f the globalists lose France to Le Pen and she opts for a referendum to exit the EU, they can kiss their Soviet styled EU bloc goodbye. Germany will then need to explore alternative methods to conquer Europe for the third time over the past century.

One of the tools of the left to discredit ideologies or people that don’t mesh with their distorted way of thinking is to label them as ‘racists’, ‘anti-Semitic’ or even ‘conspiracy theorists.’ During the recent Presidential elections in the U.S., the left, spearheaded by their agents in the press, utilized all of these tools, in a flaccid attempt to discredit Donald Trump. They failed, miserably — because the spirit of nationalism and the cries for free and fair markets were stirring inside of the non-elite. After decades of docile compliance, thanks to the failed policies that have resulted in the greatest transfer of wealth in the history of mankind, from west to east, people are keenly aware of the unharmonious and ignoble canticle of lies — streaming out of the mouths of the empty vessels (extra John Harwood) doing the bidding for the global elite — are nothing more than shackles, a cantankerous obstacle in the way of the pursuit of happiness.

Le Pen might not be perfect; but, she’s an agent of change. And that’s why she’s crushing her competitors in recent polls.

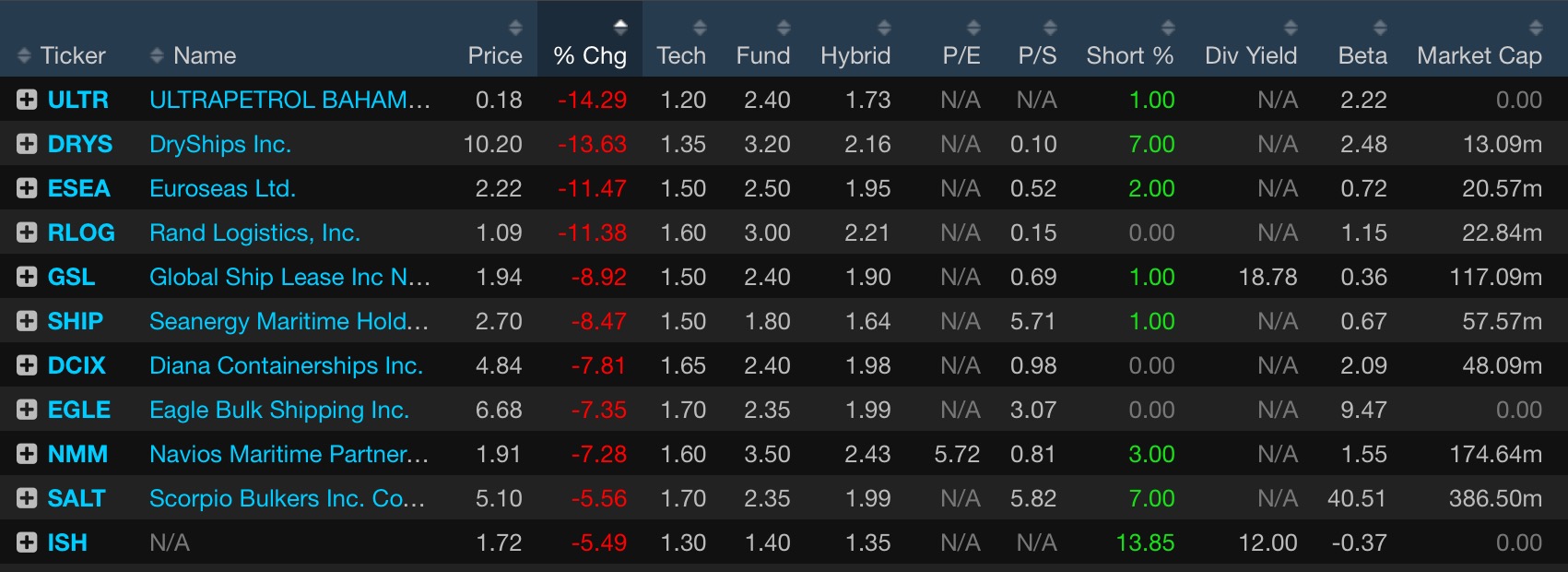

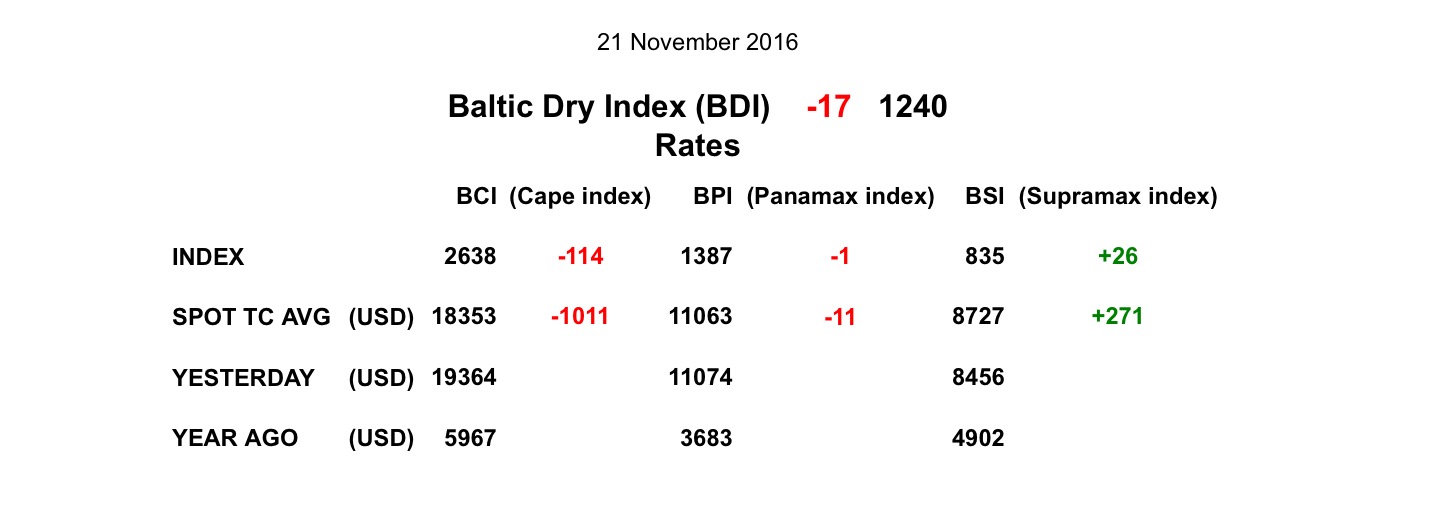

Typical of Wall Street, none of this is being priced in, not BREXIT, not Trump and certainly not the definitive end of the EU. With markets at all time highs, wistfully edging higher on a daily basis on the absurd prospect of runaway inflation, extreme downside risk beckons — just around the bend.

Here’s Le Pen in a CNBC interview today, discussing the farce that is multiculturalism.

Comments »