I noticed the Monday pop-up in Bezo-coin and wanted to record some notes to help me think through the big picture on Amazon:

This is a stock that refuses to die a final death. It has walked amongst us throughout most of the Internet Age, taking years of Black Friday and impulse shopping earnings to be carted off to finance Amazon’s becoming a B-film content provider, a maker of pizza-drones, a spaceship fleet, and for the last 10+ years, slowly absorbing the backend supporting that amorphous infrastructure labeled the “Cloud”. These last few years, year over year changes in working capital have worked its magic, showing how the Dot-com that would not die kept trouncing WalMart every holiday, outpacing IBM at its own Cloud game, keeping Apple at bay in the eBook space and now challenging Netflix for supremacy of BingeWatchSpace.

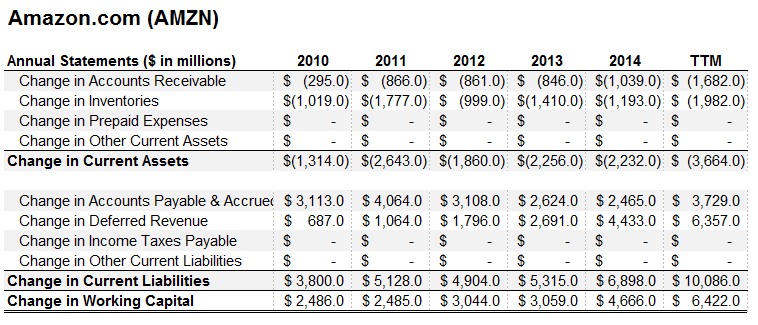

The following chart is from a blog called “Old School Value” run by an impressive analyst, Jae Jun, who teaches a course with his take on investment valuation. I don’t get a penny from this OSV blog but I was impressed by this analyst’s focus on constantly improving his valuation skills and I wanted to share it, for those with a “fundamental” bent on stocks. He recently revised his thinking on how to think about working capital, changing his focus from deriving calculations from the balance sheet and paying more attention on cash flows. This one quote from Jae Jun got my attention, “The rate at which they are collecting cash upfront before an item or service is provided is growing exponentially.” Many of you will have a better handle than me on this FANG and laugh at me or nod in agreement or whatever, I don’t care, both the weekly price action and the chart below has me attentive. Maybe I’m wrong to focus on this beyond the amazing price action, on both daily and weekly charts but this caught me off guard. I was cynical too about the “FANGs” being the new Nifty Fifty, “4 horsemen”, etc. etc being ripe for a rip and dump, but who knows, could VC billionaire Chamath Palihapitaya be right? He tweeted about Amazon being his largest position, and that it was poised for $1T USD status. (I originally thought it might be Apple or Alphabet but maybe I’ve had too much Kool-Aid and Exxon or some kind of company like JNJ will still come out on top circa 2025.)

http://www.oldschoolvalue.com/blog/valuation-methods/working-capital-free-cash-flow-fcf/

I read that the “fair value”, according to respected NYU-based valuation expert Prof. Aswath Damodoran, for the Dot-com that walks amongst mortal man is about $200 per share. Fair enough, and a reasonable average “floor” for shares currently poised to hit the “3” century handle. That said, we trade price and if we size accordingly, I’ll ride the trend for as long as I can and ratchet the stops on a weekly basis. Faster hands, on the internet, and most likely at iBC, will be trading stocks and juicy options for maximum effect on a daily basis, either for the finest Suntory Whiskey or watered down beer at the corner tavern depending on their risk management.

I hope to gather more notes and get a handle on this, and add, or maybe I’ll just dump the position if it hits my stop. Either way, I’m “wrong” probably, depending on the time frame.

If you enjoy the content at iBankCoin, please follow us on Twitter

Hi Ed,

Great article, which begs the question: Are you arguing that Warren Buffet should be and must be compelled to buy AMZN?

Hi Phil, haha, I think we both know he won’t be buying this one. This one is a tough one to reconcile with. What we have here is a frustrating exercise in a dominant founder’s willingness and ability to ignore everyone on a 10, 20+ year time frame. I have tried to make sense of this one through either just trading price and keeping trading size small and from reading what smarter minds have to say about what is being done with the cash and also with perspectives about “platform companies”.