…is to go after some of the defensives. I am circling back to this blog post from Sunday titled, “Defensives No Longer So Defensive.”

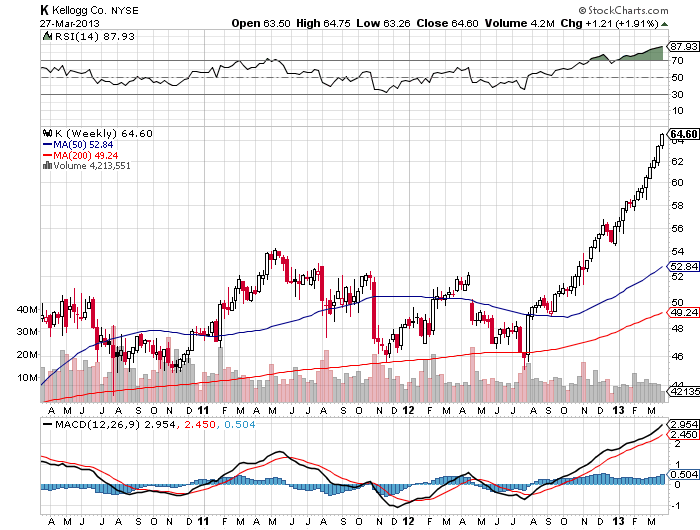

Specifically, Kellogg appears to be imminently close to buyers exhaustion. On the weekly chart below, we can see an abnormally steep angle of ascent beginning in January, combined with a dramatically overbought RSI for a sustained period of time. Keep in mind, we are talking about a very defensive stock here, which appears to be trading like a hot growth momentum name.

True, the defensives and Kellogg could simply bull flag out a few days before pushing higher again. But the main point is that sideways or down is more probable in the coming days and even weeks than a sustained leg higher from current levels. You do have to pay a dividend if you are short Kellogg or many other defensives, which may be a reason to look at options here.

_______________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Dayum that thing has been screaming.

Last year it was AAPL this year it is the staples. Sold to you.

The real question is what is next? Fucking breakfast cereal is so lame as an investment thesis one could almost assume that may be it. If Tony the Tiger or a retarded bumble bee or multiracial rice krisps is all you got? Wtf is next?

Jeez, I wish I’d been on top of that cereal trade.

(no position…ever…believe it or not)

Although, it’s a great relief to see MI not soulfully dependent on the major 3’s..

you know what they say about tigers(in particular here..Tony)?

haha

Shorting just because it went up a lot is like jumping in front of a fast moving train and expecting it to stop and reverse before running you over. Good luck.

Normally I’d agree but we’re talking about a staple here. And it has been a crowded sector for a while now “seeking yield”

What would be your timeframe?

into May