When it comes to prospective short sales, the traditionally defensive consumer staples and large healthcare firms often receive sacred cow status by traders. After all, many of those stocks are rather low beta, and often compel short-sellers to pay a dividend. Thus, the incentives for short-selling or initiating bearish options plays are eschewed.

Furthermore, many of the powerful breakouts staged over the past quarter or two that we have seen in the likes of GIS K KR PEP are bonafide long-term moves. And we had been out in front of those moves well before Berkshire & friends bought out Heinz in February. Indeed, they were all working through some multi-year coiled pattern or another, ripe for massive explosions.

However, understanding your timeframe as a trader is more than just a cliché. Make no mistake, long-term investors in healthcare and consumer staple stocks are in the sweet spot with these textbook multi-year bullish breakouts. But, for traders, there simply must be no sacred cows. As has been a recurring theme here for over a week now, many defensives are now abnormally crowded and prone to an abrupt unwinding into May.

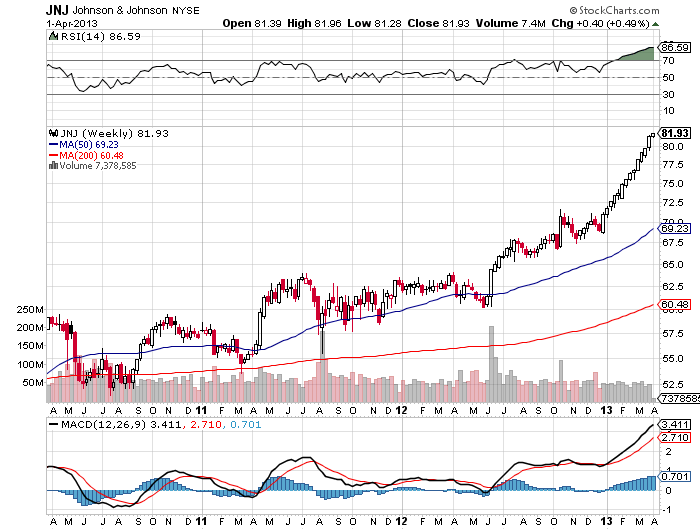

As an example, I charted the monthly timeframe of healthcare giant Johnson & Johnson back in July 2012, discussing the massive diamond consolidation portending an imminent big move.

Specifically, I wrote:

Long-time readers of mine know that I avoided the 2010 “Flash Crash” after identifying the prior diamond topping pattern on the major index charts in late-April of that. However, the diamond is not always a bearish topping pattern. In fact, on long-term charts of secular bull runs it tends to be a mere consolidation pattern (albeit a particularly tedious one) that eventually resolves much higher. (emphasis added)

As we can see on the updated monthly chart, first below, JNJ has certainly left that decade-long diamond consolidation in the dust, in favor of buyers. Nonetheless, the angle of ascent on this monthly chart is abnormally steep and prone to be being corrected sharply. Moreover, the top pane of the second chart below, of the weekly timeframe, indicates the RSI has remained very overbought for quite some time. Similar comments apply to @Rhino_Cap’s March Madness winning pick, Gilead. Kudos to Rhino for the excellent trading prowess, without question.

But with respect to JNJ, here again, we have to reconcile our timeframes. For long-term investors, this is precisely the type of bullish demand for JNJ you want to see after the stock lay dormant for years on end. On the other hand, when gauging the coming days and weeks, the extent to which these stocks have become crowded plays renders them vulnerable well beyond the primitive reaction of “I will short these stocks because they went up a lot and must now come down.”

In other words, the fact that these defensives are often seen as untouchable sacred cows adds to the short-term complacency currently present by holders of these parabolic stocks.

__________________________________________

__________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter