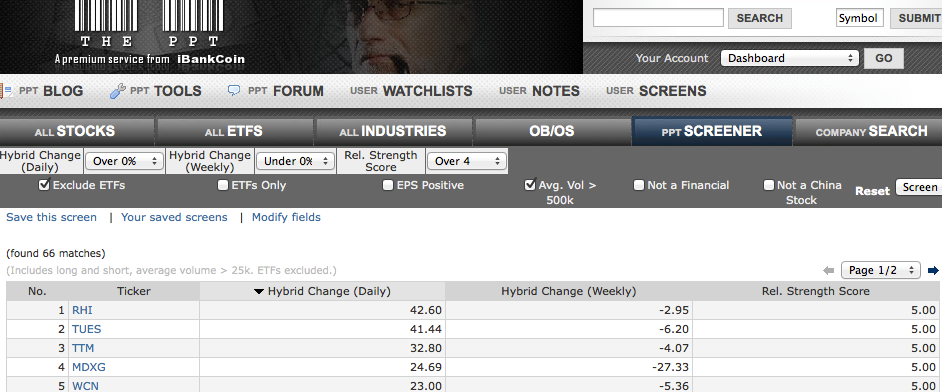

This morning’s rotation for hot money longs seems to be circling back to recent IPO’s, such as BABA GPRO LOCO TUBE YDLE, among others.

In addition, even beaten-down names are showing signs of life, such as PBPB SEAS SPLK.

To be sure, if this action continues after the Fed it is going to be another round of musical chairs for momentum longs, with the quickest ones making fast scores before the music stops.

But, more than anything else, the action today smacks of the market burning time until the big FOMC announcement tomorrow afternoon.

After threatening a clean breakdown yesterday, Tesla is squeezing back higher, effectively chopping up many a trader and certainly punishing yesterday’s new shorts. Indeed, it is that type of market.

Crude oil continues to hold the line at major support, which may very be good enough for now with sentiment quite bearish on the black gold.

Circling back to equities, the SEAS contrarian long interests me most, over $19, as does a quick PBPB squeeze higher before their 11/04 earnings.

Comments »