_____________________________________

I apologize again for only being among you in rare circumstances these past few days. Except for a brief glimpse at The PPT and the regular iBankCoin panopoly today, I had little time to visit and surely none to roll out a post of any quality.

You see I was getting ready for my Washington trip. Washington, DC, the seat of the Federal Maw, that is. And oh what an egregious trip it is, as I’m off to see an actual Federal functionary. A cypher. A paper pusher. A true honest to goodness Level 15 bureaucrat. Assistant to the assistant secretary of Tax Payer Deflowerment and Refurbishing.

I attend with a client, and I must say I’m morbidly curious. I’ve never actually had to correspond in person with a Federal government employee (at least none that didn’t have to be elected first). We are actually going to see this particular green eye shade public pensionairy about an interesting subject that I wish I could share with you here, but cannot. It would make for a good story, let me tell you, and maybe I’ll roll it out a year from now.

Until then, I will be busy as Paul Ryan in a forest of red tape and pork loin. I will try to Blackberry in, and perhaps post from my hotel tomorrow evening, provided I’m not eaten by some brand of obscene government-provisioned and taxpayer fortified bed mite.

_______________________

What’s that you say? Wasn’t it a shame to see all the lily-livers jumping off the bus at 3:00 pm today? Well yes, I admit it was. But I must also say it was quite amusing, as I was in meetings all afternoon and only got to review the tape in 20-20 hindsight. It’s amazing to watch the experienced, hoary old gold and silver bulls shake the noobs like a passel of defeated rats fleeing the maze. Here’s some advice next time the dollar is melting down and you feel trapped into pushing the panic button:

Be the maze. Don’t listen to the dufuses and the short termers, but think about how you are constructing the web, the maze, the golden thread spun up around their misbegotten strategies. You are the maze, and they cannot gnaw their way out, as you are a maze constructed of the finest cement… not maize.

Attend to the dollar this evening:

We could bounce here again, for sure. But the way the rest of the stochs are looking, it doesn’t look like a bounce is imminent. I think we’ll see a snap of this long term support line, and then there will be the deluge.

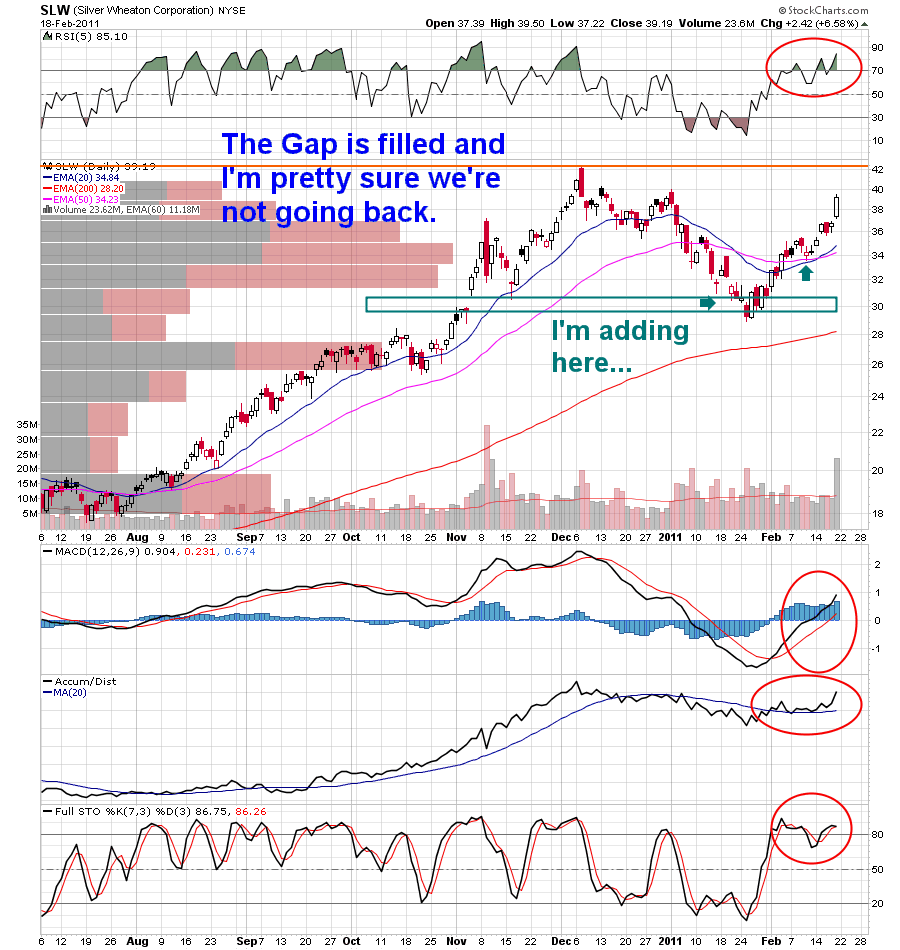

For now, let’s stick to high quality names, though I like crazy stuff like AAU, IVN IAG, NGD, EXK and even AGQ. However, there is one silver stock that stands asportfolio royalty — the mineless and therefore sinless, SLW. Remember this reminder chart I published just over two weeks back?

Did you indulge? Those who follow me on The PPT did, as do those who are watching my pick in the March Madness Tourney. All found SLW and were comforted:

Thank you indeud for you patience and indulgence, as always.

____________________________

Comments »