The following is just a small excerpt from my latest Weekly Strategy Session (please click on that hyperlink for details about trying it out). which I published for members and 12631 subscribers this past Sunday.

Without question, there remain plenty of divergences pointing towards a mature bull market running on borrowed time. Divergences, by nature, do not seem to matter much until they do, and then they seem to matter in such a way where market players who ignored them wonder why they never took them seriously. At the same time, bull markets have a knack for rendering bearish divergences to be pure folly for extended periods of time until, again, they do not–And then those negative divergences and other warning signs abruptly and unforgivingly come home to roost.

For those reasons, in this weekend’s Strategy Session I am going to present three tangible keys to the week ahead.

Before I do that, though, I still think it is instructive to briefly run through just some of the current warning signs which, once more, should be taken with a grain of salt until we see some actual price deterioration on the major averages.

First, for context, consider just how long this bull market has been grinding higher. The S&P 500 Index has not experienced even a mild 10% correction off the highs, nor a trip down to its 200-day simple moving average since 2012, both historically rare circumstances, indeed.

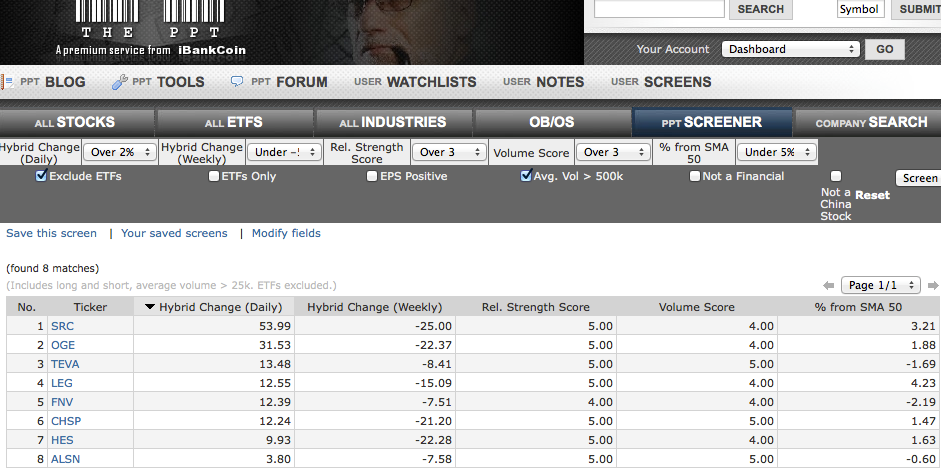

In addition. as the following chart illustrates, the S&P…

Please click here to continue reading

Comments »