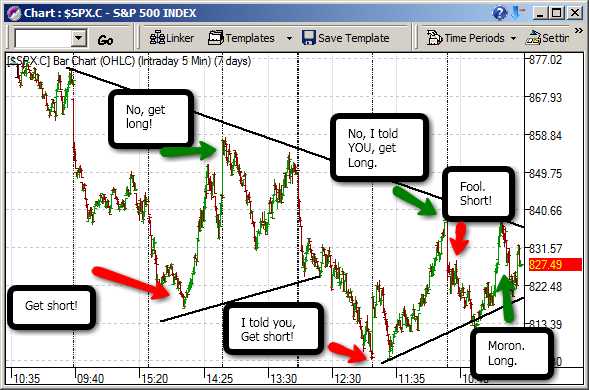

I’ve wrote about this topic before- when markets get extremely volatile, the VIX becomes a more powerful tool to predict, well, maybe not predict, but at least find a good spot where the market will reverse its trend. It’s so powerful, it even trumps that of some of the most basic technical analysis tools. Conversely, when the market moves in trends (loss of volatility), the VIX is more difficult to use and you have to use “vix extremes” which come in the forms of spikes near the top or bottom of a channel.

Last week was a very volatile week, and I was able to spot at least 4 intraday reversals in the market (about 1 per a day) to and enter a trade. On Friday I caught almost the top of the Dow (Dow +22) when I observed it could not take out yesterday’s support.

Anyway, now for the good stuff. Notice whenever the VIX reversed, the probability for a powerful squeeze or a powerful selloff commenced. Remember though, not all Vix intraday reversals lead to market reversals, but EVERY market reversal follows a Vix reversal. Here we go!…

Knowing this VERY POWERFUL correlation, I as able to trade last week’s choppiness quite effectively. Here’s a basic review of the charts I put up last week, with the relationship of Vix~Market. Notice, there is a pattern. ALL market reversal followed a reversal in the VIX.

January 23, 2009: I never posted it, but I spotted the markets high at Dow +22, then shorted FAS as the market went back down to -100. Understand that Friday’s are very tricky on volatile weeks.

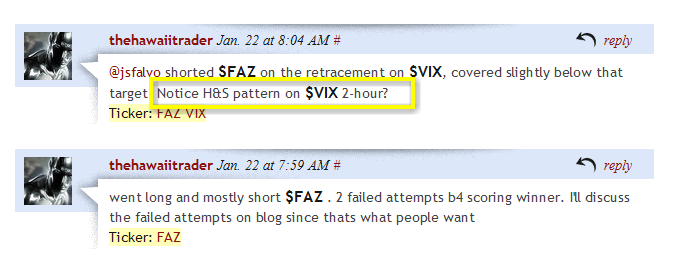

January 22, 2009: “Using the Vix Intraday to find today’s market reversal” …in this post, I identified the breakdown in the VIX intraday to find a massive 2-hour squeeze. The pattern was a breakdown of a H&S pattern.

January 21, 2009: “Rare day trading day strategy applied to Wednesday’s market squeeze” …in this post I noticed the reversal in the Vix at 54. Then the market, DJI and SPX, crossed an important 3-day resistance point almost simulatenously with the VIX =50. Enter the squeeze! Got long FAS for FAStastic gains.

So, all week long I didn’t pick a side. I went into the week knowing very well that the bulls and bears were at a deadlock and kept cash high, swing trade positions low (all shorts), and day traded the rest. The best way to describe my feelings on the market was the use an analogy to compare the market to a giant poker game, where we can’t pick a side until more cards are shown. Know the game, play by the rules.

Keep one thing in mind… I noted on Friday that the VIX is losing strength. Barclays also is coming up with a Vix ETN which I do NOT like. Making the VIX available to commercial/retail investors is stupid, and will further weaken this powerful tool. Therefore, volatility will be dying down soon, so obviously the rules of the game are going to change again. Be dynamic, figure out what the rules are, and trade accordingly.

It’s all about fear and greed.

Aloha!

-gio-

Comments »