And I bet it has outperformed 99% of all traders over the past 2 years.

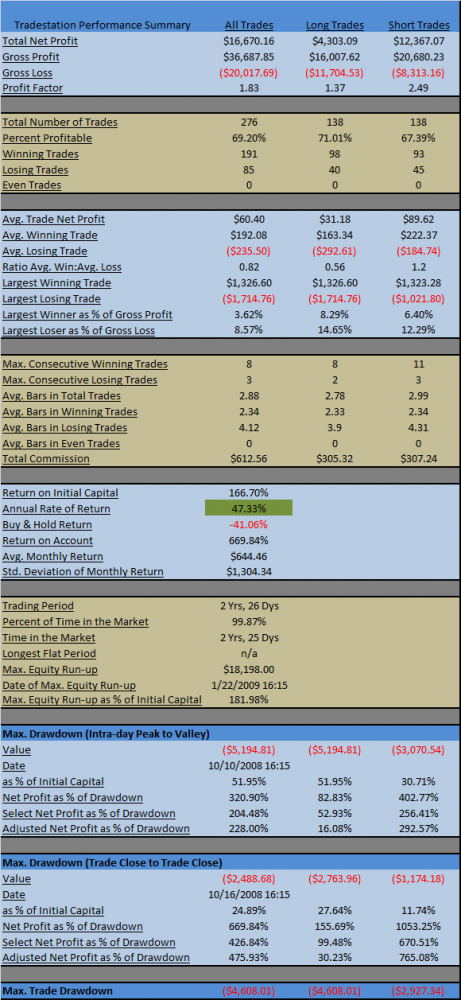

Annualized, over the past 2 years, the system has returned 47.33%

Here are the rules:

1. If the close is below the 2 day moving average, buy the SPY.

2. If the close is above the 2 day moving average, sell the long position and sell-short the SPY.

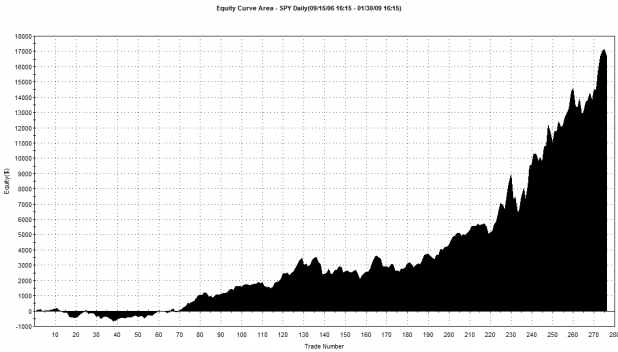

Below is the equity curve. The first trade was on 1/05/07.

And here are all the trade statistics. Assume $10,000 in starting equity with net profits added to each trade (gains are compounded). Commissions of .01 / share are included.

I am not recommending this as a viable system. Instead, I think it does a good job of detailing the type of market conditions we have experienced over the past 2 years. Furthermore, I think it may have some important implications for the future, in regards to what we should expect in terms of the changing market conditions.

Specifically, how can the market get any more short-term mean reverting? The only way I can see it could become more short-term is if it scales down from a daily basis to an even shorter time frame. What about a moving average based on hourly bars? It could certainly vacillate around a 2 hour moving average.

Instead, I believe that at some time over this year we will see extreme short-term mean reversion begin to fail and the re-emergence of short-term trending conditions. Based on this theory, moving average mean-reversion strategies will have to be built around longer moving averages. Similarly, short-term momentum and maybe even breakout strategies may begin to perform, once again.

What this could look like is watching for breakouts to pullback to the 10DMA, before buying (remember how well the 20DMA used to work for buying pullbacks?).

Certainly these volatile, mean-reverting conditions can remain for a long, long time. But when the 2DMA optimizes as the best moving average to use for buying and selling price crossovers, over the past 2 years, it seems as if conditions cannot be drilled down much further.

I am also including a shot of of some of the recent trades the system would have taken. The 2DMA is included. LE=Long Entry and SE=Short Entry.

Feel free to leave any thoughts about the implications of this study in the comments section.

Sounds good –

Newbie question –

for this coming Monday,

we are below the 2 DMA, so short SPY?

Ohanes, this system like MR systems do, are contrarian, so as price falls, you buy, and as price rises, you sell.

Current the system is long the SPY, because on Thursday 29th it got long at the close as price closed beneath the 2DMA. The syste also closed an unprofitable short-sale.

So, since we are beneath the 2DMA, you would buy the SPY.

Good article thanks

Great work Wood and here’s a confirming finding.

I took a peek at the SPY vs 200MDA and found that March 2003 was when it began the last mini-bull run up which ended in Nov 2007 so that was the testing range.

I set a pool of 100 Genetic Algorithm Systems with the top 10% only allowed to cross breed.

This system was first discovered in the 2nd generation however there were several variations viable within 1 Standard Deviation of this system.

Findings

Start Date: March 1, 2003

End Date: December 31, 2007

Starting Equity: $10,000

Round trip cost: $40

Buy Rule: Buy SPY on the next open after it closes beneath the 72 DMA

Sell Rule: Sell SPY on the next open after it closes above the 27 DMA

Return on Equity: 30.03%

I dub the system the Palindrome72.

