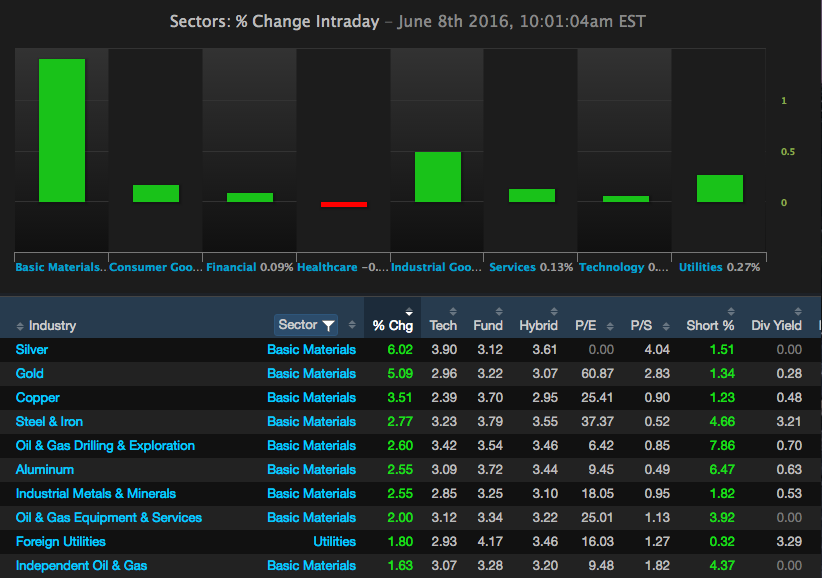

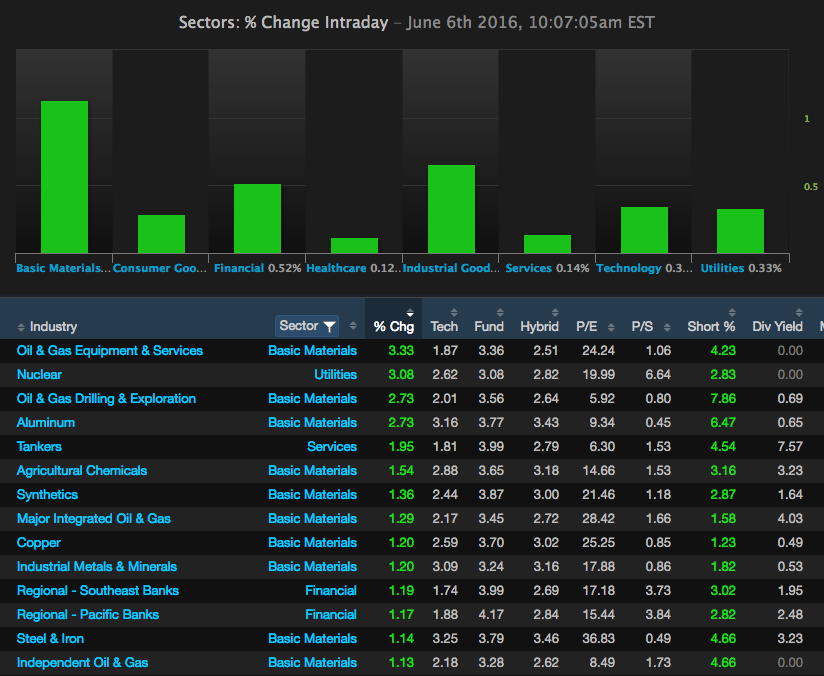

Shake Shack ($SHAK) is up there in my top 5 charts I’m watching right now. I took a position right after I finished eating at their fine establishment in Grand Central station, a review of my experience can be found HERE.

The daily chart of the $SHAK looks just about ready to go here with all of the short term moving averages lining up underneath price. This pattern normally creates a springboard for price and also gives you a clear exit point should the trade go against you.

The pattern below is a pattern we look for often inside our trading room, 12631. Note: If you’re not inside our trading room, I suggest you give it a try. We have some big changes coming to the room as we launch the second half of 2016.

$SHAK – Watch for a “BTFO” move here:

__

__

__

__

___

___