Let’s just take a second to really breath in the absurdity that takes place around us on a day by day basis, shall we?

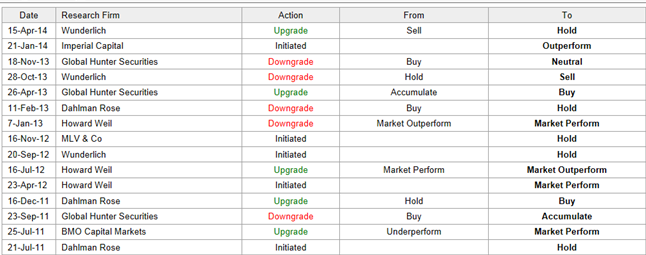

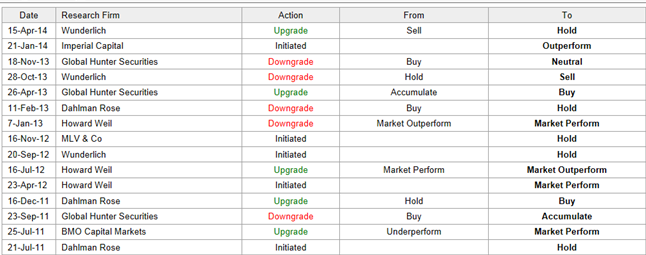

Here is a recent history of analyst recommendations for BAS (one of my favorite positions, I will say right off the bat, since it traded at $12).

Look specifically at the ratings being issued by Wunderlich Securities. On October 28, 2013, Wunderlich downgraded BAS from a Hold to a Sell. Then, yesterday, they upgraded BAS from a SELL to a HOLD.

And now let’s look at the price action in BAS.

Wunderlich almost marked the explosive upside to the inflection point. If we don’t go anywhere, they will have “downgraded” 100% of equity gains.

Okay so Wunderlich blew the call and got it wrong. They then reversed their rating to a Hold from a Sell (if you listened you missed out on a move that is being converted to a logarithmic scale on most finance sites). Fair enough – mistakes happen.

That’s not what irritates me. This is what irritates me:

“Will This Upgrade Help Basic Energy Services (BAS) Stock Today?

NEW YORK (TheStreet) — Basic Energy Services Inc. (BAS_) was upgraded to “hold” from “sell” at Wunderlich Securities.

The firm upgraded their rating based on improvements in the weather and natural gas prospects.”

Will this upgrade help BAS? I would fucking hope not…

I don’t want to sound indignant here because I guess as a shareholder, any good news is welcome. But…Christ…

We have just devolved to the point of putting anything out there that we can slap a curious headline on to whore a few hits on a website. After a miss like that, why should Wunderlich Securities’ have the ability to move markets with regards to BAS? If I were to make a list of analyst opinions I care about when it comes to BAS, Wunderlich (and basically half the others on that sheet at the top of this post)…they’re not even at the bottom, okay? They’re not even on the list.

The 24/7 “news about nothing” cycle just starts to grind on you after a while. We have a multi-million (billion?) dollar industry that seems to exist for the sole purpose of employing people to tell me stuff. Why I should listen though…as of yet, nobody has really explained that.

Maybe The Street should instead do a story about how many analysts (including their own) completely missed an obvious buying opportunity. And if you relegate yourself to those sites (rather than read the grassroots efforts of iBankCoin or like), you probably had no idea.

Because less I let this slip by, here’s The Street’s own rating for BAS:

TheStreet Ratings team rates BASIC ENERGY SERVICES INC as a Hold with a ratings score of C-. TheStreet Ratings Team has this to say about their recommendation:

“We rate BASIC ENERGY SERVICES INC (BAS) a HOLD. The primary factors that have impacted our rating are mixed some indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a positive or negative performance for this stock relative to most other stocks. The company’s strengths can be seen in multiple areas, such as its solid stock price performance, increase in net income and revenue growth. However, as a counter to these strengths, we also find weaknesses including disappointing return on equity, weak operating cash flow and poor profit margins.”

What’s that? Sorry I’m too busy being up 130% on this position to hear you.

Comments »