I bought some shares of UEC for $1.71. This is not a full position. It is just a couple percent of my account.

I consider this a leveraged addition to my CCJ position. That CCJ position is quite large, banking on a recovery in uranium. I wanted to add some more, but diversify a little, with the potential for a big payoff.

UEC recently secured a finance deal and have done very well bringing operations on line. They’re exceptionally small, and I cannot condone buying them in size. Small fluctuations could snuff them out.

However, I am a believer in uranium. Forces around the globe are converging. My main play is CCJ, but if pricing recovers, UEC will skyrocket in ways CCJ could only dream of.

___________________________________________

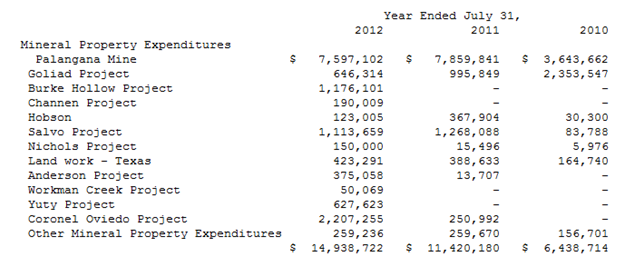

Update: here’s UEC’s capital spending on projects. Look at all the projects they’ve brought online in just a few years. There are good things coming down the pipeline.

Comments »