Quarantine protocol for biotech basket $IBB. Yes, it’s been telegraphed on daily charts for about six months as in trouble, and it seemed like it was over but now it’s not. I use weekly price filter for prices and it sucks again. I can’t trade opinions, I trade price. Swing, reversion and shorter-term traders will have a field day. There are bargains to be found in space like raw materials and among the survivors of what could be a wash-out in energies. In BIOTECH however, in that space which has all the allure of Unicornian optimism but none of the income necessarily and is prone to regulatory preemption (hello FDA) we have real trouble.

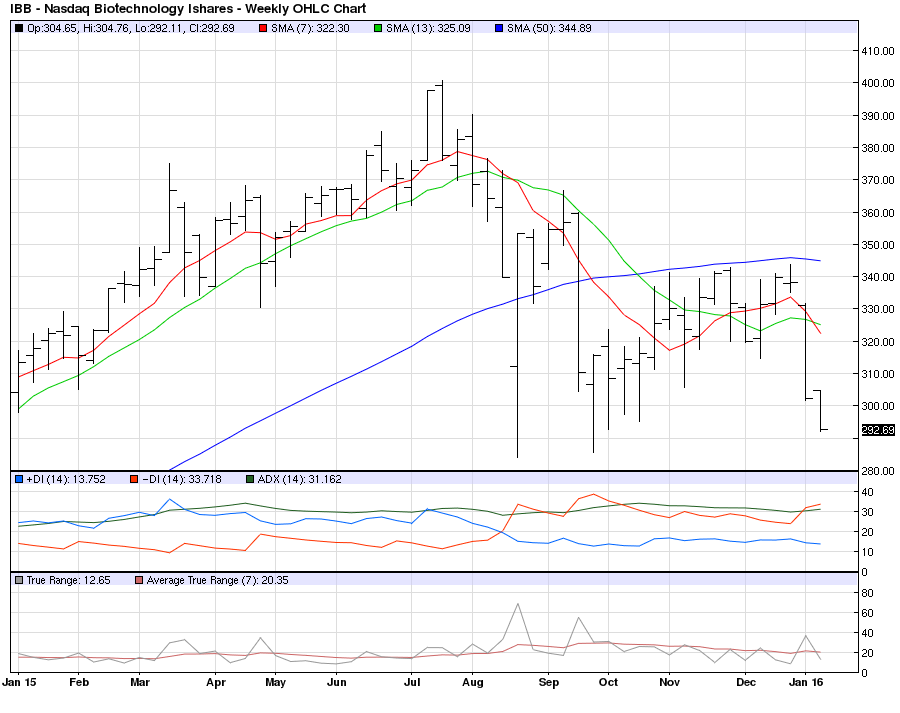

The 50 week SMA has begun to dip, again, and this could be something you trade against on a shorter time frame. Watch for bounces and price action that will idiotfy this post, but I wouldn’t make “holds”, I would bank them and short against them. (I’m looking at June puts, I’m not set up for shorter time-frame trades and if it’s right, it gets more right and suddenly we’re talking about the “2” handle as absurd as it might be but so was “3” last summer, wasn’t it?)

Background view as this is unfolding: Europe is weakening as I write this again. The China/RMB/Yuan narrative dominates. Let’s see what the New Year (of the Fire Monkey) brings. None of this matters for this post. I see $IBB dropping now. This is the one biotech play that’s easiest to hold and it is not doing well.

Yes, it is Monday. Tomorrow could make a hero out of longs. But right now $IBB is below $300. Maybe this is the tradable bottom. We’ll see.

Below is a quick chart, weekly basis, with some SMAs (but the 50 Week is on my mind). Ripe for rip? Yes but ripe to sell against (extra vaccination).

If you enjoy the content at iBankCoin, please follow us on Twitter