Wood,

Are you still using Tradestation/Stockfetcher for backtesting? I ask because this looks like you are doing this test using Excel, and if so did you create all the formulas yourself or did you utilize a preexisting spreadsheet? I am taking to heart your comment about seeing if you can find if existing strategies are not longer working by walking a particular strategy that has been working well recently (last 5 yrs IE RSI(2)) over smaller increments of time (1 yr – to 6 months) and seeing if the returns are getting smaller due to changing market conditions.

Cuervo, that period was characterized by a possible artificially low amount of volatility. It would make sense that price tended to trend. You’re getting good at that GA stuff. I’d like to see you play with RSI2 and volume.

Tyler, mainly Tradestation, but my partner is re-doing all of our “secret” lol strategies in Traders Studio. It is more powerful and allows for portfolio level testing. Everything you see done here is Tradestation and excel.

I have yet to find a good way to export the Tradestation summary into the blog. Instead I copy/paste it into Excel. Then I make it look purty. I like things to look purty.

As for evaluating if a system is still working or is beginning to breakdown, consider comparing expected win/loss percentage vs. actual win/losses over n trades. I like though what you are doing by breaking it into small timeframes.

All systems will outperform and underperform during their total life expectancy. However, how does one discern a period of normal underperformance from a period when the system begins to just quit working?

Just sketch it onto a sheet of parchment paper and toss some BBQ sauce on it. Wallah! Purty.

Fly, lately I’ve been swearing by Johnny Fleeman’s Honey Mustard dressing. Damn that stuff is good. Plus, the yellow looks good on parchment.

However, how does one discern a period of normal underperformance from a period when the system begins to just quit working?

Yeah, that’s the question alright.

However, how does one discern a period of normal under performance from a period when the system begins to just quit working?

At the most basic level I use it to evaluate my position sizing. Lets say we use a system which has > 80% winners based upon historical results over a period of time (5yrs). And then I start to notice my wins are not in the 80% level, especially based upon the number of consecutive losses I’ve incurred. I start to scale back my position sizing as I’ve seen most TA people recommend and start to reevaluate my strategies to understand if the market is experiencing changing conditions.

However, I’d really like to put together a visualization based upon time frames using excel because I can’t get the same results from Stockfetcher.

I’m still using a ChiSquare test for relevancy however I had to tweak it – when it gets “almost significant” it’s about time for the system to stop being used.

It’s not bulletproof – I’ve seen some GA developed strategies be successful at 60% of the time and never go higher in terms of ‘significance’.

Interesting result – I ran the same thing and got a trade on 1/3/07. I assume you’re also buying/selling/shorting/covering on the same day as the signal?

Damian, yeah, I wasn’t too careful with the lookback period. If I adjusted the lookback by a couple of days I could have included that trade on the 3rd.

Yes, the system is in the market all the time one is buying/covering selling/shorting on the same day as the signal.

is this system buying End of Day the signal is hit or beginning of next day after the signal is given?

B-rad, the system is buying end of day. One would have to have a market-on-close order in to get the price. Or, one would have to buy the end of day funds such as the profunds products.

Current Chi Score 4.

It was up to 8 at one point.

I can send you a workup if you’re interested.

And your point is …

…his point might be that profitable system ideas or ways of looking at the market don’t have to be complex. Simplicity is often overlooked by traders. Stan Weinstein’s simple use of the 30 weekly MA still works (for me) even in this crap market.

Nice research Woodshedder.

Thanks for another great post!

Newbie question: Since you’ve backtested it and this system has a pretty amazing rate of return, why shouldn’t I immediately start trading it? (If the worry is that it only worked in the market conditions of the last few years and might start breaking down, then isn’t the great rate of return worth trying it for a while until it starts failing for several trades in a row, perhaps using a system like Tyler suggested?)

Thanks very much!

Michael, well I hope I’ve established that an index cannot vacillate around a 2DMA forever. I would say then if you wanted to trade this, then you would throw out the 2 day and use something between the 5-10DMA. I can tell you from testing that the 5 and 6 day average have also been working very well. This way, when the market begins to trend a little more, you wouldn’t immediately get hurt using the 2 day average.

You have identified a major problem with trading systems that do not have a long-term edge (a decade or more). It is easy to say, “I’ll just trade it for awhile…until it quits working…”

IMO, inevitably, as all systems do, it will enter a drawdown, and you will think the system has just quit working. Instead of continuing to trade it through the drawdown in order to re-capture profits on the next run-up, you will be left with losses as you quit trading it right at the worst possible point.

A more scientific approach is necessary, but we just aren’t sure yet exactly how to quantify when a system starts to breakdown.

So I’d say sure, start trading it, preferably with a longer moving average, but be very very honest with yourself that you will more than likely quit trading it at the exact wrong time, and likely long before it actually quits working.

In the stats I provided you would be able to get a pretty good idea of when something starts to go wrong…For example, if the win/loss percentage drops way off for over 30 or more trades.

Wood,

Good stuff. Thanks for sharing

Does the 2-day moving average include today’s closing price (in which case, the system is just looking at today’s price versus yesterday’s price) or is it lagged so that I look at today’s close versus the preceding two-day moving average?

I’m sure the language is clear for people with more experience than me. If so, I apologize in advance.

The next is where I open up things way up: do any one of you need experience acquiring old areas? If you need to do, what would you do along and it has your choice worked well available for you? Are there some other techniques an individual recommend?