The following is just a small excerpt from my latest Weekly Strategy Session (please click on that hyperlink for details about trying it out). which I published for members and 12631 subscribers this past Sunday.

It is still the same old story in a bull market: The negative divergences are ignored by buyers, even negated, for long stretches of time before they suddenly matter and matter in a major way. Of course, by the time the bearish divergences seem to matter, they are universally eschewed as being irrelevant, as they “no longer matter” in a one-way bull market. But nothing lasts forever, and the tide eventually turns.

Thus, the overlooked micro-cap ETF chart, which we previously observed but remains off the radar of many market participants, is as much of a warning sign for equities as there is in a mature bull run.

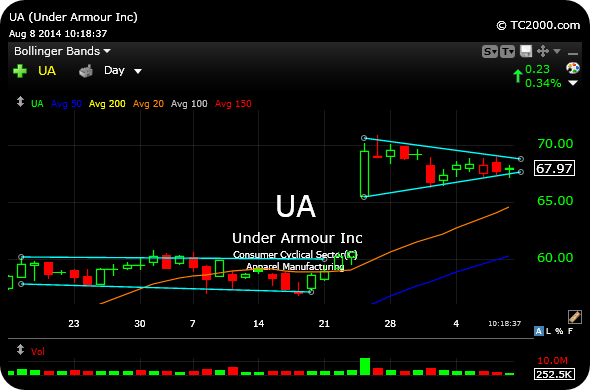

On the daily and weekly timeframes, respectively, note the very ominous potential head and shoulder top not too far from confirming. A close below $68.80 again confirms this pattern, projecting a move down to around $61. This potential topping pattern is now in its eight month, making it even more ominous if it triggers since, “the bigger the top, the bigger the drop.”

And, of course, the regular small caps in the Russell 2000 Index are still weak. The daily and weekly timeframes, respectively, show a major double-top potentially also in play. A close below 1,082 is still necessary to trigger the pattern, projecting a move down to around 950.

Furthermore…

Please click here to continue reading

Comments »