Goldman is out with a note of doom, regarding the miners and how they’re soooo much worse than oil companies. They’re especially brutal to the coal miners, pointing to a recent Alpha Natural mine auction gone awry. Essentially, coal miner are now worth $00.00. They offer nothing in return for hard labor and are simply wealth destroyers, whereby the owners of these properties bleed out and die, without ever making a profit.

Environmental concerns are haranguing the miners, unlike the cool purveyors of crude oil–who get to sell their ware unimpeded.

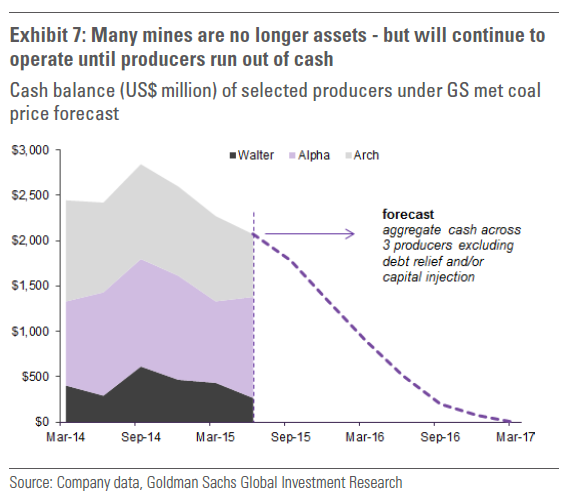

“Many of the [mining] structures are no longer assets but rather liabilities due to environmental regulations,” write Goldman analysts led by Head of Commodities Research Jeffrey Currie. “This suggests that, in order to delay the environmental costs of mine rehabilitation, the penalties associated with employee layoff and non-performance of commercial obligations, owners will operate the facilities until they run out of cash and are obliged to suspend operations.”

“[Last] week we saw Alpha Natural Resources cancel an auction of 35 coal mines at the last minute due to a lack of interest, illustrating the fact that some mining assets burdened with outstanding liabilities and negative margins are left without any residual value,” Goldman notes.

“Theoretically, once an energy market breaches storage capacity, prices need to collapse below cash costs to immediately re-balance supply with demand. In practice, however, operational stress in energy is a local, not global concept as breaching storage capacity happens most likely in landlocked locations, but it does whittle away at the global supply overhang,” the analysts write. “In contrast, metals can be ‘piled high’ in low-cost locations almost anywhere in the world with far greater density, i.e. dollar per square foot, than energy.”

To illustrate the point, Goldman calculates that $1 billion worth of gold would, at current spot prices, fit into a generously-sized bedroom closet, while $1 billion worth of oil would take up 17 very large crude carriers, each with a capacity of more than a quarter of a million deadweight metric tons.

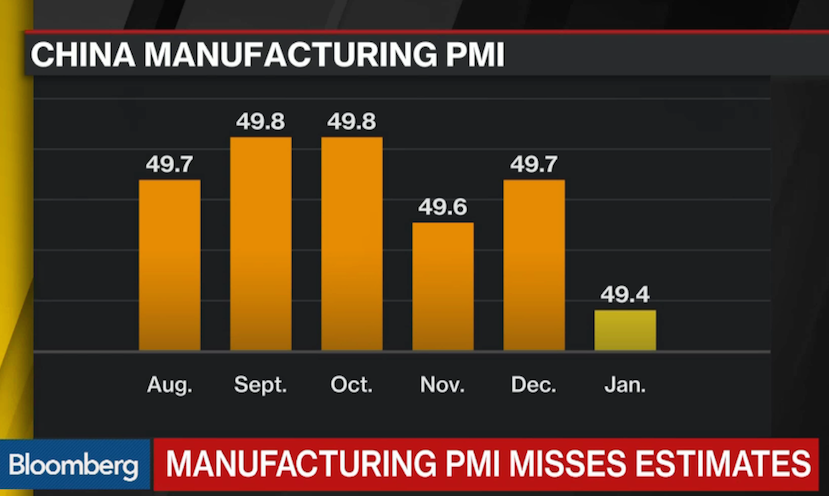

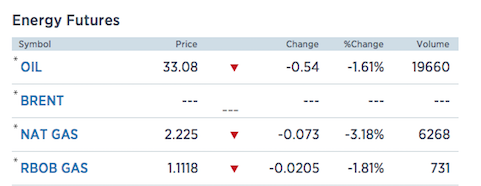

With an estimated 12 months of cash reserves left for some U.S. coal miners, financial stress needs to deepen before the supply-demand balance even begins to resolve itself.“This leads us to forecast that oil prices will outperform the base and bulk commodities once the current inflection phase has run its course, likely at some point in the second-half of 2016,” Goldman concludes. “On a macro basis this also suggests that some of the slowdown in global manufacturing maybe more permanent, as high cost producers of capex commodities shutter facilities on a more permanent basis, particularly in the west.”

Miners have 12 months of cash left, then we’ll never hear from them again.