Fear, what fear? It’s almost as if the stock market is saying, “My bad America…. world …. nothing happened.”

This is quite misleading though!…

Remember, the “numbers” that print on the VIX are not as important as the magnitude of a given move in a short period of time. Fear and greed are short-term emotions so what matters most to us is when they are at conspicuous levels making a lot of noise, kind of like a lie-detector. I keep referring to this as a “vix-spike”, and if you’ve studied the Vix, it could spike either way. So, what do we have then with the VIX under 30? Same thing we had when it got under 34- an overly complacent tape, but regardless, that doesn’t give us a clear signal of a major reversal because there hasn’t been any spikes down on the VIX to signal greed. Sure, there’s a lot of dumb money getting sucked in, and a lot of laggards coming to life, but when you take a step back it’s not as surprising: Seeing how severe we sold off in a matter of months does not surprise me too much to see the Dow rally over 2,000 points back. Hey, we were once at 14,000 right? Pull out a 5-year chart and you’ll see we only rallied out of capitulation levels when we broke down under 9,000 – 10,000 range. I want to call this an epic-rally, but the more I look at the multi-year chart of the indexes, it just looks like a giant melt-up… a rally brought by hesitation and lack of institutional backing. But that doesn’t matter, what does matter is that these melt-ups are real bear-killers and although they are more common in ugly beat up individual stocks, it happened to an entire market. For that reason, I have HUGE doubts on this rally. If I ignore all news, and treat the entire market as an individual stock, then it has the same traits as a chart pattern of a company that had bad business practices and which creditors and investors bailed out sending the company’s stock price down.

Anyway, now that we are at medium-term extreme levels on the Vix, I am in search of a very valuable spike down on the Vix. That would be a great spot to search for a major market reversal, and a much better spot to short aggressive, or move your portfolio more to the short side (like 70/30). I’ve been keeping things at no more than half-size because the overhead gap is gigantic! In theory, just above 10,000 is not impossible, although improbable in the near term.

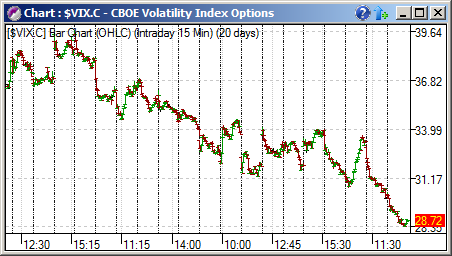

One last thing, and it’s an important lesson for those shorting the market in shorter time frames. If the VIX is trending down as market inches up, and there is no spiking action down, then you have a confirmed melt-up pattern. This is a real bear-killing occurrence, so you better study it and not get caught heavily short in the middle of it. If you are, then chances are you are trying to catch “the top”, which never works. Look at what has happened in the past 20 days…

– In a matter of 20 days, the VIX “trickles down” more than 10 points! This is bullish. What would be bearish would be if the VIX drops 3 points one day, then 2 points the next, then 5 points a few days later… once again, its not so much the # on the VIX, but how fast it gets there … again, let me emphasize this, because fear and greed are relatively short-term emotions and can easily taint historical data.

So far, all of my shorts are still good thanks to averaging in and out using the VIX (I used <34 as 1st entry point to start shorting)… ZNH, OSTK; while keeping with “what works” by staying long GMCR since the 30s and 50s, and bailing out casino plays like FLWS when it didn’t immediately take off (momentum trading basics). Other than that, I’ve just been keeping an eye out for everyone else keeping tabs on sectors that are currently leading (ags, education, medical, farms), and which are acting strange (gold, oil, retail). Once again, using the VIX 20s rule, I’m downgrading gold based on market sentiments (fading not gold itself, but the safe-haven trade). Finally, remember as volatility drops, money is being made on swing set-ups, not day-trade set-ups. Trade accordingly!

Sorry for being verbose. It’s been a while since I used the VIX to explain the broad market, and since everyone on TV is cheerleading the fact that it’s now under 30, it’s probably a good time to make sure we know the real story the VIX is telling.

Aloha!

-gio-

Very good post.

“remember as volatility drops, money is being made on swing set-ups, not day-trade set-ups” Yes!

Gio, this is a great post. Thx.

Love the VIX analysis and insight. Thanks GIO!

-7.6% on the VIX right now. I will be looking to short 928-930 area on the $spx if we get there today.

Yeah, the UUP chart here http://tinyurl.com/p5umqc looks like it’s over due to break that first downtrend. if it breaks I am looking to see if that correlates with VIX starting to trend up.

Good post, interesting stuff about the VIX

“Berk’s rules for the VIX signal:

For a $VIX confirmed signal you need 3 things:

a close outside of the 2.0 Bollinger Band

a close back inside the 2.0 Bollinger Band – this issues the signal

a higher close (sell) or lower close (buy) than the close of the day back inside the 2.0 Bollinger Band – this confirms the signal

Once you get those 3 things a major reversal usually occurs within the next week. The sell signals are far more accurate than the buy signals.”

So a close above 29.05 tomorrow