Gold has been sloppy lately, but if you look carefully, we are in a sweet position to play gold either way.

For the next few weeks I am downgrading gold, and am setting 905 as a point to short it. I don’t know, maybe it’s all those “cash-for-gold” commercials that are getting to me. This is a heads-up play, since we are waiting for Gold to come to us… under 910 is a nice psychological point. With VIX trading near 30 even, the “safe-haven” play is almost out the window. Gold will not trade well with VIX back in the 20s.

The risk part to betting against gold is that other psychological point… 1,000. Odd, no? It just seems 990 was that double top in the past few months. It will take a lot to get gold above 990, so as a trader who wants to fade gold, we don’t have to worry about that. If the VIX were trending up, then I would go long gold. The channel is pretty clear and clean 850~950 and that’s what I’m basing this strategy on.

I’ve been following these commodities, trying as much as I can to link it to world events, but I can’t quite put the past 3 weeks of gold/precious metals rally to anything specific… China? No. Inflation scare? Nope. Maybe I missed something. Nevertheless, I’m thinking on the other side too… what can happen in the world that can get gold above 1,000?

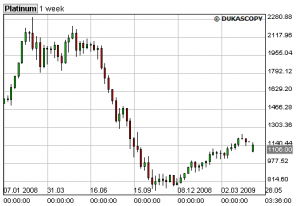

Meanwhile, this commodity looks better for bulls to play from a technical move. There’s so much room to move above, BUT it is best to wait for a confirmed bounce off that nice trend line that started since mid-August of 2008. There’s one problem with this commodity- not that many great companies to invest in this sector …

————————-

Other notes:

– PPT Score for GLD: 1.62, last Friday it was at 3.51. Big drop.

– Oil right back at that 60 spot. It must consolidate here to be bullish. Too much “noise” on TV concerning this sector.

– Ags strong. Highlighted IPI unusual activity last Friday, stock moved 7% Monday with PPT-Hybrid score of +28%.

– “Vince Carter” screen pumped out 22 stocks yesterday! aap arrs asia azo cern coms cree int mfe mvsn nktr orly palm pas pbg pzza rvbd sgp smg tklc tndm twx urs

If you enjoy the content at iBankCoin, please follow us on Twitter

my short call and my long GLD are both in the green and I’ve been thinking of simply exiting stage left. the other option is to hold the gold and rent the dream out to the giddy bugs (sell the call each month)

There’s a mild inverse relationship between GLD and USO.

It’s down from where it shot up in March to -0.86 for a about a week.

100 Day Correlation is -0.52

Don’t do it Gio! Playin’ with fiah!

__________

i go long gold/silver and you come out saying your shorting it. lucky for me i took off TC. and will put back later on breakouts of other gold stocks

we are in a dead-zone for gold, 850-950. i’m playing it either way, but leaning on the fade. just kick back and let it come to you.