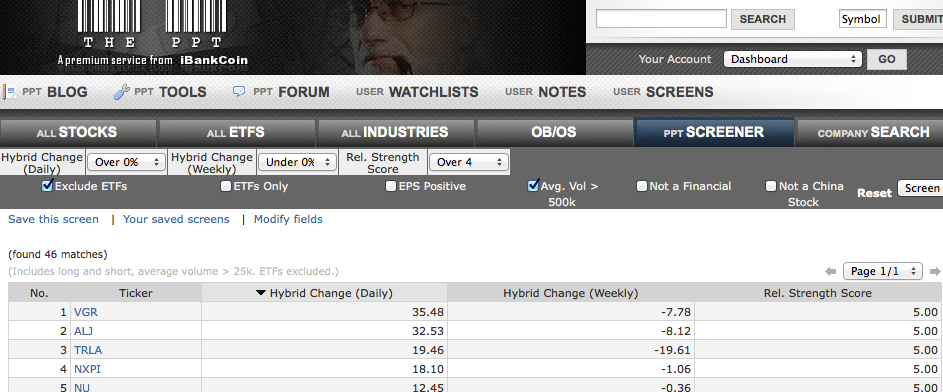

Headed into September, it is tough to think of two more unloved charts than silver and one of the volatility ETF’s.

And yet, on their respective zoomed-out 30-minute charts, below, you can see the potential for rounded bottoms for a surprise rally into September.

I am flat both but actively considering building a position in them as early as tomorrow or next week,

See you after the bell for my video market recap.

_______________________________________________________________

_______________________________________________________________

Comments »