Good afternoon, and Happy President’s day. I hope many of you are enjoying a day away from the markets, I know I’m not. While I have some time today, let’s go ahead and look at some setups to watch for the upcoming week. The following names all come from the Momentum Delta scan inside Stocklabs. Members can view and save scan HERE.

First on our list is $HOOD. There have been a few tweets going around over the weekend with bullish takes on $HOOD. Apparently, many are finding out that the company has no debt, and a massive cash pile to the tune of 6 BILLY, while sporting a marketcap of 12 BILLY. I expect, after a bullish beat on earnings, that momentum continues this week as it starts to fill in some volume voids left on the chart. I like this one enough to buy strength, or a dip:

Next on our list is $XPEV, a Chinese auto play. China has been showing signs of bouncing, but so far has yet to have any meaningful moves. If we do see strength within China this one can move fast. Again, all of the names come from our Momentum volume scan, which tell us that the volume pattern is changing and above average. I would watch for a squeeze here on strength.

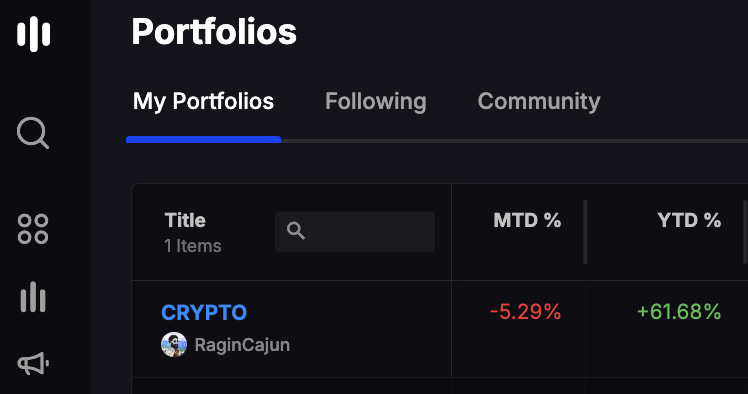

CLSK is probably my favorite Bitcoin miners here. While it’s true I sold my position after a massive 300% move, I will be looking for another entry here. If we take out highs, with a breakout in Bitcoin, that will trigger a buy, or I will simply look for a dip to add here.

ENVX looks like an old fashion breakout on the way. I would look for strength here accompanied by volume to place a trade here. Setup looks sweet below:

TSHA looks like we got a retest of a breakout last week and a big move on Friday. Let’s see if this one continues and pushes past $2. It was scan heavy last week:

NNOX is a blast from the Covid past, this one can move and FAST. Last week we got word that Nvida is an INVESTOR in the company. Ideally, I would like to see this one flag out, consolidate its move from last week, and trade up and out. It’s on my radar for a momentum push higher:

$RGTI is one of these small computer hardware plays that loves to trade on AI hype. I don’t know much about the company here but I do know it has been flagging on scan all last week:

$BMR – This is your momentum name. This one can trade 50% lower from here, or 50% higher. You guess as is good as mine. What I do know is this name has made our scan and has consolidated it massive candle, lets see if we can get another push higher this week. Note: HIGH RISK:

$ICU – another high risk play that looks to break resistance here. Scan heavy and potential FDA approval here. However, no approval and this one goes back to a penny stock. High risk play:

$HKIT – Just another small bomb to watch for momentum. Again, high risk here but on scan.

Comments »