Did you catch it? Hope you did! We had a number of signals that alerted us for a squeeze. If you missed my last post on “How to spot a rare day-trading day, how to trade them”, then you may want to take a look at it. Today (Wednesday’s relief rally) was another wonderful example of a rare, powerful, and day-tradable squeeze day. Let’s go through those steps:

Step 1: What is the state of the market (premarket): Market sold off big time on Tuesday on news of bank weakness; perhaps selling was accelerated by news of new president. We took out Thursday’s lows, so it’s NOT a good idea for swing longs ( low probability). However, leadership sectors still held ground despite selloff. Noticing strength in school stocks and medical stocks, therefore, as concluded during yesterday’s selloff, it was NOT a good idea to enter new swing shorts. In fact, I issued a “you better hedge your shorts” warning.

Going into the market…

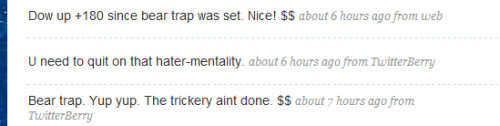

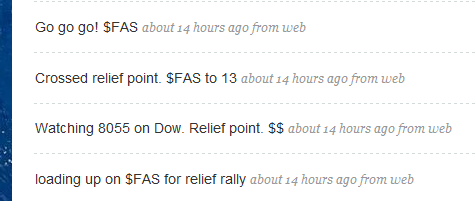

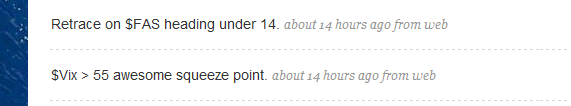

Step 2: Check volatility- VIX is red! Reversal from yesterday’s test of 55, back under 50 we go.

Step 3: Find the sector influencing the market and the VIX. Answer: Banks. Find the stock or stocks in that sector that dominates investor sentiment. Answer: BAC

Step 4: Did banks hit an intraday bottom? Is stock from step 2 (BAC) squeezing? Yes. Probability for squeeze up.

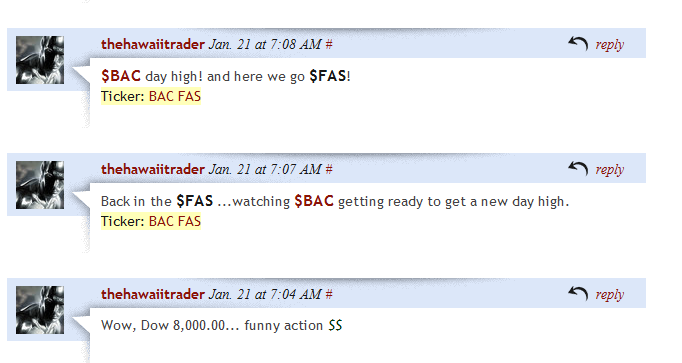

Step 5: Find the intraday “relief point” (check technicals on market). Got it, near 8000 or 8050! (there was actually a lower “relief point” but, I didn’t trust it. Went for confirmation. Actually, 8050 was from Agwarner, our old tabbed blogger Adams Options guy. We both went long FAS).

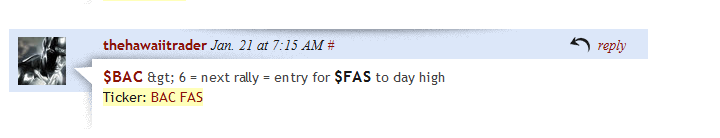

Step 6: Make the call! “BAC > 6 = market new highs = FAS new highs” … FAS was up about 8% when I made the call.

And here’s how everything played out…

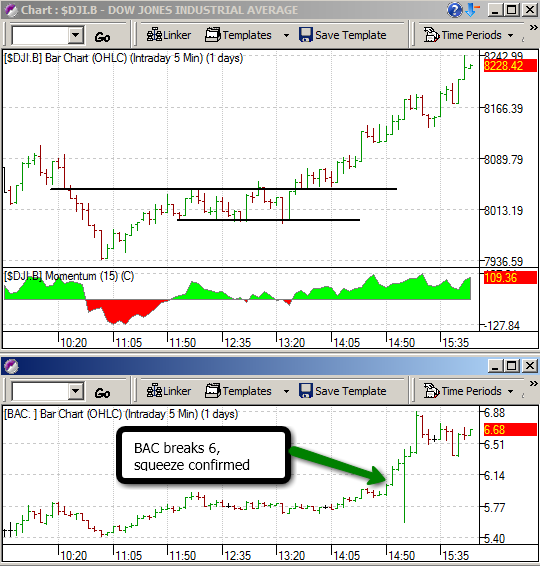

- Vix reversal (Step 2)

- Breakout above relief point (technical confirmation; Step 5)

(Step 3, 4)

- Same Dow Jones chart, but compared with BAC since that was our stock we were using for direction. Remember, above 6, market explodes!

- The relief point / breakout point again. Notice the channel that was broken to the upside. Bears don’t like quiet channels, especially after a big down day.

- And, make the trade. I got long FAS, but capped my gains at 5%. If I let them run, it would have been another nice 15% day. Once again, “rare day trading days”.

(Step 6)

… what a crazy and volatile market! I warned about not picking a side just yet. We have to let a few cards come down first before we place bigger bets on the swing trade.

Again, don’t worry that you missed an opportunity, or try and force a trade. The next one is coming to you as we tweet.

Aloha!

-gio-