I first suggested Wal-Mart as a long-term investment idea back in this post in October 2011.

At the time, the stock was thought to be on the cusp of becoming a creative destruction victim and trading in the low-$50′s.

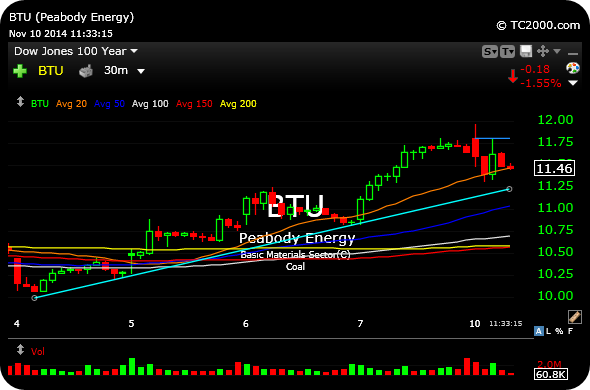

The updated monthly chart, below, shows the potential for another imminent leg higher, despite all of the talk about the firm becoming obsolete or marginalized in a new, online world. I think you can make an add after earnings, barring no massive move either way.

So, would another breakout in Wal-Mart make it bullish for the market at-large? Not necessarily, if you look back at the stock’s strong rally in the first half of 2008. More on that in one of my videos this week.

The firm reports earnings this Thursday, November 13th.

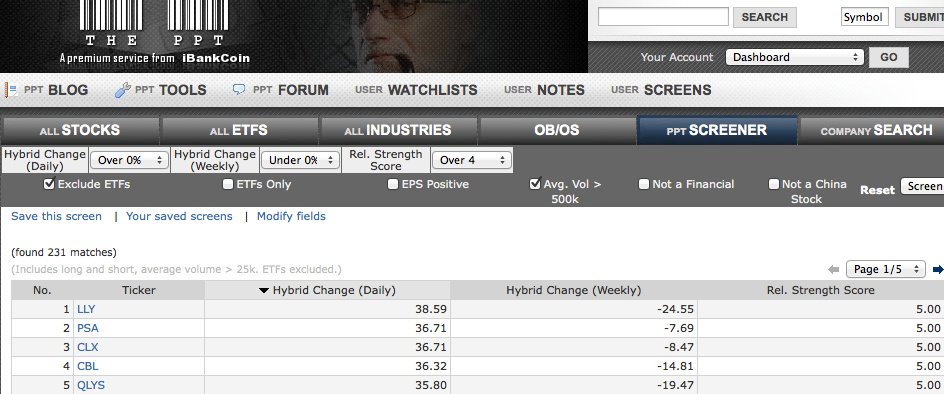

Regarding a few other long-term investments: CPL PKX have been laggards but not quite at the point where I am cutting them yet. I also have a few consumer staples still in the long-term portfolio.

All in all, though, my long-term investment portfolio still has the highest level of cash on hand since 2009.

_______________________________________________

Comments »