I missed one hell of a week in the market last week while traveling to Colorado Springs. I finally got a chance to visit the Garden of the Gods, and scale Pike’s peak. Definitely a bucket list item.

A few years ago, I got a chance to watch 311 at the Red Rocks Amphitheater, but fell short on time to hit the peak that is Pike’s. It’s been a transition period for me, an end of an Era one could say. Covid/inflation did a number on my small businesses and I’m finally moving on from my group of franchises and settling in the corporate world.

I used to think school was a waste of time after starting multiple businesses, I felt it hindered my progress. My thoughts were if I had not went to school I could have had better territories within my franchise. However, being in the fitness business for 15+ years, nobody was safe from Covid-19. And, it only got worse thereafter. Inflation raised rents across the board, electricity prices were at all time highs, and franchise fees doubled. All costs were raised significantly, and it was hard to raise prices when the industry was lowing prices ie. Planet Fitness.

At this moment, Im pretty happy I went to school and earned my Accounting degree. I ended up landing a pretty sweet role at a fortune 500 company and pretty excited to see where I can take it within the company. The role is remote four days a week, which makes the transition easy. I also get to move back to my home town, New Orleans leaving Cajun country, Lafayette behind. My time may be limited inside Stocklabs as I make this transition, so I need to make sure I get my ideas out nightly via the blog.

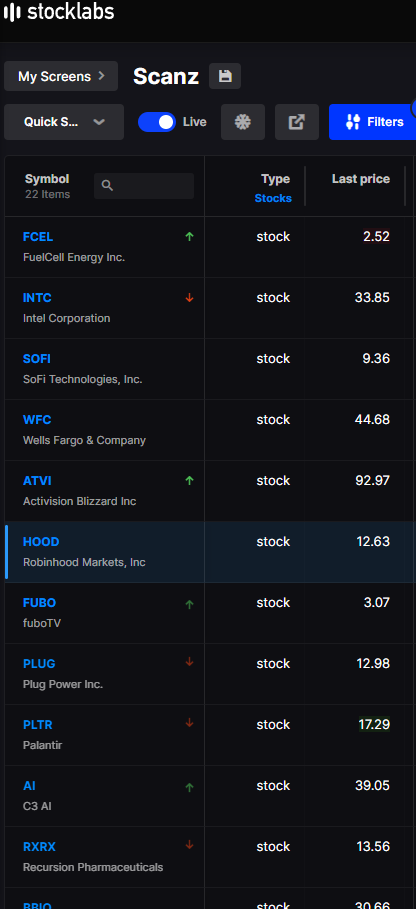

iBankcoin celebrates another birthday today, and it’s a blessing that I still get to share my ideas on this platform. But, enough about me, let’s get into some scans for the week ahead. The Momentum Delta scan is where I like to start when performing my weekend homework, members scan find it HERE. Plebs can find the fullscan HERE imported to finviz.

From the scan, I will be watching the following names: PLTR, MARA, NU, CCL, DVN, SE, PENN, IBRX, PATG, AVGO, & DDOG.

It’s also worth noting that seasonally speaking this is where we begin to see a dash for trash in the small caps. Let’s see if the Russell can finally get out of the doldrums, $TNA is on my radar.

Happy Birthday iBankCoin! Cheers to another year.

Comments »

__

__ __

__

__

__