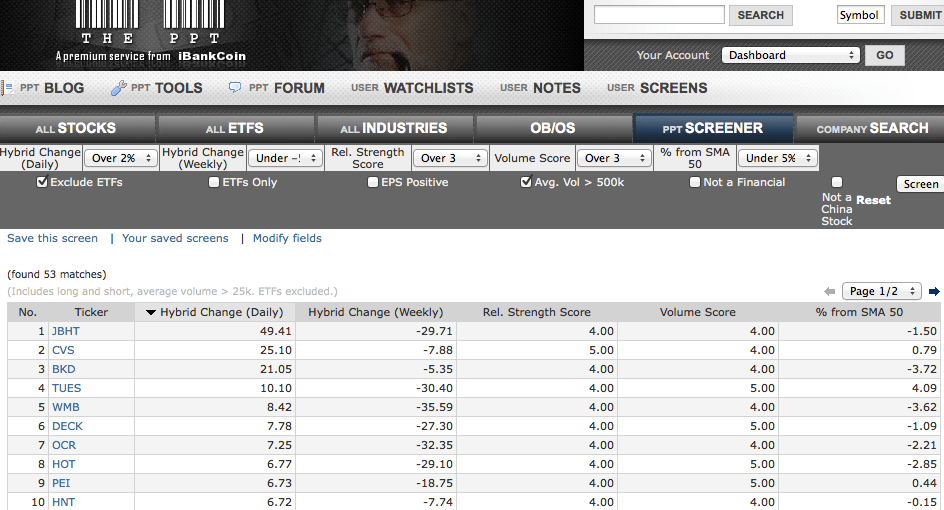

If you are looking for some (quick) support buys here, a good algorithm screen to have, courtesy of The PPT, is one I made called “12631 Quick Bounce Plays.”

In the screen, I am looking to isolate stocks with positive daily Hybrid PPT scores, but negative weekly ones.

Thus, they are ripe for a quick bounce as the momentum seems to be turning, if only for a bit. I also screen for PPT Relative Strength scores, as well as volume and % from 50 day moving average.

Members please click here to view and save the screen

Here are the readings as of Friday’s close. Remember, we are talking about short-term flips here, not high quality, multi-week swings. Keep those stop-losses in place.

(Click on image to enlarge)

________________________________________________________________

Comments »