A sexy contrarian position of late is that Europe and even the emerging markets will basically outperform the world, especially the hot U.S. markets, into the end of 2013.

As I have noted before, even if the emerging markets have bottomed (still a big “if”), the bottoming process is likely to be painful, random (huge gaps either way), and tedious one.

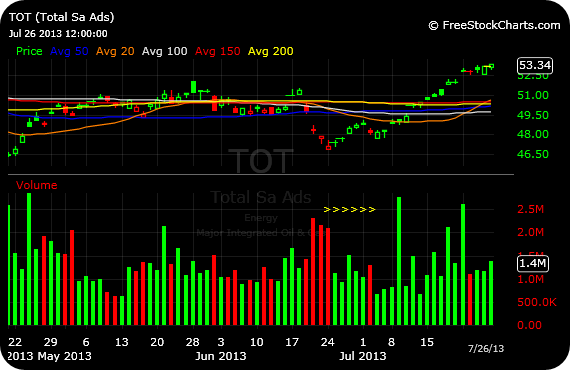

That said, two charts worth watching as price attempts to back and fill here to possible form bottoms are: GGB TOT.

GGB is a Brazilian steelmaker, at the cross-section of two sectors which have gotten worked over the past few quarters. But look at the buy volume on the bottom of the daily chart, first below, That is some serious buy volume,

And the same applied to TOT, a long idea I posted in the $40’s. Here we have a French energy/chemicals play also with impressive buy volume at the bottom of the second chart.

I will be following-up on this idea. But for now the main takeaway is to temper your enthusiasm about major bottoms in these markets, with the understanding that even if true they are likely to be grueling processes.

_________________________________________

_________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter