Sick of this market? Inhale some of this stuff

Today I spotted an intraday bullish reversal, which was simultaneous with the VIX reversal. Someone asked me before to annotate any trades that did not work, so here you go! It took me 3 tries to spot the reversal on this trade. There were two failed attempts to short FAZ. Notice on chart, I took short positions in FAZ every time the VIX reversed (momentum cooled on FAZ, but that’s a more difficult topic). Notice, however, that the VIX bounced back up slightly and the market continued to accelerate selling into -200 area, and this is essentially what stopped me out. I did not mind getting stopped out on these shorts because I was long FAZ earlier in the morning for a buffer gain. Finally, on the 3rd reversal of the VIX, I shorted FAZ and this time it worked. FAZ dropped -8% from the top (“head”), but I capped my gains at about 6%.

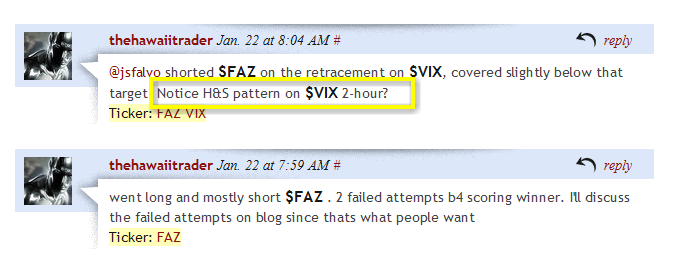

Another development occurred that I pointed out to a fellow trader on StockTwits was the development of a Head and Shoulder pattern in the VIX. This presented us with another great “short FAZ” or “long FAS” opportunity if the floor was taken out. It sure did break that floor, and in came the panic buying. (One note about panic buying/selling action intraday, you usually want to scale out or exit a winning trade during the second bar.) Nevertheless, this breakdown in the H&S pattern on the VIX provided ample room to short FAZ (aka, “get long the market”) as FAZ fell about 12% from the breakdown point.

Actually, volatility was decreasing on today’s tape, and that’s why today’s tape wasn’t as dramatic as the ones before it. This at least gives me some information on how the market will trade in the next few weeks. Trade accordingly.

aLoHa

If you enjoy the content at iBankCoin, please follow us on Twitter

BTW… ESI blew em out! Education stocks still on fire. 4 of the top 10 stocks on the PPT are education stocks. yee ha.

Niiiiice.

Could not STAND to have that rank Vicks stuff smeared on my chest when I was sick as a little kid, btw. So I just stopped getting sick.

Thanks for the daily updates on “The Twitter.”

… just stopped getting sick? wow, what a great solution.

Are you easily able to locate FAZ to short ? I have tried and can never get any. Same with stocks like MAC.

@shortBus …yeah. o/w go with long FAS… btw, volatility is fading relative to the past 3 days, so I’m staying away from the leveraged ETFs for now.

I haven’t tried MAC yet.

I can’t find any inventory on FAZ either. This is something I’ve noticed before on the inverse ETFs. I’m pretty sure a lot of people are shorting both the long and short(inverse) ETF pairs to capture the slippage over time.

Also, agree that it’s a good idea to steer clear of the leveraged ETFs if the VIX starts trending down.

gio,

would it be a good idea to short both the UYG and SKF at the same time given the expected decrease in volatility?

That sounds like a good idea. It would work if the VIX had the same pattern from early December to mid January. for now, I can see you’re getting a good feel for leveraged ETFs, in that they often trade at premiums.