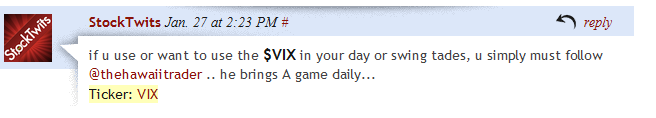

… thanks Phil, now you jinxed me. Lol. Anyway, for those StockTwitters genuinely interested hope this helps…

Educational Posts on IBC on using the VIX:

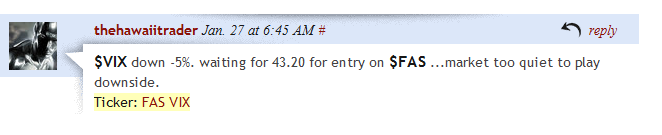

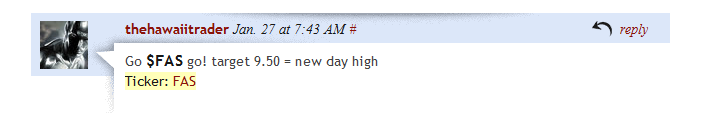

– January 27, 2009 Using the VIX to trade long side (FAS). (day trade)

– January 22, 2009 Using the VIX to trade long side by shorting FAZ. Head and Shoulder breakdown on VIX. (day trade)

– January 16, 2009 intraday reversal spotted using VIX above 50 for contrarian setup. (day trade)

– January 16, 2009 How to spot rare day-trading days using the VIX and technicals (day trade)

– January 15, 2009 Using the VIX to trade the bull side again. Long FAS. (day trade)

– January 13, 2009 Prepare for a battle to no where with the bulls versus the bears. Poker analogy to show that there is no edge, therefore bet small. (swing trade)

– January 7, 2009 Wave Trading Basics. A little tip on how to trade momentum tapes. (swing trade)

– January 6, 2009 Betting against the news. Using complacency in overseas market to time EEV on the bottom (rose 40% from this point in a few days) As a contrarian trader, I look for complacency on news headlines. If markets rally on low volume, then its probably time to bet against them. (swing trade)

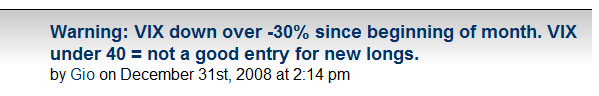

– December 31, 2009 Predicting the top of the Nov-Dec-Jan rally at VIX 35-38. Vix bottoms right below 40, sending Dow down 1,100 points (Swing Trade)

Improve your trading- use the VIX! Understand that the market is moved by fear and greed. It always has, and always will. People buy and sell on emotion, and when you figure that out and learn how to use that as a tool, you will drastically improve your trading. Now get out there and make some money.

ALoha!

-gio-