This is pretty incredible, especially considering it’s from CBS’s 60 Minutes… Watch the whole thing if you can. Sobering.

___________________

Feel free to pay attention to all the goings on in this weekend’s G-20 Meeting in Seoul, South Korea. It’s said they will “contain” this current race-to-the-bottom devaluing fest we’ve seemed to have ignited in order to keep our mortgage market afloat.

I have other ideas, however.

I will instead sacrifice a small goat in a special backyard Harvest Celebration in hopes the the Great Pumpkin will descend into my wife’s tomato gardens, and fix all of our U.S. currency iniquities without locking us up in a stockade in the Hague or sending us to plantations in Dominican Republic to hack tall cane for short beer.

I really believe this is the wiser strategy, and what’s more, it seems goats are running three for six dollars down at the Kroger this weekend. That leaves two for milking as a bonus.

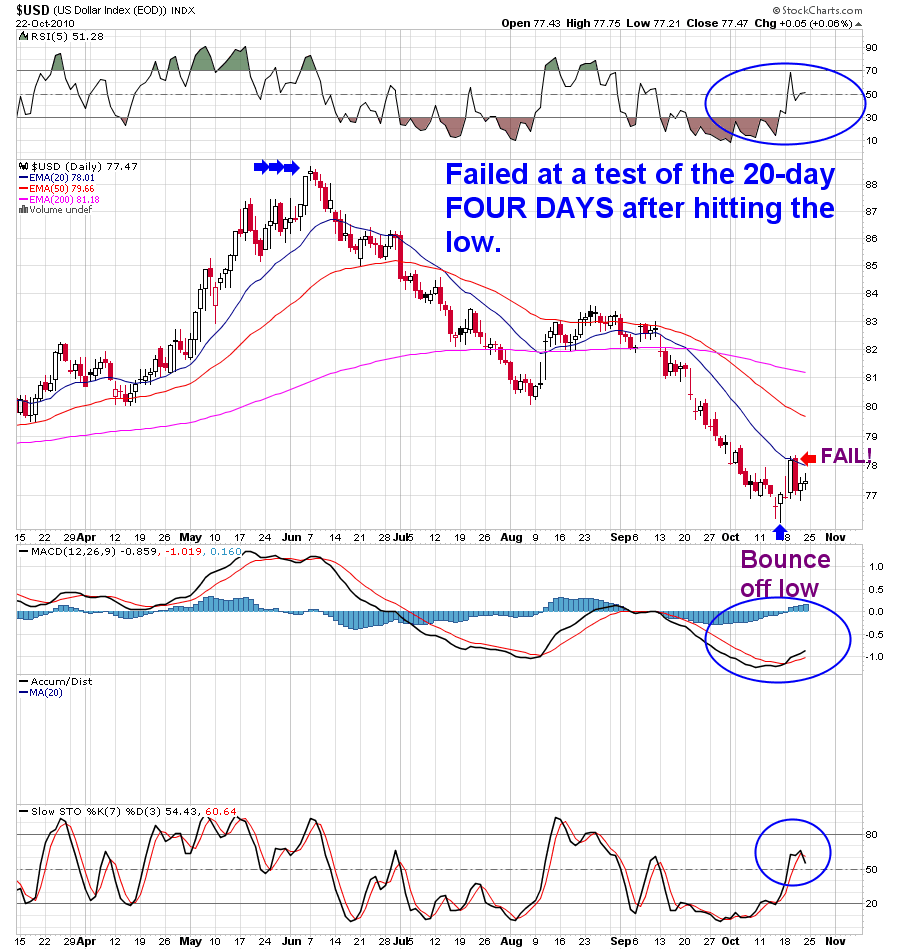

The dollar markets are already returning to form this evening, and they are down below $77, again, as I type this. Here’s what’s got me scratching my ribcage like I’ve got a needle-sharp case of the Shingles:

The prospects for the plummeting dollar may change by tomorrow morning, but as for now, I’m planning on giving thanks to the Great Pumpkin (a god as powerful, some say, as the Turkey gods themselves!) and putting back on most of my precious risk trades….

And mooooooooaaahh!

And yes, that includes going back to AGQ, and adding to all of my silver hordes, including EXK, PAAS, EXK and maybe even some MVG. I will also be adding IVN as mentioned, and more GSS, and RGLD if I can get it quickly enough.

Watch yourselves this week, folks, and watch that vid to get a taste of where we really are these days. My best to you all, especially my friends in California.

___________________________

Comments »