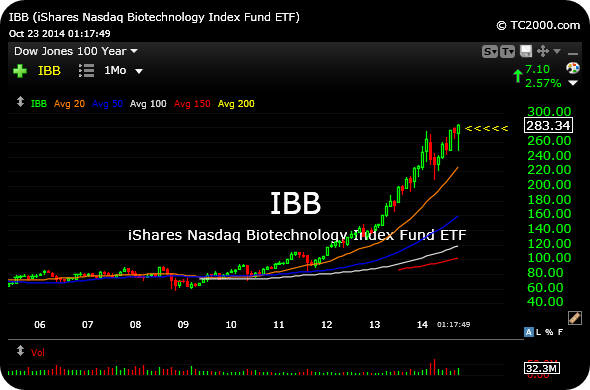

Biotechnology stocks continue to give off an aura of invincibility, as demonstrated by the biotech sector ETF’s latest V-shape rally from just below its 200-day moving average to new all-time highs…in just a matter of days.

At this point, it is hard to see bears being able to hold the broad market initiative for more than a day or two unless we see a meaningful downside reversal which holds in this sector. CELG REGN appear to be leafing the group, while BIIB GILD are slightly lagging and not making new highs today.

I have taken a few shots on the short side but have not been stubborn with them–There will be plenty of time to press and hold when the market finally does crack.

For now, biotechs are part and parcel of the pain trade for underinvested fund managers who need to chase performance into year-end.

The monthly sector ETF chart, below, illustrates my point, with a steep ascent coupled with October’s enormous and rare monthly candle, obviously well off the lows.

______________________________________________

Comments »